Cash management is the process of forecasting, collecting, disbursing, investing, and planning for cash a company needs to operate smoothly. Cash management is a vital task because it is the most important yet least productive asset that a small business owns. A business must have enough cash to meet its obligations or it will be declared bankrupt. Creditors, employees and lenders expect to be paid on time and cash is the required medium of exchange. However, some firm retain an excessive amount of cash to meet any unexpected circumstances that might arise. These dormant cash have an income-earning potential that owners are ignoring and this restricts a firm’s growth and lowers its profitability. Investing cash, even for a short time, can add to company’s earning. Proper cash management permits the owner to adequately meet cash demands of the business, avoid retaining unnecessarily large cash balances and stretch the profit generating Continue reading

Financial Concepts

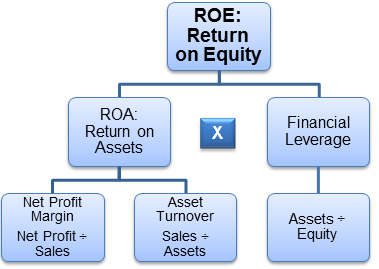

DuPont Analysis – Return on Equity (ROE) Analysis

Financial statement analysis is employed for a variety of reasons. Outside investors are seeking information as to the long run viability of a business and its prospects for providing an adequate return in consideration of the risks being taken. Creditors desire to know whether a potential borrower or customer can service loans being made. Internal analysts and management utilize financial statement analysis as a means to monitor the outcome of policy decisions, predict future performance targets, develop investment strategies, and assess capital needs. As the role of the credit manager is expanded cross-functionally, he or she may be required to answer the call to conduct financial statement analysis under any of these circumstances. The DuPont analysis is a useful tool in providing both an overview and a focus for such analysis. History of DuPont Analysis The DuPont model of financial analysis was made by F. Donaldson Brown, an electrical engineer Continue reading

Hedging with Derivatives – Futures Hedging, Forwards Hedging, and Swap Hedging

Futures Hedging A futures contract compels the buyer to purchase a particular quantity of assets within a certain period of time. The price of the purchase is agreed in the contract at the time of entering this contract. The asset that is to be purchased is referred to as the underlying asset and the time when this asset is purchased or sold is known as the expiry date or maturity date. While the major difference between a futures contract from an options contract is the obligation to purchase an asset, forward contracts also oblige the buyer to purchase the underlying asset. However, in contrast to forward contracts, futures contracts are drawn according to standardized forms and are more liquid since they are traded on secondary markets. Futures contracts provide more liquidity in comparison with forward contracts. A party that enters a futures agreement to purchase security may sell this right Continue reading

Total Return Swaps (TRS)

Total Return Swaps (TRS), sometimes known as a total rate of return swaps or TR swaps, are an on off-balance sheet transaction for the party who pays total returns composed of capital gains or losses plus the ordinary coupon or dividend, and receives LIBOR plus spread related to the counterparty’s credit riskiness on a given notional principal. The bank paying total returns is effectively warehousing, renting out its balance sheet while transferring economic value and risk to preferably an uncorrelated counterparty to the referenced assets. A TRS is similar to a plain vanilla swap except the deal is structured such that the total return (cash flows plus capital appreciation/depreciation) is exchanged, rather than just the cash flows. It is one of the principal instruments used by banks and other financial instruments to manage their credit risk exposure, and as such is a credit derivative. They are used as credit risk Continue reading

Future Flow Securitization

Securitization of the future flow-backed receivables is a new phenomenon in developing economies. Future Flow Securitization has grown in emerging markets in response to finding lower cost funding instrument by investment grade firms in the emerging market economies where their abilities were hampered by sovereign rate ceiling. While many of these companies historically relied on bank loans, or straight debts syndicated by major foreign banks in the past, rising volatility of interest rates and foreign exchange rates as well as reduced risk tolerance of major lenders have pushed these institutions (sovereign and private companies) toward an alternative vehicle such as future flow securitization. Future flows, have successfully mitigated a variety of the risks associated with emerging-market investments, and consistently remained the most viable type of rated transactions for funding in emerging-market countries. Future Flow Securitization Model Future Flow Securitization involves the borrowing entity to sell future receivables that would have Continue reading

Catastrophe Bonds or CAT Bonds

Catastrophe Bonds (or CAT Bonds) are high-yield, risk-linked securities used to transfer explicitly to the capital markets major catastrophe exposures such as low probability disastrous losses due to hurricanes and earthquakes. It has a special condition that states that if the issuer (Insurance or Reinsurance Company) suffers a particular predefined catastrophe loss, then payment of interest and/or repayment of principal is either deferred or completely waived. These bonds were first introduced as a solution to problems resulting from traditional insurance market capacity constraints, excessive insurance premia, and insolvency risk due to catastrophic losses. Catastrophe Bonds or CAT Bonds are complex financial tools which transfer peril specific risks to the capital markets instead of an insurance company. The peril risk is transferred through a complex system of events which include creation of a special purpose vehicle by a sponsor, modeling event scenarios by qualified risk management firms, drafting of a bond Continue reading