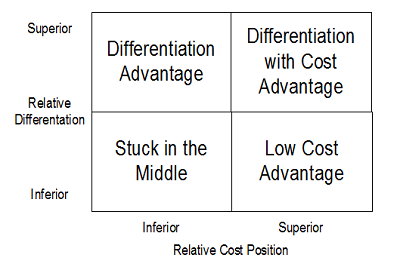

The three Porters generic competitive strategies are alternative, viable approaches to dealing with the competitive forces. The converse of the previous discussion is that the firm failing to develop its strategy in at least one of the three directions – a firm that is stuck in the middle – is in an extremely poor strategic situation.

According to Porter, a company’s failure to make a choice between cost leadership and differentiation essentially implies that the company is stuck in the middle.

Porter argued that cost leadership and differentiation are such fundamentally contradictory strategies, requiring such different sets of resources, that any ï¬rm attempting to combine them would wind up “stuck in the middle” and fail to enjoy superior performance, Cost leadership requires standardized products with few unique or distinctive features or services so that costs are kept to a minimum. On the other hand, differentiation usually depends on offering customers unique beneï¬ts and features, which almost always increase production and marketing costs.

This firm lacks the market share, capital investment, and resolve to play the low-cost game, the industry wide differentiation necessary to obviate the need for a low- cost position, or the focus to create differentiation or a low-cost position in a more limited sphere.

“The firm stuck in the middle is almost guaranteed low profitability. It either loses the high-volume customers who demand low prices or must bid away its profits to get this business away from low-cost firms. Yet it also loses high-margin businesses – the cream – to the firms who are focused on high-margin targets or have achieved differentiation overall. The firm stuck in the middle also probably suffers from a blurred corporate culture and a conflicting set of organizational arrangements and motivation system.” – Michael Porter (Competitive Strategy, p. 41-42)

There is no competitive advantage for a company that is stuck in the middle and the result is often poor financial performance. Being “stuck” implies low profits as a rule: profits are bid away to compete with low cost producers; or, the firm loses high margin business to firms who achieve better differentiation.

Clark Equipment may well be stuck in the middle in the lift truck industry in which it has the leading overall U.S. and worldwide market share. Two Japanese producers, Toyota and Komatsu, have adopted strategies of serving only the high-volume segments, minimized production costs, and rock-bottom prices, also taking advantage of lower Japanese steel prices, which more than offset transportation costs. Clark’s greater worldwide share (18 percent; 33 percent in the United States) does not give it clear cost leadership given its very wide product line and lack of low-cost orientation. Yet with its wide line and lack of full emphasis to technology Clark has been unable to achieve the technological reputation and product differentiation of Hyster, which has focused on larger lift trucks and spent aggressively on R&D. As a result, Clark’s returns appear to be significantly lower than Hyster’s, and Clark has been losing ground.

IBM’s personal computer business offers another example. IBM tried to position its personal computers via a differentiation strategy. In particular, IBM’s personal computers were offered at high prices, and the firm promised to offer excellent service to customers in return. Unfortunately for IBM, rivals such as Dell were able to provide equal levels of service while selling computers at lower prices. Nothing made IBM’s computers stand out from the crowd, and the firm eventually exited the business.

A firm that is stuck in the middle must make a fundamental strategic decision. Either it must take the steps necessary to achieve cost leadership or at least cost parity, which usually involve aggressive investments to modernize and perhaps the necessity to buy market share, or it must orient itself to a particular target (focus) or achieve some uniqueness (differentiation). The latter two options may well involve shrinking in market share and even in absolute sales. The choice among these options is necessarily based on the firm’s capabilities and limitations. Successfully executing each generic strategy involves different resources, strengths, organizational arrangements, and managerial style, as has been discussed. Rarely is a firm suited for all three.

Once a firm that is stuck in the middle, it usually takes time and sustained effort to extricate the firm from this unenviable position. Yet there seems to be a tendency for firms in difficulty to flip back and forth” over time among the generic strategies. Given the potential inconsistencies involved in pursuing these three strategies, such an approach is almost always doomed to failure.

There is no single relationship between profitability and market share, unless one conveniently defines the market so that focused or differentiated firms are assigned high market shares in some narrowly defined industries and the industry definitions of cost leadership firms are allowed to stay broad (they must because cost leaders often do not have the largest share in every submarket). Even shifting industry definition cannot explain the high returns of firms who have achieved differentiation industrywide and hold market shares below that of the industry leader.

Most importantly, however, shifting the way the industry is defined from firm to firm begs the question of deciding which of the three generic strategies is appropriate for the firm. This choice rests on picking the strategy best suited to the firm’s strengths and one least replicable by competitors. The principles of structural analysis should illuminate the choice, as well as allow the analyst to explain or predict the relationship between share and profitability in any particular industry.

Short Case Study: 1

Levi’s dominated the jeans market for decades, but in the early 1990s, competitors moved their production function offshore, dramatically reducing their expenses. Levi’s prices remained higher than its rivals, causing big retailers to focus selling efforts on lower-priced store brands. As competitors and buyers are now following a low-cost strategy, Levi’s has been forced to follow suit; it has closed almost all of its U.S. factories. The cost leadership strategy is necessary just to survive in the industry, but the firm is still struggling to catch up with its rivals in cost reduction.

Hint: This short case study provides an excellent example of a firm that was risking getting stuck in the middle, when its traditional advantages were overcome by rival’s new business models. This case demonstrates how tough it is for a firm to change its strategy–in spite of the company’s continued long-term efforts, competitors still have a cost advantage.

Short Case Study: 2

Holiday Inns founded the market for average price, average quality motel rooms. But in the 1970s the chain ran into trouble because it failed to see that the market was fragmenting, creating the need for different kinds of products, ranging from luxurious resort features to basic, no-frills accommodation. Holiday Inns was left stuck in the middle, with its undifferentiated product and average costs. In the 1980s the company fought back by differentiating to offer a range of products, from the inexpensive Hampton Inns chain to the luxury Crowne Plazas. These moves were successful, and led to a temporary advantage, but by the late 1990s, Holiday Inns was again in decline. The firm needs to find a new strategy to ensure that it prospers in the highly competitive hotel industry.

Hint: This short case study of Holiday Inns shows how easily a market leader may become stuck in the middle through strategic inattention. The firm’s reliance on their original business model made them great, yet it led them into difficulty when it became over-reliance. The case also demonstrates the difficulties in trying to move from being stuck in the middle to once again successfully pursuing a generic strategy.