The organizations have been focused towards adopting key business approaches and practices that would contribute towards their improved revenue as well as profitability in the marketplace. In order to achieve such strategic goals to revenue and operational growth, it is required by the management to identify and understand the changing market needs, as well as the stakeholder preferences and accordingly the internal business or operational strategies, are to be defined. Considering such need, it can be reflected that in the present marketplace there is a need for the business organization to focus towards the increased social preferences and need towards sustainability and societal development along with that of the business growth.… Read the rest

International Economics

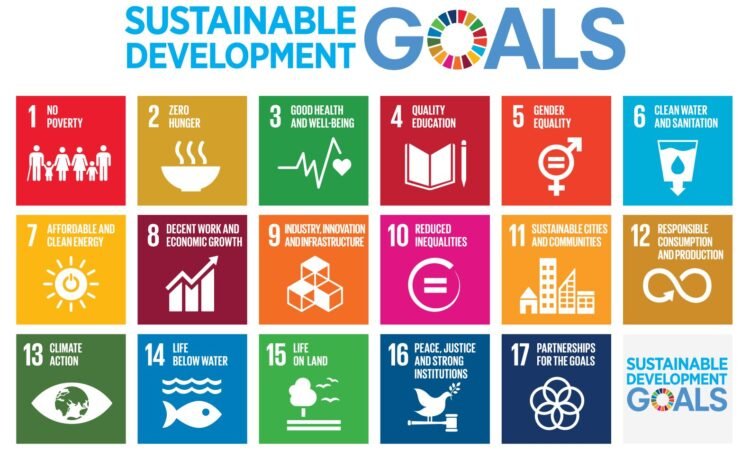

Sustainable Development Goals (SDGs) – An Overview

The United Nations Sustainable Development Goals (SDGs) is a program that was created by the United Nations. Its aim is to achieve an all-round development globally through having the desire to achieve such factors as; hunger and poverty reduction, having many people access both clean and affordable energy, improvement and provision of proper health services, industrialization, innovation and both economic and infrastructural development and many more objectives totaling to seventeen. In other words, it offers a sincerely comprehensive apparition of the future.

These sustainable development goals were created and adopted in 2015 September, after the period for which the achievements of Millennium Development Goals (MDGs) were terminated in 2015.… Read the rest

Predicting Financial Distress and Corporate Failure

The financial failure of a company can have a devastating effect on all seven users of financial statements e.g. present and potential investors, customers, creditors, employees, lenders, the general public, etc. As a result, users of financial statements as indicated previously are interested in predicting not only whether a company will fail, but also when it will fail e.g. to avoid high profile corporate failures at Enron, Arthur Anderson, and WorldCom, etc. Users of financial statements can predict the financial position of an organization using the Altman Z score model, Argenti A score model, and by looking at the financial statements i.e.… Read the rest

The SCP Paradigm – Structure drives Conduct which drives Performance

The SCP paradigm assumes that the market structure determines the conduct of the organization. This conduct, in turn, is the determinant of market performance. Examples of market performance include efficiency, profitability and growth. The Structure Conduct Performance Framework seeks to establish that certain structures of the industry can lead to certain kinds of conduct or behavior which then leads to various types of economic performance. The SCP paradigm was developed through evaluation of empirical studies involving American industries. Theoretical models were not used to support the paradigm. The conclusion that was drawn from empirical studies was that market structure determined performance.… Read the rest

What is a Circular Economy?

The term circular economy (CE) has both a linguistic and descriptive meaning. Linguistically it is an antonym of a linear economy. A linear economy is one defined as converting natural resources into waste, via production. Such production of waste leads to the deterioration of the environment in two ways: by the removal of natural capital from the environment (through mining/unsustainable harvesting) and by the reduction of the value of natural capital caused by pollution from waste. And the word circular has a second, inferred, descriptive meaning, which relates to the concept of the cycle. There are two cycles of particular importance here: the biogeochemical cycles and the idea of recycling of products.… Read the rest

The Lemon Market Theory

The Lemon Market Theory (LMT) explained by Nobel Prize winner George A. Akerlof in 1970 in his seminal paper, “The Market for Lemons: Quality Uncertainty and the Market Mechanism” describes how markets that sell good products is never identified because of poor quality supplying markets, as sellers of the poor quality products are provided incentives to sell their products. Incentives such as guarantees, warranties and brand names oppose the quality uncertainty issue. The Lemon Market Theory also focuses on the information asymmetry or unbalanced information between the buyer and seller, where the entire set of sellers take the credit for the quality of the product or service rather than granting the individual quality reward to the appropriate seller who provides the good quality ones.… Read the rest