Working Capital, being lifeblood for any enterprise, its management becomes a crucial exercise for the Financial Manager of a firm. The need of working capital is directly linked to the growth of the firm. Working Capital refers to the funds invested in the current assets of a firm such as raw materials, work-in-progress, finished goods, receivables, cash etc. From the viewpoint of manufacturing process, working capital means that part of capital, which is required to keep the flow of production smooth and continuous.

For day-to-day operations, a business needs to carry certain amount of raw material of all sorts so that commencement of production is not delayed, certain amount of work-in-process so that production operations go smoothly, certain amount of finished goods so that supply to market is not hampered by fluctuations in production, certain amount of book debts so that sales take place continuously and certain amount of cash and bank balance for meeting daily routine payments and for providing for any unforeseen contingencies. In other words, working capital refers to the investment in the current assets of the business. Working capital is also referred to as revolving capital as current assets and current liabilities are converted from one form to other and again converted back to original form and reconverted into other on and on. Hence it is called revolving capital or floating capital.

There are several concepts of working capital – We just saw that working capital means investment in the different current assets. Here two interpretations are possible. These are:

- The value of all the current assets and

- The value of all current assets minus the value of all current liabilities, because to the extent of current liabilities, the firm’s investment in current assets stands reduced.

Accordingly we have two concepts of working capital, viz., Gross concept and Net concept.

- Gross working capital refers to investment in all current assets -raw materials, work-in-progress, finished goods, book debts, bank balance and cash balance. The gross concept of working capital is significant in the context of measuring working capital needed, measuring the size of the business, continued and smooth flow of operations of the business and the like.

- Net working capital refers to the excess of current assets over current liabilities. That is, value of current assets minus value of current liabilities (current liabilities include trade creditors, bills payable, outstanding expenses such as wages, salaries, dividend payable and tax payable, bank overdraft, etc.) The net concept of working capital is significant in the context of financing of working capital, the short term liquidity aspects of the business, and the like.

Gross working capital is a going concern concept that enables the financial planner to provide the proper amount of working capital at the right time, so that the operations of the business are not interrupted and the return on capital investment is maximized.

Net working capital may be positive or negative. A positive net working capital arises when current assets exceed current liabilities and a negative working capital occurs when current liabilities are in excess of current assets. It shows bad liquidity position. This is a qualitative concept which highlights the character of the sources from which the funds have been procured to support that portion of the current assets which is in excess of current liabilities.

Working Capital Types

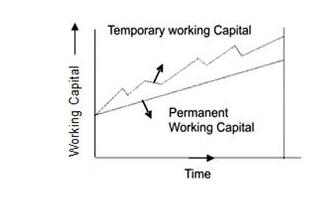

There are two kinds of working capital. These are i) permanent working capital, ii) temporary/varying working capital.

1. Permanent Working Capital refers to the minimum amount of all current assets that is required at all times to ensure a minimum level of uninterrupted business operations. Some minimum level of raw materials, working process, bank balance, finished goods, etc. a business has to carry all the time irrespective of the level of manufacturing/marketing operations. This level of working capital is referred to as core working capital or core current assets. Permanent working capital is defined as the “amount of current assets required to meet a firm’s long-term minimum needs”. You should note, that the level of core current assets is not, however, a constant sum all the times. For a growing business the permanent working capital will be rising, for a declining business it will be decreasing and for a stable business it will be remaining more, or less stay-put. So permanent working capital is perennially needed one though not fixed in volume. This part of the working capital being a permanent investment, needs to be financed through long-term funds. Depending upon the changes in the production and sales, the need for working capital, over and above the permanent working capital, will fluctuate.

- Initial Working Capital: In the initial period of its operation, a firm must need enough money to pay certain expenses before the business yields cash receipt. In the initial years the banks may not grant loans or overdrafts, sales may have to be made on credit and it may be necessary to pay the creditors immediately. Therefore the owners themselves have to provide necessary funds in the initial period, which may be known as initial working capital.

- Regular Working Capital: The firm is always required to keep certain funds with it to continue the regular business operations, which is called as Regular Working Capital. It is required to maintain regular stock of raw materials and work-in-progress and also of the finishes goods, which must be maintained permanently at a definite level. Regular working capital is the excess of current assets over current liabilities. It ensures smooth operation of business.

2. Temporary or Varying Working Capital varies with the volume of operations. If fluctuates with scale of operations. This is additional working capital required during up seasons over the above the fixed working capital. During seasons more production/sales take(s) place resulting in larger working capital needs. The reverse is true during off-seasons. As seasons alternate, temporary working capital moves up and down like tides. Temporary working capital is defined as the “amount of current assets that varies with seasonal requirements”. Temporary working capital can be financed through short term funds, ie. current liabilities. When the level of temporary working capital moved up, the business might use short-term funds and when the level of temporary working capital recedes, the business might retire its short term loans.

- Seasonal Working Capital: Some business operations require additional working capital during a particular season. For example, the groundnut oil producers may have to purchase groundnut in a particular season and have to employ additional labor for that purpose. These may require additional funds for a temporary period, which may be called as seasonal working capital.

- Special Working Capital: In all enterprises, some unforeseen events do occur like sudden increase in demand, downward movement of prices of raw materials, strike or natural calamities, when extra funds are needed to tide over such situation. Such type of extra funds is called as Special working capital.

Both the kinds of working capital — permanent and temporary — are necessary to facilitate the production and sales through the operating cycle. However, the temporary working capital is created by the firm to meet the liquidity requirements that will last only temporarily.