An option is a contract, which gives the buyer the right to buy or sell foreign currency at a specific price, on or before a specific date. For this, the buyer has to pay to the seller some money, which is called as premium. There is no obligation on the buyer to complete the transaction if the price is not favorable to him.

Whenever a person has an intention to sell foreign currency by paying a premium amount immediately and settling the same on a later date, it is known as a Put Option. Put Option has two parties, one a buyer of a Put Option and other a seller of a Put Option.

Example:

Mr. A is interested in selling a US Dollar. Spot rate is US$ 1 = 45.50. Mr. A believes that some 15 days down the line, with the budget coming up, the price of the US dollar will decrease. Not wanting to take any chances, he goes to a dealer and purchases a put option for US dollars 1,000 after 1 month. Dealer knowing the Forex market too well, agrees to that but demands Rs. 100 as a risk measure that he is ready to take. So now they enter into a contract whereby Mr. A would pay the dealer Rs. 100 right now and after one month, the dealer would have to take delivery of the US dollar for the agreed amount of US$ 1 = Rs. 45.50.

After 15 days, budget is out and has an impact on the price of the US dollar in two instances:

- Price of the US dollar decreases to US$ 1 = Rs.44.50: Now in such a case, the buyer is in profit of Rs.1 per dollar. For US dollars 1,000 the profit will be Rs.1,000. If the premium of Rs.100 is deducted, the net profit to Mr.A is Rs.900. In this case, the option seller would have to bear a net loss of Rs.900.

- Price of the US dollar increased to US$ 1 = Rs.46.50: In this case, the buyer ideally would not prefer to go to the dealer and sell the US dollar as he is getting a better price in the open market. In such a case, he would loose the premium amount or the advance amount of Rs. 100 paid by him while entering into this contract.

In the above example, we saw that the seller of the US dollar, Mr. A has a right to approach the dealer to sell the US dollar if the price of the US dollar decreases, but if the price of US dollar increases, he has a choice of stepping back. The option buyer of the US dollar on the other hand, does not have any right to step back in case if the seller of the US dollar comes and forces him to take the delivery of the US dollar.

Such a transaction where Mr. A, who pays the premium amount, has an intention to sell foreign currency is known as Put Option.

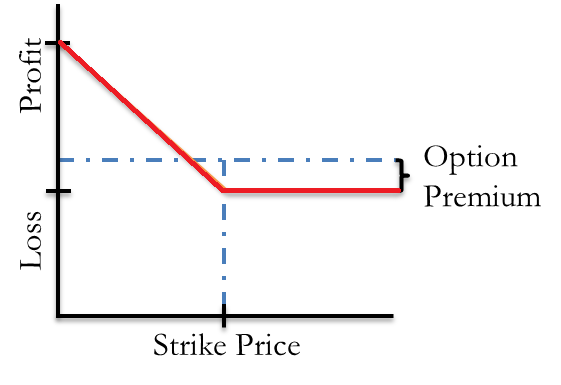

In case of a put option, if the spot rate on maturity is more than the contract rate, there will be loss to the option buyer to the extent of premium paid and profit to the option seller to the extent of premium received. If the spot rate on maturity is less than the contract rate, there will be profit to the option buyer and loss to the option seller.

In case of Call Option and Put Option the actual delivery of foreign currency does not take place. The option seller gives the option buyer the difference between the contract price and the market price.