A lease is a contractual arrangement whereby one party (i.e., the owner of an asset) grants the other party the right to use the asset in return for a periodic payment. A lease is essentially the renting of an asset for some specified period. The owner of the assets is called the lessor while the other party that uses the assets is known as the lessee. A lessee can be an individual. a firm or a company interested in the use of the assets without owning it, while the lessor may be the seller, supplier, a finance company or the manufacturer who can finance the purchase of the assets. Under the lease contract, the ownership of the assets remains with the lessor whereas the use of the assets is available to the lessee. In return, the lessee has to pay a fixed periodic amount to the lessor. This periodic payment is known as the lease rental. Generally, the lease rental is fixed and the amount and timing of its payments are a matter of agreement between the lessor and the lessee.

As already noted, leasing is a source of financing provided by the lessor to the lessee. The lessee receives the services of the asset for a specific period of time in exchange for the payment of fixed lease rental. The only other way, the lessee could obtain the services of the given asset would be to purchase it outright, and the outright purchase of the asset would require sufficient funds. The lessee might have these sufficient funds to purchase the assets outright without borrowing, but the funds would not be free as there is always an opportunity cost of the funds. Every time, therefore, a firm has to acquire an asset, it may have to decide between two mutually exclusive situations: First, should the assets be purchased and become the owner of the asset and second, should the asset be acquired on a lease basis.

Even if the firm has liquid resources with which it can purchase the asset, the use of these resources may be viewed as a form of borrowing because the opportunity cost of the funds is at least equal to the prevailing interest rate on borrowings. A firm contemplating the acquisition of an asset, the ownership of which is only incidental to obtaining the services of the assets, has also to decide whether it should lease the asset or borrow the funds and buy the assets. This is known as lease-buy decision and is essentially a financing decision. In case of lease financing the lease rentals are payable, which are analogous to payment of interest on borrowings, which may be needed for raising the funds for buying the asset. A lease-buy decision therefore, is financing decision and involves a choice between debt financing and lease financing.

Another point worth noting about a lease-buy decision is that the firm should compare leasing to borrowing the amount of purchase price and then buying the asset (rather than using equity to buy the asset). This is because leasing creates such obligations for the firm, which is very similar to those, created by borrowing. Buying the assets entirely, or even substantially, with equity capital would expose the firm to far less risk than leasing the asset in as much as lease payments represent a contractual commitments, whereas the equity do not. In case of lease, there is contractual payment in the form of the lease rental and it maybe taken as similar to the payment of interest and repayment of principal amount of the borrowing. Therefore, the lease decision may rightly be evaluated as an alternative to financing the asset purchase by 100% debt financing. In general, leasing should be compared to borrowing all the funds required for the asset and buying it. Thus, the lease-buy decision involves evaluating the relative advantages and disadvantages of leasing and of debt financing particularly in the form of effect on lessee’s cash flows.

In the lease-buy decision, the choice depends upon the present value of the two series of after tax cash flows to the lessee; and to evaluate the lease-buy decision, the financial manager has to consider only the relevant cash flows i.e., he has to consider only those cash flows that differ under the two alternatives. For example, the lessee, irrespective of the fact, may pay the maintenance cost of the asset whether the asset is purchased or is acquired on lease. This cost can be ignored by the financial manager as it is irrelevant as the maintenance cost is payable in both the options.

What is needed is an after tax present value comparisons of the two options. As in the capital budgeting decisions, all costs (of leasing as well as buying option) should be measured on an after tax basis and the lease obligations or the additional borrowing is assumed to be small relative to the total capital structure, thereby causing the firm’s capital structure and the risk to remain basically unchanged.

Analysis of Lease-Buy Decision

The decision may be taken on the basis of evaluation of both the options, for which the following steps may be required.

1. Identification of Relevant Cash Flows

First of all, the cash flows emanating from the lease option as well as the buying option is to be identified. In case of lease, the firm receives benefits from using the assets but has no claim on its residual salvage value, which is reserved for the lessor in most of the cases. The lessee firm has to make lease payments and also to meet all or some of the maintenance expenses. The lease payments and all such expense payment associated with the leased assets are tax deductible for the lessee. The lessee cannot claim depreciation, as he is not the owner.

In case of buying the assets, on the other hand, the firm assumes all the risk and benefit associated with the ownership including the salvage value, if any. It may also incur the costs of maintaining the asset. The firm also has to pay the interest on the funds borrowed to finance the asset, together with the repayment as per schedule. It may be noted that in case of buying the assets, depreciation, maintenance expense, and interest are all deductible.

The after tax cash flows emanating from the lease option are relatively easier to be identified. The lease option requires only cash outflows in the form of the lease rental payment which is to be considered on an after tax basis. The after tax cash flow of lease rental may be taken as equal to the difference between the lease rental and the tax benefit. However, the cash flows associated with borrowings are more difficult to obtain due to the need to identify both the interest and the depreciation associated with the asset. The calculation of cash outflow associated with borrowing has two steps. The first is to determine the annual interest components and the depreciation and the second is to determine the cash outflow, which is equal to interest payment less tax shield on account of interest and depreciation plus principal repayment. The cash flows associated with the buying option may be enumerated as follows:

- Interest payment on the debt, which are tax deductible.

- Principal repayment of the debt, which is not tax deductible.

- Tax savings accruing from the depreciation of the asset.

- Any other operating expenses arising as a consequence of buying the assets.

- Any salvage value at the end of assets life.

2. Analysis of Incremental Cash Flows

After identification, the cash flows are to be analyzed for each year for tax shield etc., under both the options. For this purpose, the present value of the stream of after tax cash outflows associated with each option must be calculated. This is because the cash flows occur at different point of time. However, there is a difference of opinion about the rate of discount being used to find out the present values. These are:

- The discount rate used to evaluate the cash flows should be the after tax cost of debt. It may be noted that the lease payment and interest payment create similar commitment for the firm. Consequently, they should be treated similarly, in terms of risk, for purposes of estimating discount rates. Because the discount rate for debt is the after tax cost of borrowings for the firm, the discount rate for the lease payment should also be after tax cost of debt.

- However, it is also argued that the after tax weighted average cost of capital i.e., kg and not the after tax cost of debt i.e., kd , should be used to discount the net cash flows under the buying option because funding for the purchase option in fact comes from mingled funds raised from different sources and cannot be associated with the anyone particular type of security. The same overall weighted average cost of capital should be used to discount the cash flows of the leasing option.

The evaluation procedure for a lease-buy decision can be summarized as follows:

- Compute the net present value of the asset’s cash flows if the asset is purchased.

- Compute the net present value of the cash flows generated for the firm by the asset if it is leased.

- Compare the NPV (buying option) with the NPV (leasing option). The option with the higher NPV is superior and the other should be rejected.

The above analysis is based on the assumption that the firm had decided that it needed the asset, based on project analysis. In some cases, the option to lease an asset may change a project from ‘unacceptable’ to ‘acceptable’. For this to happen, the following sequence of events has to unfold. First, the project analysis, done on the assumption that the asset would be bought, should have yielded a negative NPV. Second, the lease option should be specific to this project and should not reflect a company wide advantage to leasing versus buying. Finally, the lease decision should yield savings in present value relative to buy decision, which exceed the negative NPV from the first step.

In analyzing the lease-buy decision it has been implicitly assumed that the lease lasts for the length of the life of the asset. If the life of the lease is different from the life of the assets, however, the analysis changes. The issue may be avoided by assuming that the lessee will buy the assets at the end of the lease life or that the assets will be sold at the end of the lease life, under the buy option. In particular, one of the following two may be adopted:

- Assume that the lease will be renewed to cover the life of the assets. For example, for an asset having life of 15 years, where the lease in only 5 years, this will require renewing the lease twice i.e., at the end of 5 years and 10 years. Once this assumption is made, the NPV of the lease (with two renewals) option and the buying option may be evaluated.

- Estimate the annuity of equivalent annual cost of leasing and buying on the basis of an appropriate rate of discount. The annuities of both options may be compared to select one.

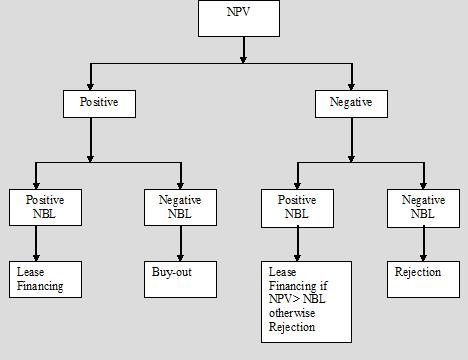

The excess of present value of lease cash outflows over buying cash outflows is also known as Net Benefit-of Leasing (NBL). If NBL is positive, it implies that the lease financing is better than the buying option, which itself may be positive or negative. Thus, a positive NBL does not itself imply that assets should be acquired. The NPV of the asset should be assessed separately as an investment. If it is found worth buying, then positive NBL suggest that lease is better option. If NBL is negative, then buying option with borrowed funds will be better for the firm. It may be noted that the NBL is not a criteria of selecting the investment; rather it only helps in choosing the method of financing the asset.

Credit: Corporate Finance Basics-CU