Promissory Note, in the law of negotiable instruments, written instrument containing an unconditional promise by a party, called the maker, who signs the instrument, to pay to another, called the payee, a definite sum of money either on demand or at a specified or ascertainable future date. The note may be made payable to the bearer, to a party named in the note, or to the order of the party named in the note.

A promissory note differs from an IOU(An IOU (abbreviated from the phrase “I owe you“) is usually an informal document acknowledging debt) in that the former is a promise to pay and the latter is a mere acknowledgement of a debt. A promissory note is negotiable by endorsement if it is specifically made payable to the order of a person.

According to section 4 of the Negotiable Instruments Act, 1881, a promissory note means “Promissory Note is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument.”

Features of a Promissory Note

- The promissory note must be in writing- Mere verbal promises or oral undertaking does not constitute a promissory note. The intention of the maker of the note should be signified by writing in clear words on the instrument itself that he undertakes to pay a particular sum of money to the payee or order or to the bearer

- It must contain an express promise or clear undertaking to pay- The promise to pay must be expressed. It cannot be implied or inferred. A mere acknowledgment of indebtness is not enough.

- The promise to pay must be definite and unconditional- The promise to pay contained in the note must be unconditional. If the promise to pay is coupled with a condition, it is not a promissory note.

- The maker of the pro-note must be certain- The instrument should show on the fact of it as to who exactly is liable to pay. The name of the maker should be written clearly and ascertainable on seeing the document.

- It should be signed by the maker- Unless the maker signs the instrument, it is incomplete and of no legal effect. Therefore, the person who promises to pay must sign the instrument even though it might have been written by the promisor himself.

- The amount must be certain- The amount undertaken to be paid must be definite or certain or not vague. That is, it must not be capable of contingent additions or subtractions.

- The promise should be to pay money- The promissory note should contain a promise to pay money and money only, i.e., legal tender money. The promise cannot be extended to payments in the form of goods, shares, bonds, foreign exchange, etc.

- The payee must be certain- The money must be payable to a definite person or according to his order. The payee must be ascertained by name or by designation. But it cannot be made payable either to bearer or to the maker himself.

- It should bear the required stamping- The promissory note should, necessarily, bear sufficient stamp as required by the Indian Stamp Act, 1889.

- It should be dated- The date of a promissory note is not material unless the amount is made payable at particular time after date. Even then, the absence of date does not invalidate the pro-note and the date of execution can be independently proved. However to calculate the interest or fixing the date of maturity or lm\imitation period the date is essential. It may be ante-dated or post-dated. If post-dated, it cannot be sued upon till ostensible date.

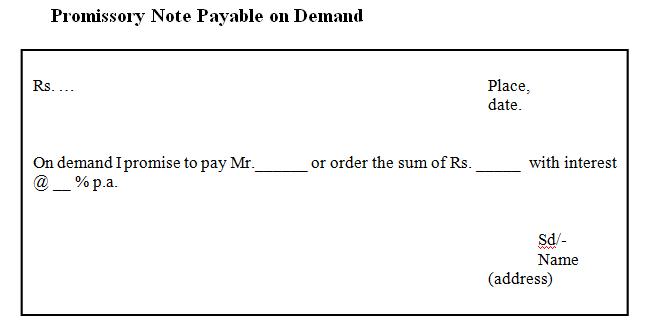

- Demand- The promissory note may be payable on demand or after a certain definite period of time.

- The rate of interest- It is unusual to mention in it the rated of interest per annum. When the instrument itself specifies the rate of interest payable on the amount mentioned it, interest must be paid at the rate from the date of the instrument.

Whether Rs.100/-note is promissory note or legal tender ?

The one rupee note (and coin) is the only denomination that is truly Legal Tender. The one rupee note is produced by the Government of India. All other higher denomination notes are bank promissory notes issued by the Reserve Bank of India. On these notes, if you read the promise carefully, you can see that the Reserve Bank Governor promises to pay the holder of the note so many Indian Rupees. The Indian Rupee (one rupee) is the only legal tender currency and that is being produced by the Government of India. All other notes are produced by the Reserve Bank of India.

I hope this would help you.

Thank You.