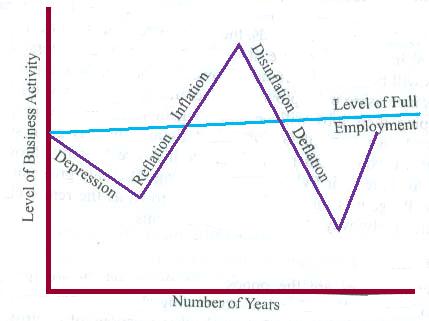

When prices are abnormally high, termed as inflation, it is indeed desirable to have a fall in prices. Such a fall in the price level is good for the community, as it will not lead to a fall in the level of production or employment. The process designed to reverse the inflationary trend in prices, without creating unemployment, is generally known as disinflation. But if prices fall from the level of full employment, then income and employment will be adversely affected and this situation is termed as deflation.

Effects of Deflation

The following are the adverse effects of deflation:

- On production: Deflation has an adverse effect on the level of production, business activity and employment. During deflation, prices fall due contracting demand for goods and services. Fall in price results in losses and sometimes forcing many firms to go into liquidation. In the face of declining demand for goods, firms are forced to close down either completely or leave part of their plants idle. Thus, production of income is curtailed and unemployment is increased. This is a serious defect of deflation, as compared to inflation in which normally there may not be an adverse effect on production and employment.

- On distribution: Deflation adversely affects distribution of income too. In the first place, producers, merchants and speculators lose badly during this period because price of their goods fall at a far greater rate than their costs, most of which tend to be fixed or sticky. Besides, most of these people are debtors who use borrowed funds in their businesses. They have to repay their debts in money, which has now more value because of deflation. For some debtors, who do not have adequate means to repay their loans had to go into liquidation.

- Deflation implies fall in price level or rise in the value of money: All those who have fixed incomes will be far better off because their money income is fixed. In other words, the fixed income groups will enjoy a rise in their real income. Therefore, it is assumed that salaried persons and wage workers will benefit by deflation. However, this is not completely true since there is increasing unemployment. Therefore, only those who are successful in keeping their jobs will be able to gain from the rise in the value of money. As a matter of fact, during deflation, there is great suffering and mystery all round and millions of families are literally thrown onto the streets to make their living through begging. The only group of people who may really gain is that small minority, known as the renter class who get their income by way of fixed interest and rents.

Methods of Deflation Control

Anti-deflation measures are the opposite of those, which are used to combat inflation.

- Monetary policy aimed at controlling deflation consists of using the discount rate, open-market operations and other weapons of control available to the central bank of a country to raise volume of credit of commercial banks. This policy is known as cheap money policy. This is based on an idea that with the increase in the volume of credit, there will be an increase in investment, production and employment. However, monetary policy is basically weak, for it assumes that the volume of credit can be expanded by the central bank. This may not be so, because even when commercial banks are prepared to lend more to businesses to enable them to expand their investment, the latter may not be willing to do so for fear of possible failure of their investments.

- Fiscal policy to fight deflation is known as deficit financing, i.e., expenditure in excess of tax revenues. On one hand government attempts to reduce the level of taxation to provide large amount of purchasing power with the public. While, on the other hand, the government increases its expenditure on public work programmes such as irrigation, construction of roads and railways. By this programme government will (a) provide employment for those who may be thrown out of employment in the private sector, (b) add to the national wealth, and (c) counteract the deficiency of private demand for goods and services. The budget deficit can be financed through borrowing from the public of their idle cash balances or banks. The basic idea of fiscal policy is to expand demand for goods or to counteract the decline in private demand. Therefore, fiscal policy is the most important policy for economic stabilization.

- Other measures to control deflation include price support programmes, i.e., to prevent prices from falling beyond certain levels and lowering wage and other costs to bring adjustment between price and cost of production. Price support programme has been extensively used in the USA in recent years but it is very difficult to carry it through. The government will have to fix the prices below which the commodities will not be sold and undertake to buy the surplus stocks. It is difficult for the government to secure the necessary funds for such transactions as well as to devise ways and means to dispose of the surplus stocks in other countries. Therefore, the best solution for deflation is to have a ready programme of public works to be implemented as and when unemployment makes its appearance.