Meaning of Stagflation

The present day inflation is the best explanation for stagflation in the whole world. It is inflation accompanied by stagnation on the development front in an economy. Instead of leading to full employment, inflation has resulted in un-employment in most of the countries of the world. It is a global phenomenon today. Both developed and developing countries are not free from its clutches. Stagflation is a portmanteau term in macro economics used to describe a period with a high rate of inflation combined with unemployment and economic recession. Inflationary gap occurs when aggregate demand exceeds the available supply and deflationary gap occurs when aggregate demand is less than the aggregate supply. These are two opposite situations. For instance, when inflation goes unchecked for some time, and prices reach very high level, aggregate demand contracts and a slump follows. Private investment is discouraged. Inflationary and deflationary pressures exist simultaneously. The existence of an economic recession at the height of inflation is called ’stagflation’.

The effects of rising inflation and unemployment are especially hard to counteract for the government and the central bank. If monetary and fiscal measures are adopted to redress one problem, the other gets aggravated. Say, if a cheap money policy and public works program are adopted to remedy unemployment inflation gets aggravated. On the other hand, if a dear money policy and stringent fiscal measures are followed unemployment will get aggravated. It is the most difficult type of inflation that the world is facing today. Keynesian remedial measures have not succeeded in containing inflation but actually have aggravated un-employment. Thus, the world stands today between the devil (inflation) and deep sea (unemployment).

Phillips Curve: Unemployment – Inflation Relationship

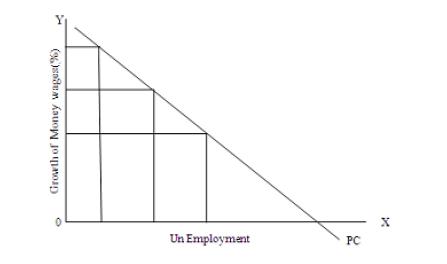

A.W.Phillips the British economist was the first to identify the inverse relationship between the rate of unemployment and the rate of increase in money wages. Phillips in his empirical study found that when unemployment was high, the rate of increase in money wage rates was low; and when unemployment was low, the rate of increase in money wage rates was high. Phillips calls it as the trade-off between unemployment and money wages. This is illustrated in the figure below.

In the figure the horizontal axis represents the rate of unemployment and the vertical axis represents the rate of money wages. In the figure PC represents the Phillips Curve; PC is sloping downwards and is convex to the origin of the two axes and cuts the horizontal axis. The convexity of PC shows that money wages fall with increase in the rate of unemployment or conversely money wages rise with decrease in the rate of unemployment.

This inverse relationship between money wage rates and unemployment is based on the nature of business activity. During the period of rising business activity wage rate is high and the rate of unemployment is low and during periods of declining business activity wage rate is low and the rate of unemployment is high. Paul Samuelson and Robert Solow extended the Phillips curve analysis to the relationship between the rate of change in prices and the rate of unemployment and concluded that there is a trade-off between the level of unemployment in a country and the rate of inflation.

We can use the same figure to illustrate this concept, instead of money wages we show rise in the price level on the OY axis. It will be clear from the above figure, that the higher the rate of inflation, the lower is the rate of unemployment in the country; and lower the rate of inflation, the higher the rate of unemployment in the country i.e., one can be achieved at the cost of the other. Phillips curve analysis can be a guide to the government in striking a balance between the measures to be adopted to solve the problem of unemployment and inflation.

External Links:

- Phillips Curve (Library of Economics and Liberty)

- Unemployment (Library of Economics and Liberty)