Financial Market Regulation

The nature of securities markets is such that they are inherently susceptible to failures due to the existence of information asymmetries and existence of high transaction costs. It needs to be emphasized that when securities markets come into existence, the interest of the member brokers are taken care of through margin requirements, barriers to entry of membership, listing agreements. However the investors/clients who buy and sell via their brokers are not able to form an organization to safeguard their interests due to the cost of creation of such organizations and free rider problems. The distinctive nature of the market can be observed with reference to the commodity, its quality, the system of transactions and the participants in the market, as follows:

(a) the commodity(the security)has a life to perpetuity.

(b) while the outcome of the contract say the redemption of debt is certain, in the case of the government, it is not always so in the case of a private debt instrument, hence uncertainty comes into focus.

(c) the quality of private debt instrument is unobservable and hence, it is the trust reposed on the trader or the issuer that is the decisive factor, here the problem of information comes into focus.

(d) in any securities market in any transaction or deal there are at least four participants, two clients and two brokers. The brokers negotiate deals with each other on behalf of their clients and thus the problem of transaction cost comes into focus. When there is so much scope for failure and opportunism, there appears to be substantial ground for prescribing an institution that oversees the market at different stages to ensure its reliability, efficiency and it’s very existence.

Objective of Financial Market Regulation

The objective of regulation and supervision is to facilitate the efficient and fair performance of economic functions, but a practical regulatory structure must deal with (and will influence) the products and institutions through which those functions are performed. This creates considerable complexities because there is no unique relationship between functions, products, and institutions. Several products might perform the same function, some functions might involve several products, institutions can provide a range of products, and these relationships can be changing over time, in response to technological change and in ways influenced by the existing regulatory structure. One focus of financial regulation is upon the characteristics of financial products, which are explicit or implicit contracts between parties, entered into with certain expectations on the basis of information held by those parties. Financial regulation stems in large part from the undesirable consequences of participants entering contracts with inappropriate expectations based on imperfect information. Participants may be unable to obtain information to appropriately evaluate the ability of a counter-party to meet a contractual obligation (such as payment of an insurance benefit), or may be given incorrect information which leads them to form inappropriate expectations of performance (such as of a managed fund). Ultimately, the focus of a regulatory structure must be on the welfare of the end users.

Financial products are contracts between two parties, issued under specific legal arrangements. While there may be an argument that individuals have a “natural” right to enter into such contracts as deposit takers, there is no “natural” right possessed by institutions, which allows them to do so. That is recognized internationally by financial legislation of most nations, which impose certain socially determined criteria upon institutions (institutional form, identity of owners, competence of managers, compliance with prudential standards etc.) if they are to be allowed to undertake such activities. Also they should be a good incentive structure for providing information in financial markets as information is very important to the investor. Often investors find it difficult to evaluate the quality of the security or service offered which calls for an intermediary to disseminate information and services that have to be regulated. Regulations also prevent monopoly of capital markets which otherwise jeopardize the market mechanism.

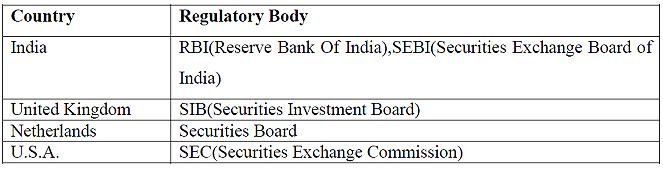

Here is a table indicating regulatory bodies of financial markets around the world.

A security scam involves the manipulation of funds in the capital market which could involve the usage of funds for highly speculative purposes resulting in the monopolization of capital market, trading in shares with money not used for their actual purpose etc.