Growth is a way of life. Almost all organizations plan to expand. This strategy is followed when an organization aims at higher growth by broadening its one or more of its business in terms of their respective customer groups, customers functions, and alternative technologies singly or jointly — in order to improve its overall performance. There are four types of expansion (Growth) strategies Expansion through concentration Expansion through integration Expansion through diversification Expansion through cooperation 1. Expansion through concentration It involves converging resources in one or more of firms businesses in terms of their respective customer needs, customer functions, or alternative technologies either singly or jointly, in such a manner that it results in expansions. A firm that is Continue reading

Strategic Management

Strategic management is the art and science of formulating, implementing and evaluating cross-functional decisions that will enable an organization to achieve its objectives. It involves the systematic identification of specifying the firm’s objectives, nurturing policies and strategies to achieve these objectives, and acquiring and making available these resources to implement the policies and strategies to achieve the firm’s objectives. Strategic management, therefore, integrates the activities of the various functional sectors of a business, such as marketing, sales, production etc. , to achieve organizational goals. It is generally the highest level of managerial activity, usually initiate by the board of directors and executed by the firm’s Chief Executive Officer (CEO) and executive team.

Retrenchment Strategies Followed by Organizations

A retrenchment grand strategy is followed when an organization aims at a contraction of its activities through substantial reduction or the elimination of the scope of one or more of its businesses in terms of their respective customer groups, customer functions, or alternative technologies either singly or jointly in order to improve its overall performance. Eg: A corporate hospital decides to focus only on special treatment and realize higher revenues by reducing its commitment to general case which is less profitable. The growth of industries and markets are threatened by various external and internal developments (External developments – government policies, demand saturation, emergence of substitute products, or changing customer needs. Internal Developments — poor management, wrong strategies, poor quality of Continue reading

Stablity strategies followed by MNC’s

The stability grand strategy is adopted by an organization when it attempts at an incremental improvement of its functional performance by marginally changing one or more of its businesses in terms of their respective customer groups, customer functions, and alternative technologies — either singly or collectively E.g: A copier machine company provides better after sales service to its existing customer to improve its company product image, and increase the sale of accessories and consumables This strategy may be relevant for a firm operating in a reasonably certain and predictable environment. Stability strategy can be of three types —No Change Strategy, Profit Strategy, Pause/ Proceed — with — caution Strategy. 1. No-Change Strategy It is a conscious decision to do nothing Continue reading

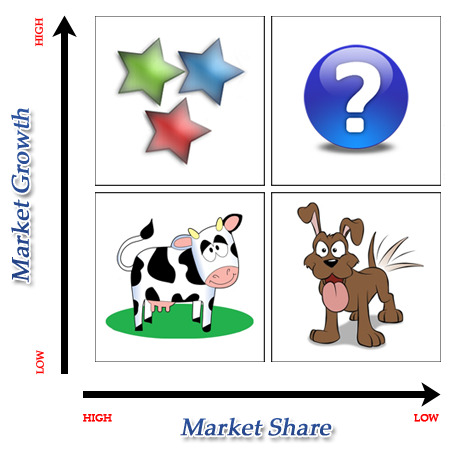

Boston Consulting Group(BCG) Growth-Share Matrix

The BCG matrix (aka B-Box, B.C.G. analysis, BCG-matrix, Boston Box, Boston Matrix, Boston Consulting Group analysis, portfolio diagram) is a chart that had been created by Bruce Henderson for the Boston Consulting Group in 1970 to help corporations with analyzing their business units or product lines. This helps the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis. Analysis of market performance by firms using its principles has called its usefulness into question, and it has been removed from some major marketing textbooks. Boston Consulting Group (BCG) Matrix is a four celled matrix (a 2 * 2 matrix). It is the most renowned corporate portfolio analysis tool. It provides Continue reading

Market entry strategies by MNC’s

Once the MNC decides to target a particular country, it has to decide the best mode of entry. Mode of entry means the manner in which the firm would commence its international operations. There are several entry modes, each with their own sets of advantages and disadvantages. A firm would have to decide which mode suits its circumstances best before it could be adopted. The different entry modes are: (1) Export entry modes: Under these modes, the firm produces in the home country and markets in the overseas markets. Direct exports do not involve home-country intermediaries and marketing is done either through direct agent/distributor or through direct branch/subsidiary in the overseas markets. Indirect exports involving intermediaries in Continue reading

GE/McKinsey Matrix

GE/McKinsey Portfolio Matrix Model GE/McKinsey Matrix is the business portfolio framework developed by General Electric with the help of McKinsey and Company, an American global management consulting firm. GE Business Screen includes nine cells based on long-term industry attractiveness and business strength/competitive position. Factors that Affect Market Attractiveness: There are several factors which can help determine attractiveness. These are listed below: Market Size Market growth Market profitability Pricing trends Competitive intensity / rivalry Overall risk of returns in the industry Opportunity to differentiate products and services Segmentation Distribution structure (e.g. retail, direct, wholesale) Factors that Affect Competitive Strength: There are several factors which can help determine the business unit strength. These are listed below: Strength of assets and competencies Continue reading