International Financial Markets

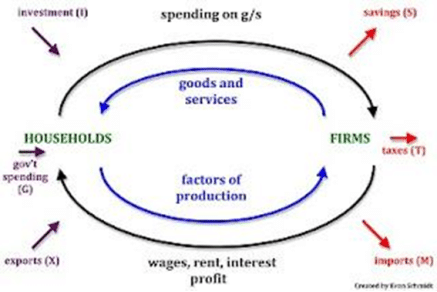

International financial markets provide links connecting the financial markets of each country and independent markets external to the authority of any one country. The heart of the international financial market is being governed by the currency market where the foreign currency is denominated by the international trade and investment. Hence the purchase of goods and services is preceded by the purchase of currency. The following are the reasons given for the enormous growth in the trading of foreign currency: Deregulation of international capital flows – Without the major government restrictions, itis extremely simple to move the currencies and capital around the globe. Gain in technology and transaction cost efficiency — The advancements in technologyis not only taking place in the distribution of information, in addition to the performance of exchange or trading. This has resulted greatly to the capacity of individuals on these markets to accomplish instantaneous arbitrage. Market upswings Continue reading