Normally multibusiness companies comprise two elements: business units, which could theoretically be independent companies, relating directly to the capital markets; and one or more layers of other line and staff managers above or outside the businesses, which we refer to collectively as “the parent”. The businesses are directly involved in value creation: they produce goods and services and attempt to sell them for more than their cost. But the parent is involved much less directly. Its ability to create value depends largely on its influence on the businesses and the way it supports them.

The parent acts as an intermediary between the businesses and outside investors. It clearly incurs costs, both direct and indirect. It is therefore justified only if, through its influence, it creates more value than these costs. If it does not, businesses and shareholders would be better off without it. This bottom-up view challenges the very existence of the parent: the parent has no automatic right to exist. To justify its existence, the parent should be able to demonstrate that its businesses perform better in aggregate than they would as a series of individual, stand-alone entities.

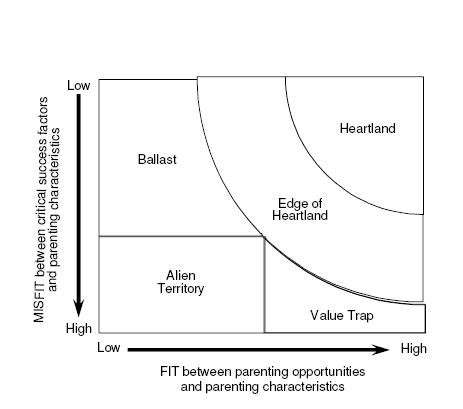

The essence of successful parenting is therefore to create a fit between the way the parent operates — the parent’s characteristics — and significant improvement opportunities that exist in its particular businesses. Parenting Fit Matrix summarizes the various judgements regarding corporate/business unit fit for the corporation as a whole. This matrix emphasizes their fit with the corporate parent Fit.

Parenting Fit Matrix composes of 2 dimensions: Positive contributions that the parent can make and the negative effects the parent can make. The combination of these two dimensions create 5 different positions:

- Heartland Businesses

- Edge-of-Heartland Businesses

- Ballast Businesses

- Alien Territory Businesses

- Value Trap Businesses

- Heartland Businesses: Heartland Businesses should be at the heart of the corporation’s future. These Heartland Businesses have opportunities for improvement by the parent, and the parent understands their critical success factors well. These businesses should have priority for all corporate activities.

- Edge-of-Heartland Businesses: In these businesses some parenting characteristics fit the business, but other do not. The parent may not have all the characteristics needed by a unit, or the parent may not really understand all of the units strategic factors. E.g.: a unit in this area may be very strong in creating its own image through advertising — a critical success factor in its industry. The corporate may however not have this strength and tends to leave this to its advertising agency. If the parent forced the unit to abandon its own creative efforts in favor of using the corporation’s favorite ad agency, the unit may struggle. Such business units are likely to consume much of the parent’s attention, as the parent tries to understand them better and transform them into Heartland Businesses.

- Ballast Businesses: Ballast Businesses fit very comfortably with the parent corporation but contain very few opportunities to be improved by the parent. Like cash cows may be important sources of stability and earnings. But if environmental changes, ballast could move to alien territory. Therefore corporate decision makers should consider divesting this unit as soon as they can get a price that exceeds the expected value of future cash flows. E.g.: IBM’s mainframe business.

- Alien Territory Businesses: Alien Territory Businesses have little opportunities to be improved by the corporate parent, and a misfit exists between the parenting characteristics and the units strategic factors. There is little potential for value creation but high potential for value destruction on the part of the parent. The corporation must divest this unit while it still has value.

- Value Trap Businesses: Value Trap Businesses fit well with parenting opportunities, but they are a misfit with the parent’s understanding of the units. This is where the corporate headquarters can make its biggest error. It mistakes what it sees as opportunities for ways to improve the business units profitability or competitive position. E.g.: To make the unit a world-class manufacturer (because the parent has world-class manufacturing skills) it may not notice that the unit is primarily successful because of its unique product development and niche marketing expertise.

Read More:

- Corporate Strategy: The Quest for Parenting Advantage (Harvard Business Review)