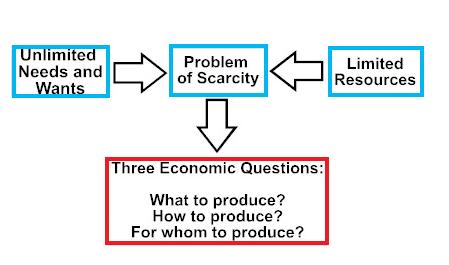

Economic system refers to the organizations and institutions created for the purpose of satisfying the wants of human beings. In a country, available resources have to be utilized to manufacture and distribute goods and services, which would meet the needs of the people so that they are satisfied. These institutions and organizations function with their own rules and regulations.

The economic system has certain broad characteristics.

- The economic system always functions with scarcity of resources. How the system effectively and efficiently uses the resources will determine the extent to which the needs of the people are met.

- An economic system comprises people.