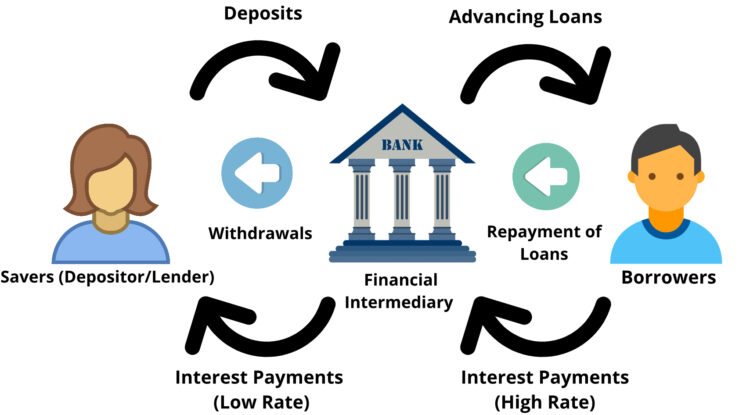

In banking, asset and liability management (ALM) is used to manage the risks that arise due to mismatches between the assets and liabilities (debts and assets) of the bank. Banks face several risks like liquidity risk, market risk, interest rate risk, credit risk, and operational risk. Asset Liability Management (ALM) is a strategic management tool to manage interest rate risk and liquidity risk faced by banks, other financial services companies, and corporations. Banks manage the risks of Asset liability mismatch by matching the assets and liabilities according to the maturity pattern or matching the duration, by hedging and by securitization.

Asset and liability management remain high-priority areas for bank regulators, with an emphasis on the management of market risk, liquidity risk, and credit risk.… Read the rest