Mutual fund is a trust that pools the savings of a number of investors who share a common financial goal. This pool of money is invested in accordance with a stated objective. The joint ownership of the fund is thus “Mutual”, i.e. the fund belongs to all investors. The money thus collected is then invested in capital market instruments such as shares, debentures and other securities. The income earned through these investments and the capital appreciations realized are shared by its unit holders in proportion the number of units owned by them. Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost. A Mutual Fund is an investment tool that allows small investors access to a well-diversified portfolio of equities, bonds and other securities. Each shareholder participates Continue reading

Investment Terms

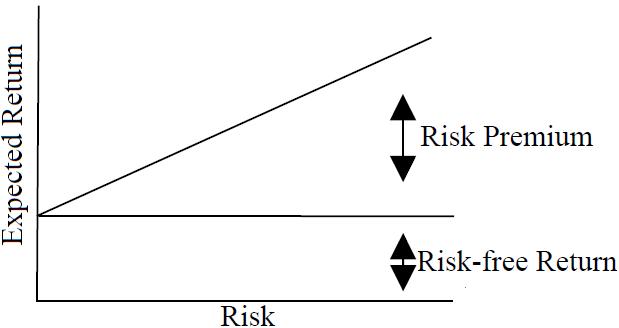

Risk-Return Trade off

Risk may be defined as the likelihood that the actual return from an investment will be less than the forecast return. Stated differently, it is the variability of return form an investment. Financial decisions incur different degree of risk. Your decision to invest your money in government bonds has less risk as interest rate is known and the risk of default is very less. On the other hand, you would incur more risk if you decide to invest your money in shares, as return is not certain. However, you can expect a lower return from government bond and higher from shares. Risk and expected return move in one behind another. The greater the risk, the greater the expected return. Financial decisions of a firm are guided by the risk-return trade off. These decisions are interrelated and jointly affect the market value of its shares by influencing return and risk of Continue reading

Technical Analysis of Stocks

Definition of Technical Analysis Technical analysis is the process of utilizing past trading information and stock price trends related to a specific security, and then equating those to how other likewise investments have responded throughout history to similar patterns. Further, when a pattern is identified, the investor can predict that the future pricing of the target investment is likely to respond in a similar manner to patterns observed earlier. Technical analysis of stocks assumes that current prices should represent all known information about the markets. Prices not only reflect intrinsic facts, they also represent human emotion and the pervasive mass psychology and mood of the moment. Prices are, in the end, a function of supply and demand. However, on a moment to moment basis, human emotions,fear, greed, panic, hysteria, elation, etc. also dramatically affect prices. Markets may move based upon people’s expectations, not necessarily facts. A market “technician” attempts to Continue reading

Buy Back of Securities

Buy Back of Securities means the purchase by the company of its own shares. Buy-back of equity shares is an important mode of capital restructuring. It is a corporate financial strategy which involves capital restructuring and is prevalent globally with the underlying objectives of increasing earnings per share, averting hostile takeovers, improving returns to the stakeholders and realigning the capital structure. Buy Back of Securities is done by the company with the purpose to improve liquidity in its shares and enhance the shareholders’ wealth. Under the SEBI (Buy Back of Securities) Regulations, 1998, a company is permitted to buy back its shares from: existing shareholders on a proportionate basis through the offer document; open market through stock exchanges using book building process; and shareholders holding odd lot shares. The company has to disclose the pre and post-buy back holdings of the promoters. To ensure completion of the buy back process Continue reading

What are Circuit Breakers?

Volatility in stock prices is a cause of concern for both the policy makers and the investors. To curb excessive volatility, SEBI has prescribed a system of circuit breakers. The circuit breakers bring about a nation-wide coordinated halt in trading on all the equity and equity derivatives markets. An index based market-wide circuit breaker system applies at three stages of the index movement either way at 10%, 15% and 20%. The breakers are triggered by movement of either S&P CNX Nifty or Sensex, whichever is breached earlier. Further, the NSE views entries of non-genuine orders with utmost seriousness as this has market-wide repercussion. It may suo-moto cancel the orders in the absence of any immediate confirmation from the members that these orders are genuine or for any other reason as it may deem fit. As an additional measure of safety, individual scrip-wise price bands have been fixed as below: Daily Continue reading

Commodity Market Participants

Commodity market is a place where trading in commodities takes place. Markets where raw or primary products are exchanged. These raw commodities are traded on regulated commodities exchanges, in which they are bought and sold in standardized Contracts. It is similar to an Equity market, but instead of buying or selling shares one buys or sells commodities. Commodity market is an important constituent of the financial markets of any country. It is the market where a wide range of products, viz., precious metals, base metals, crude oil, energy and soft commodities like palm oil, coffee etc. are traded. It is important to develop a vibrant, active and liquid commodity market. This would help investors hedge their commodity risk, take speculative positions in commodities and exploit arbitrage opportunities in the market. In current situation, all goods and products of agricultural (including plantation), mineral and fossil origin are allowed for commodity trading Continue reading