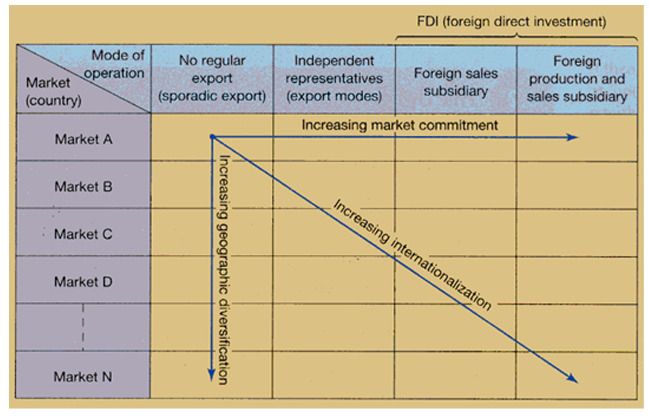

Internationalization consists of standardized products or service through globally standardized marketing and production processes that target standardized customer needs. Internationalization can be described as the process of increasing involvement in international operations. Another definition denotes internationalization as the process of adapting firms’ operations (strategy, structure, resources, etc) to international environments. Both definitions emphasize the crucial fact that internationalization needs an overall support from the organisation as it is changing the environment to expand in various manners the process mostly consists of macro factors to evolve.

The Process of InternationalizationInternationalization fundamentally alters the price-setting strategies of domestic economic agents. This is true for agents operating in product markets, factor markets and financial markets.… Read the rest