Knowledge-intensive production, technological change, shrinking economic space greater openness have also changed the context for Transnational Corporations (TNCs). There are new opportunities and pressures to utilize them. The opening of markets creates new geographical space for TNCs to expand in and access tangible and intangible resources. It also permits wider choice in the methods firms can use (FDI, trade, licensing, subcontracting, franchising, partnering and so on) to operate in different locations. At the same time, advances in information, communication and transportation technologies, as well as in managerial and organizational methods, facilitate the trans-nationalization of many firms, including SMEs. The combination of better access to resources and a better ability to organize production trans-nationally increases the pressure on firms to utilize new opportunities, lest their competitors do so first and gain a competitive advantage. Competition is everywhere – there are fewer and fewer profit reservations and market niches that remain protected Continue reading

Global Business Environment

Foreign Direct Investment and the Business Environment

Direct investment abroad is a complex venture. As distinct from trade, licensing or investment, Foreign Direct Investment (FDI) involves a long-term commitment to a business endeavor in a foreign country. It often involves the engagement of considerable assets and resources that need to be coordinated and managed across countries and to satisfy the principle of successful investment, such as sustainable profitability and acceptable risk/profitability ratios. Typically, there are many host country factors involved in deciding where an FDI project should be located and it is often difficult to pinpoint the most decisive factor. However, it is widely agreed that FDI takes place when three sets of determining factors exist simultaneously; the presence of ownership-specific competitive ages in a transnational corporation (TNC), the presence of locational advantages in a host country, and the presence of superior commercial benefits in an intra-firm as against an arm’s-length relationship between investor and recipient. The Continue reading

Role of Fiscal Policy in Economic Development

Fiscal policy refers to the guiding principles of the financial work which are constituted by the state based on political, economic and social development tasks under a certain period. Its purpose is to regulate aggregate demand through government’s spending and tax policies. On the one hand, an increase in government spending will stimulate aggregate demand and increase the national income. Correspondingly, a decrease will depress aggregate demand and reduce national income. On the other hand, a tax is a kind of contraction strength to national income. Therefore, the aggregate demand and the national income will be restrained though increasing government revenue. And they will be increased due to reducing in government revenue as well. The fiscal policy with a distinct class character is formulated by the state, represents the will and interests of the ruling class, and is subject to a certain level of development of social productive forces and Continue reading

Economic Impacts of Deficit Financing

Deficit financing can be regarded as a necessary evil which has to be tolerated, at least in the developing economies; only to the extent it can promote capital formation and economic development. This extent of tolerance is called the “safe limit of deficit financing”. This safe limit shows the amount of deficit financing that the economy can absorb and beyond which ‘inflationary forces’ may be set in motion. The economic impacts of deficit financing are: Deficit Financing and Price Level There are two opinions regarding the effect of deficit financing on the price level especially in a developing country. According to one view, deficit financing need not be inflationary in character especially if it is used during the peace time. The advocates of this view argued that: In a developing economy the existence of non-monetized sector will absorb the issue of new currency and shrink in its size over a Continue reading

Deficit Financing

Deficit financing is understood in different ways in different countries. It is understood as the excess of current expenditure over current revenue which is financed either through public borrowing or the creation of new money by the government. So the deficit budget is also called deficit financing in USA. But in India deficit financing is understood in a different way from deficit budget. While the former refers to a situation where the current expenditure exceeds current revenue of the government, the latter is taken to mean the excess of aggregate expenditure (both on current and capital accounts) over aggregate revenue. The former is called deficit budgeting and the latter deficit financing in India. Deficit financing in Indian context refers to the meeting of budgetary deficit through the creation of new money adding to the existing money supply in the economy. Deficit financing includes any or all of the following in Continue reading

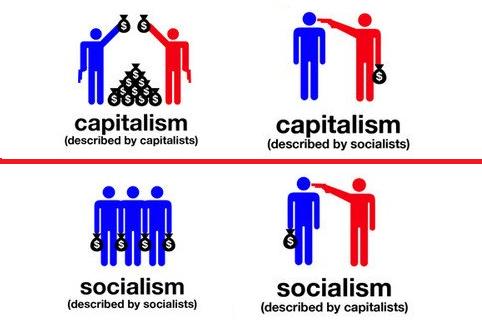

Types of Economic Systems

It has been already pointed out that the way in which the three basic economic questions are answered depends on the economic system which functions in a country. To understand how these answers differ among the economic systems, we should understand the different types of economic systems. Major Types of Economic Systems Economic systems may broadly be classified into three categories: Capitalism, Socialism and Mixed economy. A number of other types also emerged but all of them came close to any one of the above three types of economic systems. Let us now discuss the features, strengths and weaknesses of each one of these economic systems. 1. Capitalism Capitalism is an economic system based on the principle of free enterprise. Individual ownership of resources is an important feature. With control and command over resources, individuals can conduct any type of business. The object in such a system is to maximize Continue reading