In the late 1980s, organisations started realizing that, in order to assess the overall health and performance of the organisation, it was important to measure and manage non-financial measures also in addition to the traditional financial measures such as profits, share values, sales volumes etc. Traditional financial measures are usually the lag indicators of the business performance and tell the story of the past. They do not provide any insight into the intangible assets and capabilities that need to be developed in order to be able to achieve the desired financial results. For example, front-line workers in a manufacturing set up are far removed from these financial measures and have no idea about how their day to day work translates into financial results. Thus, financial measures fail in assessing the intangible value possessed by the organisation or the value it can create. They can also fail the knowledge based strategies by treating human capital as expense items; whereas it is widely recognized that human capital is actually the most important component of the value creation chain. Balanced Scorecard (BSC) was developed in response to this need. BSC introduced the idea of measuring the drivers of performance, while retaining the measures of financial performance. The term ‘Balanced Scorecard’ was coined by Art Schneiderman in 1987. But, till the early 1990’s the system was understood to be a mix of financial and non-financial measures limited to 15-20 numbers which were clustered in four perspectives. BSC became a popular term when Kaplan and Norton who worked extensively on scorecards published reports of several BSC implementation successes. In 1996, they published the book “The Balanced Scorecard”.

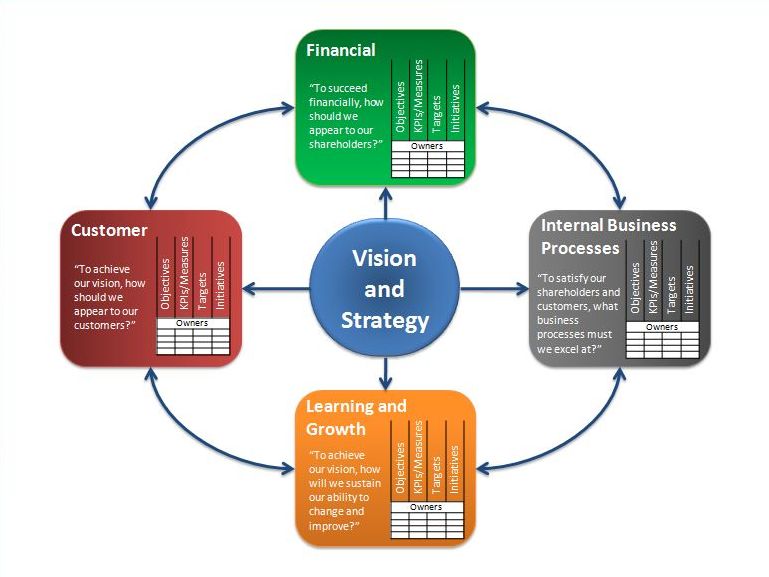

Balanced Scorecard is a strategy management system that helps managers to translate organisation strategy into operational objectives and implement it. BSC framework looks at the strategy from four different perspectives i.e. financial, customer, internal business processes and learning and growth. Thus, it brings in the necessary clarity to strategy. Further, implementation of BSC ensures that strategy gets communicated to all the employees suitably to facilitate implementation by them. Measuring organizational performance through BSC reviews remain integral to BSC concept. Based on the learning from these reviews, strategy gets updated. Thus, the four important steps in BSC designing and implementation include 1) translating vision into operational objectives, 2) communicating the vision and linking it to the individual performance, 3) planning and adjusting the strategy based on feedback and 4) learning.

The concept of Balanced Scorecard was explained by Kaplan and Norton (1996) as: Balanced Scorecard complements financial measures of past performance with measures of the drivers of future performance. The objectives and measures of the scorecard are derived from an organisation’s vision and strategy. The objectives and measures view organisational performance from four perspectives: financial, customer, internal business processes, and learning and growth. These four perspectives provide the framework for the balanced scorecard………….. Corporate executives can now measure how their business units create value for current and future customers and how they must enhance internal capabilities and the investment in people, systems, and procedures necessary to improve future performance.

Instead of relying on just one instrument or measure, using a balanced set of measures ensures that all the aspects of the employees‘ performance are covered and provide relevant support for the decisions taken. Therefore, it is necessary that the manager should be capable to observe and note the several instruments and measures simultaneously. The four perspectives given by Kaplan and Norton are;

- The financial perspective examines if the company‘s implementation and execution of its strategy are contributing to the bottom-line improvement of the company. It represents the long-term strategic objectives of the organization and thus it incorporates the tangible outcomes of the strategy in traditional financial terms. The three possible stages as described by Kaplan and Norton are rapid growth, sustain and harvest. Financial objectives and measures for the growth stage will stem from the development and growth of the organization which will lead to increased sales volumes, acquisition of new customers, growth in revenues etc. The sustain stage on the other hand will be characterized by measures that evaluate the effectiveness of the organization to manage its operations and costs, by calculating the return on investment, the return on capital employed, etc. Finally, the harvest stage will be based on cash flow analysis with measures such as payback periods and revenue volume. Some of the most common financial measures that are incorporated in the financial perspective are EVA, revenue growth, costs, profit margins, cash flow, net operating income etc.

- The customer perspective defines the value proposition that the organization will apply in order to satisfy customers and thus generate more sales to the most desired (i.e. the most profitable) customer groups. The measures that are selected for the customer perspective should measure both the value that is delivered to the customer (value position) which may involve time, quality, performance and service and cost and the outcomes that come as a result of this value proposition (e.g., customer satisfaction, market share). The value proposition can be centered on one of the three: operational excellence, customer intimacy or product leadership, while maintaining threshold levels at the other two.

- The internal process perspective is concerned with the processes that create and deliver the customer value proposition. It focuses on all the activities and key processes required in order for the company to excel at providing the value expected by the customers both productively and efficiently. These can include both short-term and long-term objectives as well as incorporating innovative process development in order to stimulate improvement. In order to identify the measures that correspond to the internal process perspective, Kaplan and Norton propose using certain clusters that group similar value creating processes in an organization. The clusters for the internal process perspective are operations management (by improving asset utilization, supply chain management, etc), customer management (by expanding and deepening relations), innovation (by new products and services) and regulatory & social (by establishing good relations with the external stakeholders).

- The innovation and learning perspective is the foundation of any strategy and focuses on the intangible assets of an organization, mainly on the internal skills and capabilities that are required to support the value creating internal processes. The innovation and learning Perspective is concerned with the jobs (human capital), the systems (information capital), and the climate (organization capital) of the enterprise. These three factors relate to what Kaplan and Norton claim is the infrastructure that is needed in order to enable ambitious objectives in the other three perspectives to be achieved. This of course will be in the long term, since an improvement in the learning and growth perspective will require certain expenditures that may decrease short-term financial results, whilst contributing to long-term success.

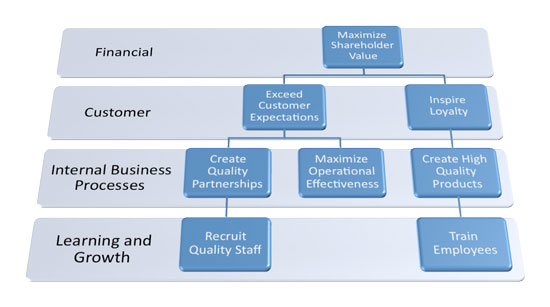

Balanced Scorecard, thus, strikes a balance between long term and short term objectives, financial outcomes and performance drivers for the same, and introduces a continuous process of learning and adaption to modified strategies. The strategy is broken down into critical operational strategic objectives considering the customer value proposition and the desired financial results. The performance drivers or the lead objectives to these outcome objectives in the financial and customer perspectives are then identified and placed in the internal business processes and learning and growth perspectives forming a causal relationship. The drawing that shows these objectives placed in different perspectives, linked with arrows depicting causal relationship is known as strategy map.

A strategy map can communicate organisation strategy in just one page and provide a framework for testing assumptions about the strategy. It can be built by first listing perspectives, followed by defining themes, creating objectives and building causal linkages among objectives. Financial perspective shows how strategy balances the long term and short term objectives. Customer perspective highlights the differentiated value proposition the organisation intends to offer to the target customer. It communicates what the organisation intends to do better or different from its competitors.

A balance is maintained between the financial and non-financial, short term and long term, and the lead and lag objectives. Each of these objectives are well defined to ensure common understanding of the terms, appropriate measures, targets and initiatives are identified with respect to each objective.

The measures on the Balanced Scorecard ensure a balance between external measures for shareholders and customers, and internal measures of critical business processes, innovation and learning and growth. It strikes a balance between the outcome measures of past performance (lag indicators); the measures that drive future performance (lead indicators), and also between clearly quantifiable and somewhat subjective measures. BSC introduced the idea of measuring the drivers of performance, i.e. the lead indicators while retaining the measures of financial performance, i.e. the lag indicators of performance. Measures in each of these perspectives are interlinked such that a change in the leading measure results in a change in the lagging measure.

The distinguishing characteristic of Balanced Scorecard which is not found in other management control systems is the assumption of the cause-and-effect relationships between measures across the four perspectives. Strategy is understood in terms of a series of linked hypothesis that describe cause-and-effect relationships. For example, it can be hypothesised that ‘employee satisfaction’ shall lead to ‘employee retention’ and ‘employee productivity’. Accordingly, when there is improvement in ‘employee satisfaction’ the other two ‘effect’ parameters shall also show improvements. If they don’t, the hypothesis can be considered invalid. Thus, measurements in Balanced Scorecard provide an ongoing account of the projected cause-and-effect relationships across perspectives which are essential for making informed decisions. The causal relationships across four perspectives help predict the financial performance based on the indication from non-financial measures.

The balanced scorecard approach can be used and applied at both the individual and the organizational level. It provides a balanced approach to evaluate the employees‘ performance (for the purpose of Performance appraisal) in a comprehensive manner rather than a partial view. In most of the organizations, the common practice of measuring the employee performance refers to only the comparison of their action plans and behaviors with the standards set i.e. without actually measuring the results of their actions like profits and increase in market share. This conventional practice can lead to the appraisal of most of the employees without any or little progress towards achieving the goals and objectives of the organization. Thus, the balanced scorecard gives the complete view of the employees and the organizational performance and helps to align the employee performance/action plans with the organizational goals.

Though, initially, Balanced Scorecard emerged as a performance management system, over a period of time it has come to be known as a strategy management system, with its ultimate aim being the achievement of long term financial performance. Balanced scorecard is seen as a strategic management system enabling business leaders to meet the challenge of strategy execution.

External Resources About Balanced Scorecard:

- Conceptual Foundations of the Balanced Scorecard by Robert S. Kaplan (Harvard Business Review)

- Using the Balanced Scorecard as a Strategic Management System by Robert S. Kaplan and David P. Norton (Harvard Business Review)

- The Balanced Scorecard: Measures That Drive Performance by Robert S. Kaplan and David P. Norton (Harvard Business Review)