A firm has to maintain an adequate level of working capital to run its operations smoothly and effectively. It should be adequate in the sense that it shall not be more than the requirements nor it shall be less than the requirements. Both the excessive as well as inadequate working capital positions are dangerous from the firm’s point view.

We know that the current liabilities are met out of the current assets. So the level of current assets shall be sufficient enough to meet the current liabilities. Excessive working capital refers to the position where when the level of current assets is much higher to meet current liabilities. The excessive capital has opportunity cost for the firm, as this excessive capital remains idle in the firm, which earns no profit for the firm. If these funds shall be invested in some profitable project, it adds the profitability of the Company.

On the other hand, inadequate working capital refers to the position where the current assets are not sufficient enough to meet the current liabilities. Such type of position may be harmful to the firm as it may interrupt the production and sales of the Company, which ultimately affects the profitability of the Company. Moreover if the liquidity position of the firm is not adequate enough to meet its current liabilities, it may affect its credibility in the market.

Therefore an enlightened management should maintain the right amount of working capital on a continuous basis. Only then the proper functioning of business operations can be ensured. The amount of the working capital shall be maintained at such level, which is adequate for it to run its business operations, neither excessive nor inadequate. This level of working capital is called as the “Optimum Working Capital”.

Liquidity Vs Profitability

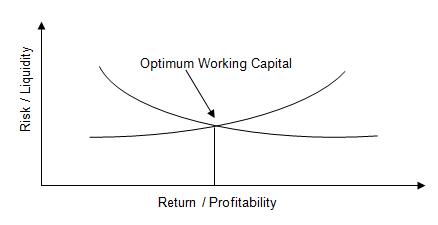

The level of working capital affects the degree of risk and profitability both. Hence the level of working capital should be so fixed that, on the one hand, its financial soundness is maintained and on the other hand, its profitability is optimized.

At this point it is necessary to be clear about the meaning of solvency or insolvency of the firm. Solvency means a situation in which a firm can easily repay its debts as and when they mature. On the other hand, insolvency is a situation in which a firm is not able to repay its debts as and when they become due for payment.

The term risk implies the profitability that a firm will become technically insolvent, so that it will not be able to meet its obligations as and when they become due for payment.

Nature of Risk-Return Trade-off

If profitability is to be increased, the firm must increase its risk. If the firm wants to decrease risk, its profitability will also decrease. If a firm wants to maintain insolvency, it must maintain a higher level of liquidity. That is, it must hold a larger amount of current assets such as cash, receivables, stock of goods etc., so that there would be no problem in repaying the debts as and when they due for payment. However, if a firm holds more amount of current assets, the prospects of profit decline due to the fact that most of its funds are locked up in idle current assets, which earn no profit.

On the other hand, if a firm wants s to increase its profitability, it must be prepared to increase its risk of insolvency, as it would have to reduce its investment in current assets. However a smaller amount of liquidity increases risk of insolvency and, at the same time, it increases profitability also.

The firm should maintain the its current assets at such level that on the one hand its profitability increases and on the other hand its risk of insolvency decreases. There should be a balance between profitability and risk. The level, at which there is a trade-off between the risk and return, is the optimum level of working capital for a firm.

Advantage of Maintaining Working Capital at Optimal Level

Some of the major advantages of keeping working capital at optimal level are as under:

- Solvency of the company: Satisfactory working capital helps in keeping solvency of the company by supplying continuous flow of production.

- Reputation: Adequate working capital enables a company to disburse timely payments and therefore, helps in creating and keeping reputation.

- Unproblematic Loans: A company having optimum level of working capital, high solvency and excellent credit position is able to get loans from banks and other sources on friendly and constructive terms.

- Cash discounts: Adequate working capital furthermore enables a company to get benefit of cash discounts on the procurement’s and therefore, it reduces costs.

- Uninterrupted delivery of raw material: Optimum level of working capital assures uninterrupted receipt of raw material for the nonstop production.

- Uninterrupted disbursement of salaries wages and other day-to-day obligations: A company which has sufficient working capital will be able to make usual disbursement of salaries, wages and other day-to-day obligations which raise the spirits of its employees, increase their effectiveness, decrease wastages, save costs and increase profits.

- Utilization of positive market conditions: Simply a company which has optimum level of working capital can utilize positive market situation such as procuring its necessities of material in bulk when the prices are low and by holding its inventory for privileged prices.

- Capability to face crisis: Sufficient working capital makes a company able to face business crisis in emergencies such as depression for the reason that during such periods, generally, there is much burden on working capital.

- Rapid and interrupted return on investment: Every saver desires a rapid and interrupted return on his savings. Adequacy of working capital makes a company able to disburse dividends rapidly to its investors as there possibly will not be much force to plough back earnings. This increases the self-confidence of its investors and creates an encouraging market to acquire further funds.

- Sky-scraping morale: Sufficiency of working capital makes an atmosphere of safety, confidence, high morale and creates effectiveness in a company, on the whole.