Embarking on a startup journey is an exhilarating experience filled with opportunities and challenges. Among the critical challenges, financial planning stands out as a decisive factor that can drive a startup from its nascent stages to successful growth. Effective financial planning not only secures a startup’s present needs but also paves the way for future expansion. This article will delve into the key aspects of financial planning that are essential for a startup’s growth. Innovative Cost Management In the early stages, managing costs is crucial for startups. While traditional cost-cutting methods are important, innovative approaches can also play a significant role. For instance, investing in sustainable technology like portable power stations for solar power can reduce long-term energy costs. This not only helps in managing expenses but also aligns the startup with contemporary eco-friendly practices. Securing Adequate Funding Securing adequate funding is the cornerstone of a startup’s financial planning. This Continue reading

Investment Ideas

An Introduction to Hedge Funds

What are Hedge Funds? A hedge fund is a type of private placement investment that is managed by investment management firms and is made up of sophisticated or institutional investors. The fundamental reason why various individuals participate in hedge funds is to protect themselves from losses in other assets. Managers of investment pools employ a variety of tactics, including leverage and esoteric asset trading, in an attempt to outperform the markets in terms of returns. Hedge funds invest in portfolios built with high risk management strategies in order to produce large returns even in the worst-case scenarios. Hedge funds displays multiple characteristics which are discussed below: Hedge funds are financial instruments which requires investment of large amount of capital and thus is not available to general public just as mutual funds are. Hedge funds are not regulated like mutual funds are which makes them highly risky asset acting as the Continue reading

Children Today Are Smarter Than Ever, Is Your Future Planning Too?

You must be wondering how smart your children are and how they are learning so much beyond their years. For instance, ask your child to open an app on your smartphone, and they would do that in a jiffy. Studies show that young children are smarter than adults and can imagine, observe and learn new things. If your children are this intelligent; therefore, don’t you want to make sure that they achieve greater heights in their lives? You know how important a role does education plays in helping your children accomplish their dreams, which is why you should make the best arrangements for them. It would help if you prepared financially to support your child’s education, especially since the high cost of education these days is steep. One of the first steps that you must take towards financial sustenance is invested in the right instrument that can help you maximise Continue reading

Think Beyond Traditional Plans to Maximize on Your Goals: Here’s How

Long gone are the days when you invested Rs. 1 lakh a year for 20 years to receive Rs. 20 lakhs. While our grandparents and parents were dependent on this benefit for their future retirement, the truth is that the present generation will not. The essential question here is, “What can the present generation do to secure their future?” and “Are there any chances of ever getting one that can match up to these plans?”. The answer is Yes. Today,there are far more ways to potentially grow your money. There is another world of investment options beyond these traditional plans that can provide opportunities for maximizing your returns and saving for retirement. The Pension Scenario Today Prior to January 1, 2009, all Indian employees reaped the benefit of a defined benefit pension plan until the National Pension System (NPS), with the decision of the Government of India, decided to put Continue reading

How To Minimize Risk When Investing Online

Any type of investment carries risk, and you should be distrustful of an investment opportunity that offers you a guarantee of your money back plus earnings. The greater the risk can mean the greater the return, however if the investment opportunities you are currently pursuing are resulting in a lack of sleep and causing you to worry about them then perhaps they are too high-risk and you should look at minimizing your stake to lower your potential losses. There are ways that you can try to minimize your risk when it comes to investing online, such as obtaining sage financial advice, diversifying your investment portfolio, and keeping up to date with all your investments and monitoring and reallocating funds where necessary. Get advice Before investing, it is worth getting an online financial advisor to help you to invest your money wisely to reach your goals. They will plan your investments Continue reading

Impact of Interest Bearing Securities in Portfolio Management

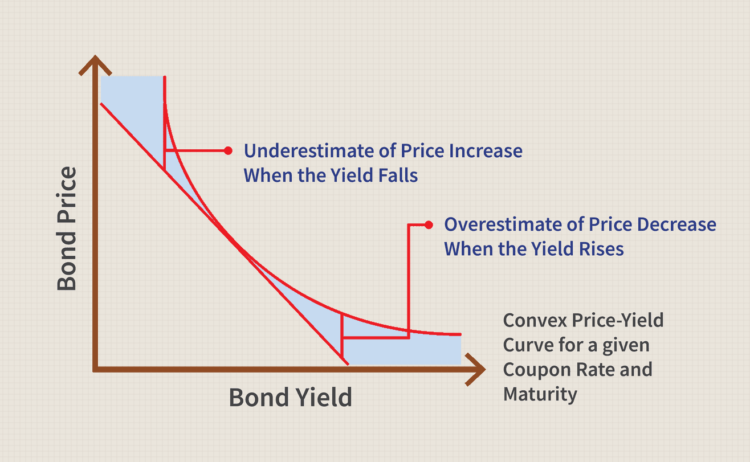

Money market is a segment of the financial market where the securities are traded for shorter term and the risk associated with the money market is comparatively lower than the capital market. On the other hand, capital market is that section of the financial, market where the securities are traded for longer term and the risk is higher than the money market. The securities, which yield interest, are referred as the interest bearing securities. There are two types of interest bearing securities. One is fixed interest-bearing securities and the other is variable interest securities. The key interest rate in the capital market includes interest on public corporation bonds, government bonds, and rates on deposit of long-term debentures. The interest bearing securities in the money market include Treasury bill, commercial paper, certificate of deposits, money market bonds. The interest rate is the yield, which is paid to the owner of the Continue reading