The Prospect Theory was originally conceived by Kahneman and Tversky (1979) and later resulted in Daniel Kahneman being awarded the Nobel Prize for Economics. The work by the authors is considered as path breaking in behavioral finance. They introduced the concept of prospect theory for the analysis of decision making under risk. This theory is considered to be seminal in the literature of behavioral finance. It was developed as an alternative model for expected utility theory. It throws light on how individual evaluate gain or losses. The prospect theory has three key aspects. People sometimes exhibit risk aversion and sometimes risk loving behaviors depending on the nature of the prospect. This is due to the fact that people give lower weight age to the outcomes which are probable as compared to those that are certain. This makes them risk averse for choices with sure gains while risk seekers for choices Continue reading

Behavioral Finance

An Introduction to Behavioral Finance

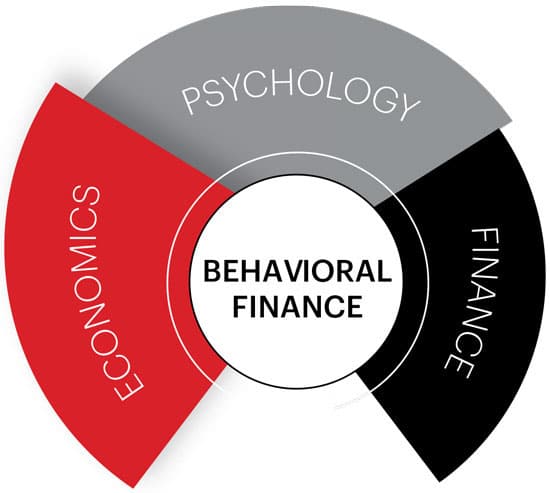

Traditionally, economics and finance have focused on models that assume rationality. The behavioral insights have emerged from the application of insights from experimental psychology in finance and economics. Behavioral finance is relatively a new field which seeks to provide explanation for people’s economic decisions. It is a combination of behavioral and cognitive psychological theory with conventional economics and finance. Inability to maximize the expected utility (EU) of rational investors leads to growth of behavioral finance within the efficient market framework. Behavioral finance is an attempt to resolve inconsistency of Traditional Expected Utility Maximization of rational investors within efficient markets through explanation based on human behavior. For instance, Behavioral finance explains why and how markets might be inefficient. An underlying assumption of behavioral finance is that, the information structure and characteristics of market participants systematically influence the individual’s investment decisions as well as market outcomes. Investor, as a human being, processes Continue reading

Confirmation Bias – Understanding Behavioral Biases in Finance

Confirmation bias is the inclination to seek or make sense of news or facts in a way that validates one’s preconceptions. So, during the decision making process for psychologist they will refer to information that supports their decision more favorably. They will rarely give the obvious negative much consideration and since our beliefs and postulations are definitely prejudiced so the tendency to give more attention and weight to data that support our beliefs than we do to contrary data will subtly but gradually have a harmful effect. An illustration of Confirmation Bias A very real manifestation of this tendency can be observed in the virtual world. For instance, investors are increasingly turning to message boards or virtual communities to search, clarify, and exchange information before making investment decisions. The volume of discussion on such portals is so intense that it has become possible to sense stock sentiments from here. These Continue reading