4. Modern Approach

Apart from the conventional methods for estimating the need for working capital, the following two methods are used in the modern enterprises for the purpose:

- Ratio of Current Assets to Fixed Assets

- Current Asset holding period

Let’s have a brief idea about each of them.

1. Ratio of Current Assets to Fixed Assets

The financial manager should determine the optimum level of current assets so that the wealth of shareholders is maximized. In a business enterprise both fixed and current assets are needed to support a particular level of output. However, to support the same level of output, the firm can have different levels of working capital. The level of current assets can be measuring the current assets to fixed assets i.e. by measuring the ratio of current assets to fixed assets.

Dividing current assets by fixed assets gives the ratio of Current Assets to Fixed Assets.

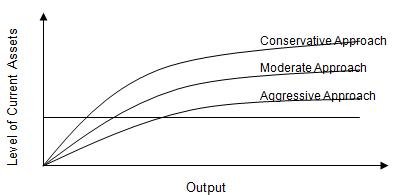

From the viewpoint of this ratio, there are three types of approaches:

- Conservative approach: Many firms maintain a high ratio of current assets to fixed assets so that they may not have any difficulty even in crisis. It suggests greater liquidity and lower risk. Risk adverse firms mainly adopt this approach.

- Aggressive approach: Many firms maintain low ratio of current assets to fixed assets, so that their funds may not block idle and they can be used for some profitable purpose. It involves higher risks and smaller liquidity.

- Moderate Capital approach: Most of the firms maintain their current level between these two extreme levels. This is an moderate capital approach. This involves moderate liquidity and moderate risk.

2. Current Assets Holding Period

In this method the working capital requirements are to be estimated on the basis of average holding period of current assets and relating them to costs based on the firm’s experience in the previous years. This method is essentially based on the operating cycle concept.

A modified version of this method is also used by various firms, in which the current assets are carefully estimated and at the same time the current liabilities are also to be estimated. The difference between two gives a rough idea about the net working capital requirements of the firm.

Let’s have a brief idea about how various components of current assets and current liabilities are to be estimated for estimating the working capital requirements:

1. Stock of Raw Materials = No. of Units Produced * Per Unit Cost of Raw materials * Average holding period of raw materials

2. Work in Progress =

- Materials: No. of Units Produced * Per Unit Cost of Raw materials * Average period of Raw materials in process

- Labor: No. of Units Produced * Per Unit Cost of Labor * Average of period of Labor in process

- Overhead: No. of Units Produced * Per Unit Cost of Overheads* Average of period of Overheads in process

Generally, the WIP is to be taken as half a month’s raw material cost and one month’s labor and variable cost.

3. Finished Goods = No. of Units Produced * Per Unit Total Cost

4. Sundry Debtors = No. of Units Sold * Period of credit given to debtors * Total Cost of Production

Profit is not to be considered for calculating the outstanding debtors. On the same way only the sales which are made on credit are to be considered. Thus the cash sales are to be deducted before estimating the debtors.

5. Sundry Creditors = No. of Units Produced * Per unit cost of raw materials * Credit period allowed by the suppliers

6. Outstanding Wages and Overheads = No. of Units Produced * Per unit cost of Wages and Overheads * Time leg in payment of Wages and Overheads

After estimating the components of current assets and current liabilities a Statement Showing the Working Capital Requirement is to be prepared as under:

Statement Showing Requirement of Working Capital

|

Particulars |

Rs. |

Rs. |

Current Assets :

Material Cost ———- Wages ———- Overheads ———-

Total Current Assets (A) |

———- ———- ———- ———- ———- ———-

|

————- |

Current Liabilities :

Total Current Liabilities (B) |

———- ——— ——— |

———– |

|

Total Working Capital Requirement (A — B) |

———– |

These are some of the methods that are used in the estimation of working capital requirements. After estimating the working capital requirements, the next task for financial manager is to think about the procurement of working capital.

very helpful to me