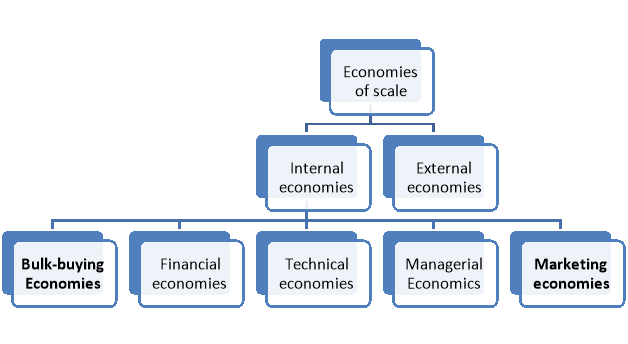

Economies of Scale The term economies of scale refers to a situation where the cost of producing one unit of a good or service decreases as the volume of production increases. Economies of scale arise when the cost per unit falls as output increases. Economies of scale are the main advantage of increasing the scale of production. Alfred Marshall made a differentiating concepts of internal and external economies of scale. That is that when costs of input factors of production go down, it is a positive externality for all the firms in the market place, outside the control of any of the firms. Internal Economies of Scale Internal economies of scale relate to the lower unit costs a single firm can obtain by growing in size itself. This means that the internal economies are exclusively available to the expanding firm. Internal economies of scale may be classified under the following Continue reading

Economics Concepts

Why Competition may Sometimes be Helpful?

Market structures refer to a total number of businesses in the market, their share and extent of competition in those businesses. Competition is a crucial aspect which cannot be overlooked in business. This is because human needs are many but resources for satisfying them are limited. As a result, firms have to compete to ensure they provide required services at certain cost. The major objective to operate a successful business is to earn a profit. In this process, resources are deployed to generate profits and thus businesses have to allocate resources strategically to ensure maximum benefits are achieved. In some business models, competition is steep while in others, they serve as a monopoly. Monopoly markets exist where there is no competition from the outside. The business operates solely in the market and thus they can control the flow of goods and services. To prevent customer exploitation, the government has to Continue reading

The Role of Government in Environmental Protection

The final controlling authority in most of the issues related to environment is the government itself. For example, most of the thermal power plants are owned by the government and also only the government can build dams, roads, railways, etc. Industrial or any other related activity cannot start without the approval of the government. Therefore, the government has to apply various checks and controls so that the environment is managed properly. How can the government establish incentives that would lead industries to choose the efficient amount of pollution control in their own best interest, even if they do not face all the social costs of residual emissions? 1. Direct Regulation Direct regulation of polluting activity (i.e., setting a legal limit for pollution) frequently comes to mind. The government could, for example, simply limit the industry’s pollution to R units by decree. Direct regulation of this sort was popular in the Continue reading

The Economists View of Environmental Pollution

Why do people use resources like the environment? This is because, pollution is a byproduct of activities that add to their welfare. These activities bring economic gain to producers and utility gain to consumers. We do not pollute the planet just for fun; we do it as part of activities that improve our welfare. The economists view of environmental pollution is that pollution creates another trade-off of cost and benefit that must be weighed on a case by case basis. Many of our streams and lakes have historically served as depositories of chemical waste generated by industrial plants and mines. Some are cleaner now, but many still suffer damage form earlier discharges of chemicals, like PCBs whose “half-lives” are measured in hundreds of years. Many pesticides, fertilizers, and detergents used by farms and homes find their way into our lakes and waterways, where they have damaged commercial and recreational fishing. Continue reading

Poverty Trap

Poverty trap is a situation where an unemployed person receiving social security benefits not encouraged to seek work because his or her after €tax earnings potential in work is less than the benefits currently obtained by not working. The poverty trap occurs due to benefits such as income support, housing benefit, single parent allowance and family tax credit. Given that social security benefits represent the ‘bottom line’ (that is, the provision of some socially and politically ‘acceptable’ minimum standard of living), the problem is how to reconcile this with the ‘work ethic’. For example, consider the case of a low-skilled person in the UK. He is unable to get a high-paid job because he doesn’t have the right skills, training or experience. He has two options. First one is to get a low-paid job or second option is to claim unemployment benefits. If he gets a low paid job he Continue reading

Government Policy Instruments for Managing Foreign Direct Investment (FDI)

By their choice of policies, home countries can both encourage and restrict FDI by local firms. We look at policies designed to encourage outward FDI first. These include foreign risk insurance, tax incentives, and political pressure. Then we will look at policies designed to restrict outward FDI. Home Country Policies to Encourage Outward FDI Many investor nations now have government backed insurance programs to cover major types of foreign investment risks. The types of risks insurable through these programs include risks of expropriation (nationalization), war losses and the inability to transfer profit back home. Such programs are particularly useful in encouraging firms to undertake investments in politically unstable countries. Home Country Policies to Restrict Outward FDI Virtually all investor countries, including the US, have tried to exercise some control over outward FDI from time to time. One common policy has been to limit capital outflows out of certain concern for Continue reading