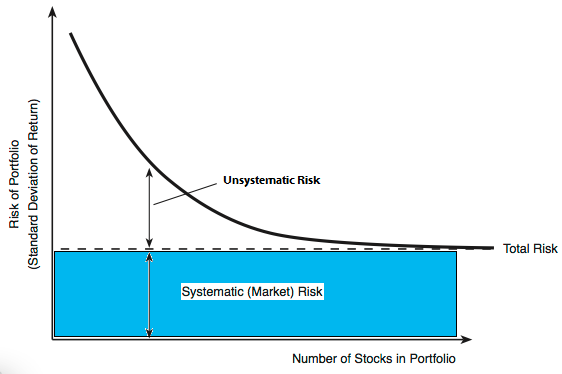

The benefits from diversification increase, as more and more securities with less than perfectly positively correlated returns are included in the portfolio. As the number of securities added to a portfolio increases, the standard deviation of the portfolio becomes smaller and smaller. Hence an investor can make the portfolio risk arbitrarily small by including a large number of securities with negative or zero correlation in the portfolio. But in reality, no securities show negative or even zero correlation. Typically, securities show some positive correlation, which is above zero but less than the perfectly positive value (+1). As a result, diversification (that is, adding securities to a portfolio) results in some reduction in total portfolio risk but not in complete elimination of risk. Moreover, the effects of diversification are exhausted fairly rapidly. That is, most of the reduction in portfolio standard deviation occurs by the time the portfolio size increases to Continue reading

Portfolio Management

Naïve Diversification of Investment Portfolio

Portfolios may be diversified in a naïve manner, without really applying the principles of Markowitz diversification, which is discussed at length in the next paragraph. Naïve diversification, where securities are selected on a random basis only reduces the risk of a portfolio to a limited extent. When the securities included in such a portfolio number around ten to twelve, the portfolio risk decreases to the level of the systematic risk in the market. It may also be noted that beyond fifteen shares, there is no decrease in the total risk of a portfolio. Before discussing about portfolio diversification process, what the researches of investors and investment analysts have found is to be set out briefly. Firstly, they found that putting all eggs in one basket is bad and most risky. Secondly, there should be adequate diversification of investment into various securities as that will spread the risk and reduce it; Continue reading

The Process of Diversification of Investment Portfolio

The process of diversification of investment portfolio has various phases involving investment into various classes of assets like equity shares, preference shares, money market instruments like commercial paper, inter-corporate investments, certificate of deposits etc. Within each class of assets, there is further possibility of diversification into various industries, different companies etc. The proportion of funds invested into various classes of assets, instruments, industries and companies would depend upon the objectives of investor, under portfolio management and his asset preferences, income and asset requirements. A portfolio with the objective of regular income would invest a proportion of funds in bonds, debentures and fixed deposits. For such investment, duration of the life of the bond/debenture, quality of the asset as judged by the credit rating and the expected yield are the relevant variables. Bond market is not well developed in India but debentures, partly or fully convertible into equity are in good Continue reading

Diversification of Securities in Portfolio Investments

Reduction of Risk through Diversification of Securities The process of combining securities in an investment portfolio is known as diversification. The aim of diversification of securities is to reduce total risk without sacrificing portfolio return. To understand the mechanism and power of diversification, it is necessary to consider the impact of co-variance or correlation on portfolio risk more closely. We shall examine three cases: (1) when security returns are perfectly positively correlated, (2) when security returns are perfectly negatively correlated and (3) when security returns are not correlated. Diversification means, investment of funds in more than one risky asset with the basic objective of risk reduction. The lay man can make good returns on his investment by making use of technique of diversification. Main forms of Diversification of Securities Simple Diversification, Over Diversification, Efficient Diversification. 1. Simple Diversification It involves a random selection of portfolio construction. The common man could Continue reading

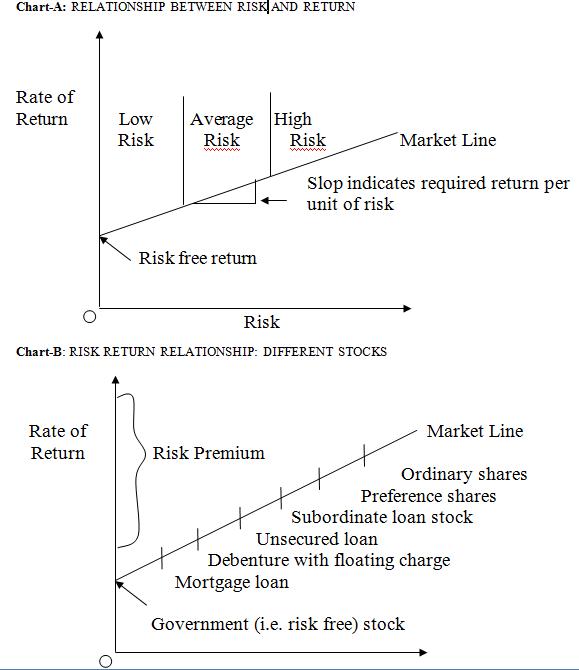

Risk-Return relationship in investments

The entire scenario of security analysis is built on two concepts of security: Return and risk. The risk and return constitute the framework for taking investment decision. Return from equity comprises dividend and capital appreciation. To earn return on investment, that is, to earn dividend and to get capital appreciation, investment has to be made for some period which in turn implies passage of time. Dealing with the return to be achieved requires estimated of the return on investment over the time period. Risk denotes deviation of actual return from the estimated return. This deviation of actual return from expected return may be on either side — both above and below the expected return. However, investors are more concerned with the downside risk. The risk in holding security deviation of return deviation of dividend and capital appreciation from the expected return may arise due to internal and external forces. That Continue reading

Risk and Return in Portfolio Investments

Risk in Portfolio Investments The Webster’s New Collegiate Dictionary definition of risk includes the following meanings: “……. Possibility of loss or injury ….. the degree or probability of such loss”. This conforms to the connotations put on the term by most investors. Professional often speaks of “downside risk” and “upside potential”. The idea is straightforward enough: Risk has to do with bad outcomes, potential with good ones. In considering economic and political factors, investors commonly identify five kinds of hazards to which their investments are exposed. The following are different components of risks associated with portfolio investments: A. Systematic Risk Systematic risk refers to the portion of total variability in return caused by factors affecting the prices of all securities. Economic, Political and Sociological changes are sources of systematic risk. Their effect is to cause prices of nearly all individual common stocks or security to move together in the same Continue reading