The Federal Bureau of Investigation (FBI) defines industrial espionage as “an individual or private business entity sponsorship or coordination of intelligence activity conducted for the purpose of enhancing their advantage in the marketplace.” While this definition may imply Industrial Espionage to be more or less the same as business or competitive intelligence, but there is an essential difference between the two – while business intelligence is generally under private sponsorship using an “open” methodology, espionage may be either government or privately sponsored and clandestine. Industrial Espionage is the process of collecting information and data for the purpose of generating revenue. Generating revenue is very important aspect for these people. They are not thrill seeker, if the compensation does not justify the reward they will not bother attempting to collect the required information. Individuals who commit Industrial Espionage are not looking for information for information sake, but for information that will Continue reading

Business Ethics

Case Study on Business Ethics: Madoff Investment Scandal

Bernard “Bernie” Lawrence Madoff is an American investment adviser and stock broker who operated Madoff Investments in an unethically acceptable manner. He used the company as a front to commit a Ponzi scheme which fleeced investors of over $65 billion. This has been regarded as the largest Ponzi scheme ever. Madoff grew up in a humble background and he established the Madoff Investments Company with support from the father in law. A few friends and family members also supported Madoff with the operations and growth of the business. Madoff used the returns from investment to support several charitable and political causes which his firm believed in. However, in 1999, there was concern that the profits made by Madoff Investments surpassed the normal profits expected from a firm in such a venture. Markopolos, an expert in investments informed the exchange commission that it was not possible to achieve the level of Continue reading

Good Governance – Meaning, Principles and Characteristics

In general, good governance is perceived as a normative principle of administrative law, which obliges the State to perform its functions in a manner that promotes the values of efficiency, no corruptibility, and responsiveness to civil society. It is therefore a principle that is largely associated with statecraft. While the government is not obliged to substantively deliver any public goods, it must ensure that the processes for the identification and delivery of such goods are concrete in terms of i) being responsive to public demands; ii) being transparent in the allocation of resources and; iii) being equitable in the distribution of goods. The principle of good governance has also been espoused in the context of the internal operations of private sector organizations. In this way, corporate decision-making strategies integrate the principle of good governance and ensure that shareholder interests (i.e. public limited companies) and employees are taken into account. The Continue reading

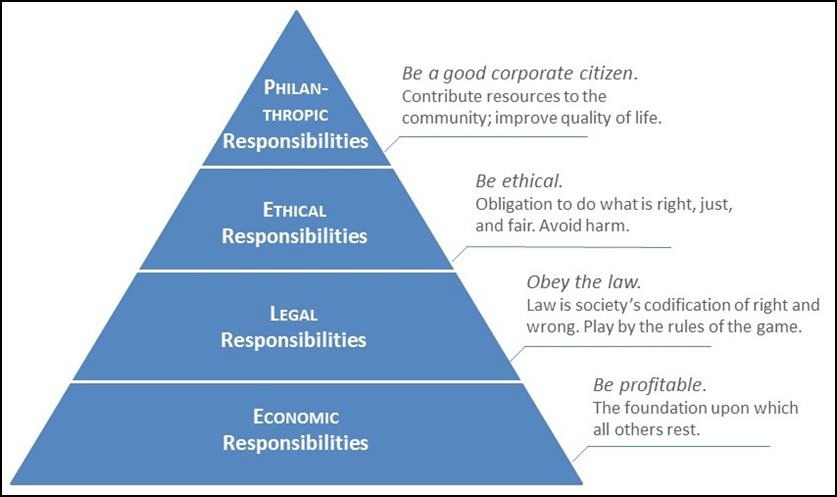

Carroll’s Pyramid of Corporate Social Responsibility

In the past, the common perception of a business responsibility was to maximize their firm’s profit. This is because businesses were perceived to always put the shareholder interests first. However, businesses are moving towards impacting the socials and environments. Several studies have found that businesses now have direct responsibilities to various other stakeholders which include preventing the harm of human rights and ensuring that there are solutions available if abuses occur. The modern view of business responsibility demands companies to help in problems relating to public welfare. As firms have no utmost responsibility for these unpleasant situations, philanthropic responsibilities are still not mandatory. However, due to a decrease of social institutions that provide help to the communities, people have higher expectations towards company and believe that they should take part in filling up the shortages. Carroll has proposed a CSR concept, Carroll’s Pyramid of Corporate Social Responsibility, which states the Continue reading

Case Study on Business Ethics: The Inside Story of the Collapse of AIG

AIG or American International Group and its subsequent failure are one of, if not the most well-known company failures in financial history. Of the more recent bankruptcies filed for companies like Enron and Worldcom, the effects and unforeseeable consequences of the failure of a company like AIG would be much more widespread and felt by many more Americans at the lay person level. AIG is primarily an insurance company that sells Property casualty, life, and travel insurance to customers the world over. However, there was another arm to the company known as AIG FP or American International Group Financial Products division. This division dealt in the financial markets as more than an intermediary, but actually as a trader. The most publicized and understood version of what happened at AIG is that the federal government bailed them out. The term bailout has come to be understood as a final resort transaction Continue reading

Madoff Scandal – How Bernie Madoff’s Ponzi Scheme Worked?

Bernard L. Madoff, simply known as Bernie is an American allegedly the operator of what is known as the largest Ponzi scheme in history. Bernie before his capture, acted as the stock broker, investment adviser and non-executive chairman of the NASDAQ stock market. It was not later than 2009 when Madoff pleaded guilty; he was guilty for turning his wealth management business into a massive Ponzi scheme. This scheme according to various sources defrauded thousands of investors billions of dollars. In 1960, Bernard Madoff founded one of the biggest firms in Wall Street. He was the chairman of his company “Madoff Investment Securities LLC”, until his arrest was warranted on the December of 2008. Before his arrest, the Madoff Investment Securities emerged as one of the top market maker businesses on the Wall Street. After his arrest, Madoff explained to his children as a confession that most of his asset Continue reading