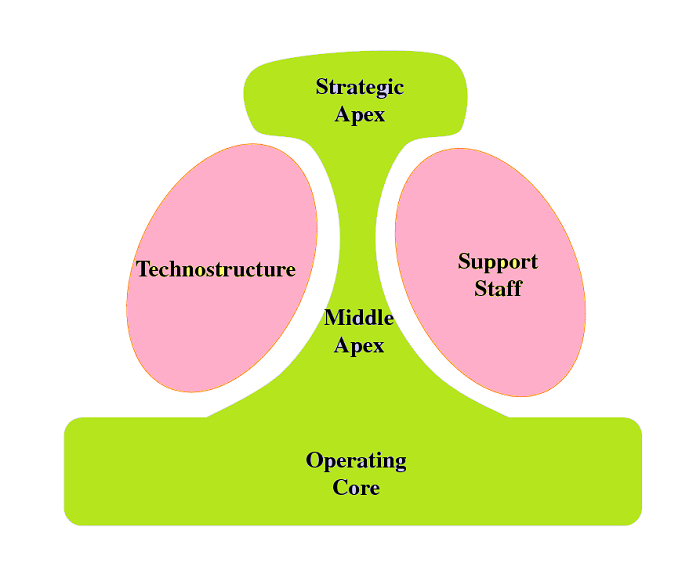

Mintzberg’s Model of Organizational Structure

Management expert Henry Mintzberg proposed that traditionally organizations (profit making or not for profit) can be divided into five components. In practice organizational structure may differ from proposed model. Factors influencing organizational structure are industry norms, size, experience, culture, external forces (competition, inflation, minimum wage legislation etc). Components identified by Mintzberg is useful for understanding the workflow of organizations. The structure of an organization can be defined simply as the sum total of the ways in which it divides its labor into distinct tasks and then achieves coordination among them” – The Structuring of Organizations, Henry Mintzberg. 1. Strategic Apex Strategic apex is the most senior level in the organization. Management working at this level is referred as Continue reading