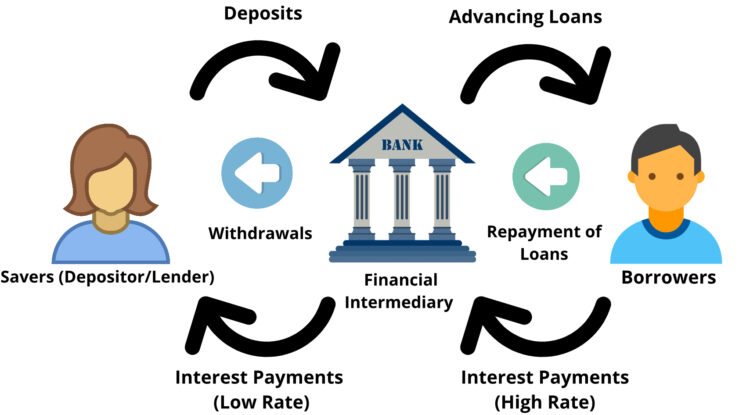

Financial intermediation is defined as the process which had been carried out by the financial intermediaries as the middleman between the borrower (spender) and lender (saver) to smooth the flow of the fund. Financial intermediation called the process of using indirect finance in the financial system, which the primary route to transfer funds from lender to borrower. Those savers who have the surplus money will deposit their funds in the financial institution, which will lend those funds to borrowers such as business firms, households, government, or foreigners who shortage of funds. Financial intermediaries are that financial institutions such as commercial banks, finance companies, or merchant banks.… Read the rest

Financial Institutions

Microfinance Through Self Help Groups (SHG)

In India, the Task Force on Supportive Policy and Regulatory Framework for Microfinance has defined MF (Microfinance) as the “Provision of thrift, credit and other financial services and products of very small amounts to the poor in rural, semi-urban or urban areas for enabling them to raise their income levels and improve living standards”.

Major characteristics of Microfinance are:

- Small amounts of saving and credit

- Collateral free credit through collateral substitute like peer pressure

- Group formation to create peer pressure and bring discipline

- Easy access

- Less and simplified procedures and documentations

- Credit for both investment and consumption needs

- Poor are bankable

- Affordable interest rates

- Sustainability

There are different methodologies for delivering microfinance like Grameen bank model of Prof.… Read the rest

8 Risks Faced by Modern Banks at the Present Competitive Business World

The unanticipated part of the return, that portion resulting from surprises is the true risk of any investment. If we always receive what we expect, than the investment is perfectly predictable and, by definition, risk-free. In other words, the risk of owning an asset comes from surprises-unanticipated events. RISK is a concept that denotes the precise probability of specific eventualities. It is simply the future uncertainty and not only the incidents of predictable outcomes but also the unpredictable favorable outcomes. All the firms or companies whether it is in real or providing service are facing some sort of risk at present competitive business world to run its business.… Read the rest

How Financial Markets Helps Savers and Borrowers?

What are financial markets and why it is important for savers and borrowers? A financial market is a system that includes individuals and institutions, and procedures that together borrowers and savers and it is no matter where is the location between the savers and borrowers. The main role of the financial market is to facilitate the funds from the individuals and businesses that have the majority fund to individuals, businesses, and governments to fulfill their needs of income. The financial institution is a process used by an organization that provides various types of financial services to their customers. The government authorities have controlled and supervised the institution according to the rules and regulations.… Read the rest

Functions of Commercial Banks

The main functions of commercial banks are accepting deposits from the public and advancing them loans. However, besides these functions there are many other functions which these banks perform.

Paul Samuelson has defined the functions of the Commercial bank in the following words: “The Primary economic function of a commercial bank is to receive demand deposits and a honor cheques drawn upon them. A second important function is to lend money to local merchants farmers and industrialists.”

The major functions performed by the commercial banks are:

1. Accepting DepositsThis is one of the primary functions of commercial banks. The commercial banks accept different types of deposits, the deposits may be broadly classified as demand deposits and time deposits. … Read the rest

Credit Rating

Credit rating is a codified rating assigned to an issue by authorized credit rating agencies. These agencies have been promoted by well-established financial Institutions and reputed banks/finance companies. Credit rating is a relative ranking arrived at by a systematic analysis of the strengths and weaknesses of a company and debt instrument issued by the company, based on financial statements, project analysis, creditworthiness factors and future prospectus of the project and the company appraised at a point of time.

Objectives of Credit RatingCredit rating aims to:

- Provide superior information to the investors at a low cost;

- Provide a sound basis for proper risk-return structure;

- Subject borrowers to a healthy discipline, and

- Assist in the framing of public policy guidelines on institutional investment.