Geoffrey Moore, An American organizational theorist, management consultant and author, in his books Crossing the Chasm (1991) and Inside the Tornado (1995), draws on marketing theory and high-tech experience to describe the elements of the product life cycle for technology innovations. His work examines how communities respond to discontinuous innovations – or any new products or services that require the end user in the marketplace to dramatically change their past behavior. He describes how companies must position their products differently through the cycle to reach their full sales potential and become an industry standard instead of a novelty. Many new technologies start along a classic new product diffusion curve, but fail soon thereafter. Through the various phases of the technology adoption life cycle, very different strategies for product and service offering and positioning are called for.

The basis of the technology adoption life cycle is similar to the basis for diffusion models: different groups of potential customers react differently to innovations, and adoption proceeds from most enthusiastic to most conservative. Communities respond to discontinuous innovation – when confronted with the opportunity to switch to a new infrastructure paradigm, customers self-segregate along an axis of risk-aversion.

The significance of technology adoption life cycle is that it provides insight into the current market conditions for a technology and a glimpse into the future. This is achieved by understanding the types of buying personalities, and the percentage of the population they represent, as a technology matures and progresses through its adoption life cycle.

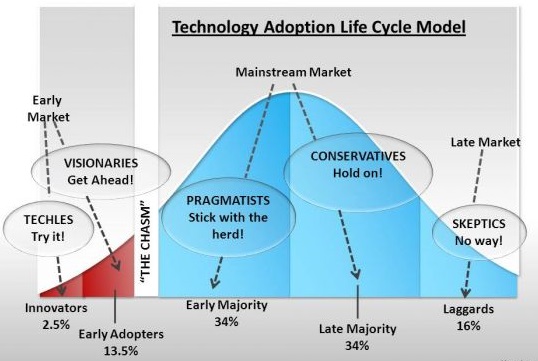

Moore separates customers into five categories, along which the cycle of new technology adoption proceeds:

- Innovators (2.5%) – Technology Enthusiasts, who are fundamentally committed to new technology on the grounds that sooner or later it will improve their lives. They pursue new technology aggressively,learning about and evaluating new products in an effort to be first. They’re likely to try anything new. They’re also relatively few in number. So for marketers, they represent a beachhead,an important source of references and referrals.

- Early Adopters (13.5%) – Visionaries and entrepreneurs in business and government who want to use the innovation to make a break with the past and start an entirely new future. They find it easy to imagine,understand,and appreciate the benefits of new technology. When it comes to high tech products,they’re looking for fundamental breakthroughs,not small improvements. They care about ROI and see new technology as helping them reach a business goal in a hurry, before their window of opportunity closes.

- Early Majority (34%) – Pragmatists, who make up the bulk of all technology infrastructure purchases; their purchasing behavior is based on evolution rather than revolution, and they buy only when there is a proven track record of useful productivity improvement. They’re ready to buy when someone else has taken the risk and worked out the bugs. Their goal is to make a percentage improvement ,rather than a quantum leap. They see a technology decision as something they’re going to have to live with for a long time, so service is important.

- Late Majority (34%) – Conservatives, who are very price sensitive and pessimistic about the added value of the product; they buy only when technology has been simplified and commoditized. They’re content to be followers, and often are not comfortable in their ability to handle new technology. They’re not going to buy until lots of others have the product, and what they’re using instead has become inconvenient. They are extremely service oriented and want lots of support.They won’t support high price margins.

- Laggards (16%) – Skeptics who are not really potential customers; goal is not to sell to them, but sell around their constant criticism. They are very late adopters and may, all things being equal, never adopt. In fact ,their major role in the technology marketplace is to block purchases by pointing out that new systems don’t deliver on the promises that are made at the time of purchase.

In addition to the above five zones, there is a sixth zone in technology adoption life cycle, that Moore calls the “chasm,” separating adoption by the early market customers (1,2) from adoption by the early majority (3). The name of this stage is significant, because it is a true representation of the chaos and turmoil existing at this point in the adoption life cycle. If not properly bridged, a new technology can stall and possibly fall to the bottom of the chasm, never to be heard from again. The chasm is created by the extreme differences between the buying habits of the visionaries and those of the pragmatists.

Moore describes the chasm as follows:

“Whenever truly innovative high-tech products are first brought to market, they will initially enjoy a warm welcome in an early market made up of technology enthusiasts and visionaries but then will fall into a chasm, during which sales will falter and often plummet. If the products can successfully cross this chasm, they will gain acceptance within a mainstream market dominated by pragmatists and conservatives. Since for product-oriented enterprises virtually all high-tech wealth comes from this third phase of market development, crossing the chasm becomes an organizational imperative.” – Geoffrey Moore (1995, p.19)

The strategy for “crossing the chasm,” as well as the strategy for each of the other “zones”, are very particular to where the product is in the life cycle. From the above figure its clear that, until the chasm is successfully bridged, the pragmatists will not enter the market. And until the pragmatists enter the market, the mainstream market will not be captured, and revenues will demonstrate little growth.

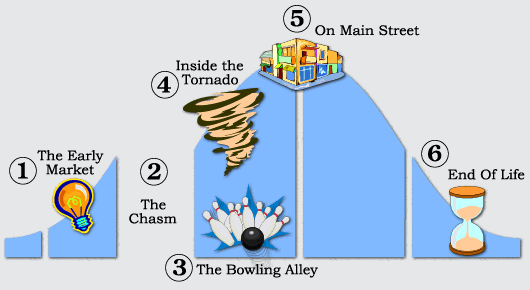

The figure below emphasizes the different value disciplines required at different stages. Note that the source of competitive advantage changes through the cycle – in Porter terms, it draws on various combinations of competing on cost leadership (operational excellence), differentiation (product leadership), and focus (customer intimacy).

Geoffrey Moore (1995, p.25) characterizes the six zones of technology adoption life cycle as follows:

- The Early Market: A time of great excitement when customers are technology enthusiasts and visionaries looking to be first to get on board with the new paradigm. Visionaries are willing to work through bugs and put in effort themselves to make the solution work. The product sells itself.

- The Chasm: A time of great despair, when the early market’s interest wanes but the mainstream market is still not comfortable with the immaturity of the solutions available. The only safe way to cross the chasm is to put all your eggs in one basket – target a single beachhead of pragmatist customers in a mainstream market segment and accelerate the formation of 100 percent of their whole product.

- The Bowling Alley: A period of niche-based adoption in advance of the general marketplace, driven by compelling customer needs and the willingness of vendors to craft niche-specific whole products. A whole product is the minimum set of products and services necessary to ensure that the target customer will achieve his or her compelling reason to buy. Pragmatists want a whole product, with the necessary user infrastructure and customer support. At this stage, companies should resist the temptation to try to provide a general purpose whole product and simplify the whole product challenge. To get customers on board, service content is high, ROI to end user must be high, and partnerships with other companies may be called for. Success in the niche can then be leveraged elsewhere. The two keys to targeting the right niche customers here are (1) the segment has a compelling reason to buy, and (2) the segment is not currently well served by any competitor.

- The Tornado: An ugly and frenzied period of mass-market adoption, when the general marketplace (early majority customers) switches over to the new infrastructure paradigm. It’s a herd mentality. Keys to success in this period are to ignore customer needs and product modifications and just ship, riding the wave. Market share is critical at this stage to lock out competitors, and partners should be eliminated. Companies entering the tornado should expand distribution channels, attack the competition, and price to maximize market share.

- Main Street: A period of aftermarket development, when the base infrastructure has been deployed and the goal is now to flesh out the potential. Another reversal of strategy is needed back to niche-based marketing. Before the product becomes obsolete, there is an opportunity to settle into a profitable period of differentiating the commoditized whole product with extensions focusing on the end user.

- End of Life: Which comes too soon in high-tech. Companies should find caretakers that can take over a fully commoditized product with low profit margin.

External Links: