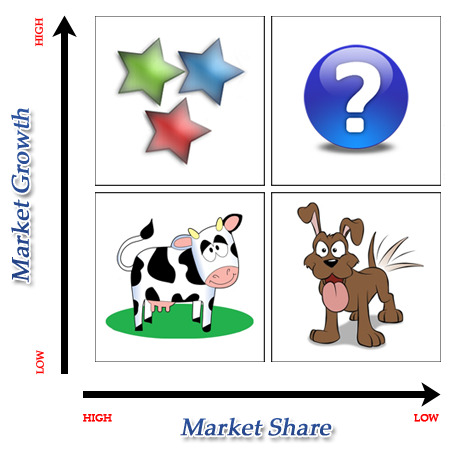

The BCG matrix (aka B-Box, B.C.G. analysis, BCG-matrix, Boston Box, Boston Matrix, Boston Consulting Group analysis, portfolio diagram) is a chart that had been created by Bruce Henderson for the Boston Consulting Group in 1970 to help corporations with analyzing their business units or product lines. This helps the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis. Analysis of market performance by firms using its principles has called its usefulness into question, and it has been removed from some major marketing textbooks. Boston Consulting Group (BCG) Matrix is a four celled matrix (a 2 * 2 matrix). It is the most renowned corporate portfolio analysis tool. It provides a graphic representation for an organization to examine different businesses in it’s portfolio on the basis of their related market share and industry growth rates. It is a two dimensional Continue reading

Strategic Management Tools

GE/McKinsey Matrix

GE/McKinsey Portfolio Matrix Model GE/McKinsey Matrix is the business portfolio framework developed by General Electric with the help of McKinsey and Company, an American global management consulting firm. GE Business Screen includes nine cells based on long-term industry attractiveness and business strength/competitive position. Factors that Affect Market Attractiveness: There are several factors which can help determine attractiveness. These are listed below: Market Size Market growth Market profitability Pricing trends Competitive intensity / rivalry Overall risk of returns in the industry Opportunity to differentiate products and services Segmentation Distribution structure (e.g. retail, direct, wholesale) Factors that Affect Competitive Strength: There are several factors which can help determine the business unit strength. These are listed below: Strength of assets and competencies Relative brand strength Market share Customer loyalty Relative cost position (cost structure compared with competitors) Distribution strength Record of technological or other innovation Access to financial and other investment resources Continue reading

Shell’s Directional Policy Matrix (DPM)

The Shell Directional Policy Matrix (DPM) is another refinement upon the Boston Consulting Group (BCG) Matrix. Along the horizontal axis are prospects for business sector profitability, and along the vertical axis is a company’s competitive capability. Business sector profitability includes the size of the market, expected growth, lack of competition, profit margins within the market and other favorable political and socio-economic conditions. On the other hand company’s competitive capability is determined by the sales volume, the products reputation, reliability of service and competitive pricing. As with the GE Business Screen the location of a Strategic Business Unit (SBU) in any cell of the matrix implies different strategic decisions. However decisions often span options and in practice the zones are an irregular shape and do not tend to be accommodated by box shapes. Instead they blend into each other. Each of the zones in Shell’s Directional Policy Matrix is described as Continue reading

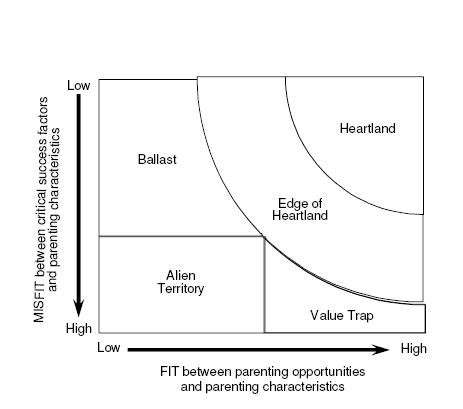

Parenting Fit Matrix

Normally multibusiness companies comprise two elements: business units, which could theoretically be independent companies, relating directly to the capital markets; and one or more layers of other line and staff managers above or outside the businesses, which we refer to collectively as “the parent”. The businesses are directly involved in value creation: they produce goods and services and attempt to sell them for more than their cost. But the parent is involved much less directly. Its ability to create value depends largely on its influence on the businesses and the way it supports them. The parent acts as an intermediary between the businesses and outside investors. It clearly incurs costs, both direct and indirect. It is therefore justified only if, through its influence, it creates more value than these costs. If it does not, businesses and shareholders would be better off without it. This bottom-up view challenges the very existence Continue reading

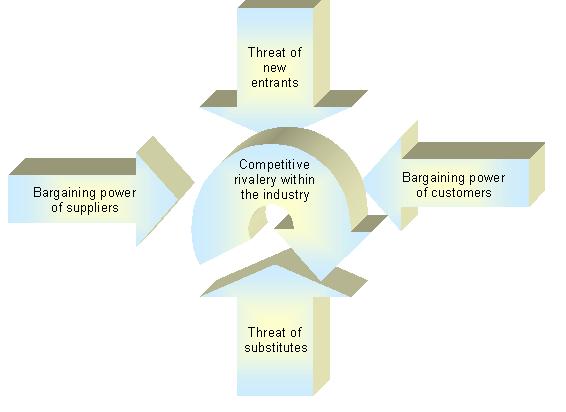

Porter’s Model of the Five Competitive Forces

The nature of competition in an industry in large part determines the content of strategy, especially business-level strategy. Based as it is on the fundamental economics of the industry, the very profit potential of an industry is determined by competitive interactions. Where these interactions are intense, profits tend to be whittled away by the activities of competing. Where they are mild and competitors appear docile, profit potential tends to be high. Yet a full understanding of the elements of competition within an industry is easy to overlook and often difficult to comprehend. Porter’s Competitive Forces Model is one of the most recognized framework for the analysis of business strategy. It is based on the insight that a corporate strategy should meet the opportunities and threats in the organizations external environment. Especially, competitive strategy should base on an understanding of industry structures and the way they change. Porter’s Competitive Forces Model Continue reading

PEST Analysis – External Business Environment Analysis

A PEST analysis is a way to analyze the general external environment of an organization. Every organization has an external environment. The external environment is quite important because it is the environment in which a company operates. PEST analysis is a useful tool for understanding the “big picture” of the environment in which industry is operating, and environmental understanding will bring the advantage of the opportunities and guide to minimize the threats. PEST components are Political, Economic, Social and Technological. The PEST analysis is used to identify forces in the macro-environment that are affecting the business at present and are likely to continue to affect the business in the future. Macro-environmental analysis is interested in factors in the wider environment that influence the demand for the product or service offered by a company; demand for the product or service; the manner in which the product or service is distributed; the Continue reading