There is no information in the guidance note on lease accounting, 1995, for non-performing assets. The general accounting principles for non-performing assets is contained in accounting standard 9 on Revenue Recognition which is more or less on the lines of the International Accounting Standards on the issue.

The Standard provides that whereas, in general, incomes are to be recognized on the basis of accrual, in case of an uncertainty in the ultimate realization of an income, the treatment is as follows:

- If the uncertainty is prevalent at the time of raising the claim for the income, the recognition of the income shall be postponed

- If the uncertainty arises subsequent to the claim being made, there shall be a provision made to the extent of the uncertainty.

This statement lays down the basic difference between a provision against an income, and non-recognition of income, which is very significant. The accounting for non-performing assets is guided by the Prudential Norms of the RBI.

A lease will be regarded as a non-performing asset based on overdues for more than 12 months. That is, if dues under a lease or hire purchase transaction remain unpaid, fully or partly, for more than twelve months, the transaction will be treated as a non-performing asset. The twelve month time frame is markedly longer than the general international standard of 3 months only.

If the lease transaction is a non-performing asset, there is a four-fold impact on the revenue/provisioning requirements:

- No income shall be recognized on an accrual basis-income recognition will shift to cash or accrual basis.

- Income already recognized, and lying unrealized, will be reversed-this, in accounting sense means the income recognized will be provided for. Notably, in case of lease transactions, the income that requires reversal is only the financial charge element inherent in the rentals, not the entire rental.

- A provision shall be made to mark the deterioration in the under lying security value on the basis of the depreciation of the asset as per the Companies Act.

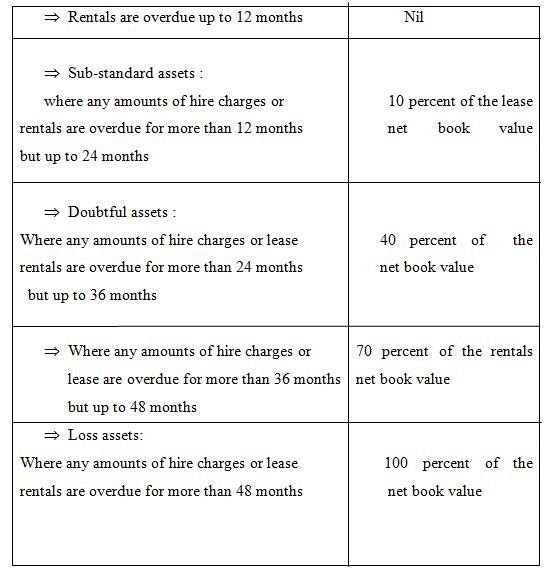

The NBFCs should make provisions against NPAs with correlation to the net book value of the assets in four stages at 10, 40, 70 and 100 per cent as follows :