Michael Porter introduced the diamond model of national competitive advantage (1990) to explain why a number of countries are more competitive than others and why a number of businesses within the countries are more competitive. Porter’s Diamond Model proposes that the national home base of an industry plays an important role in achieving an advantage on a universal scale. This home base contributes the essential factors that will support the organisations in building advantages in global competition.

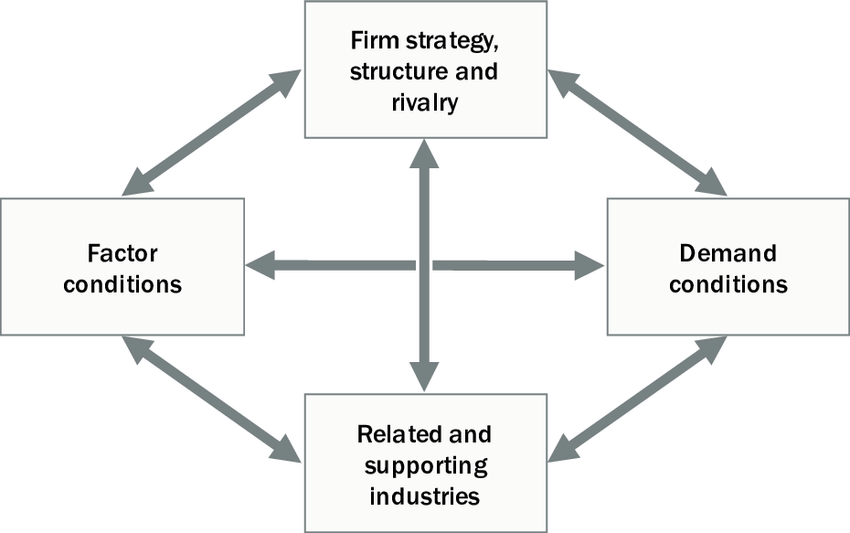

Porter identified four determinants in attaining a national competitive advantage he concludes that a combination of the four determinants within a nation has an enormous influence on the competitive strength of the firms located there. Porter argues that competitive industries take the form of specialized clusters of home based firms. Clusters are correlated through vertical relations such as buyers integrating with suppliers or through horizontal relations through customers, technology, skills, distribution channels etc. These specialized clusters will enable a nation to create business system which will lead to competitive advantage and economic success. Japan’s automobile industry and US semiconductor industry have both been linked to Porter’s diamond model in creating unique business systems and competitive advantage over other industries.

Factor condition is the nation’s position on factors of production that is necessary to compete in a given industry, for example skilled labor or infrastructure. These national factors often provide initial advantages for the nation. Each nation possess particular factor conditions that are more favorable to develop business systems and industries. For example, Japan’s large pool of engineers which is reflected by the number engineering graduates has been essential to Japan’s success in variety of manufacturing industries. Porter points out that these factors don’t have to be nature made or inherited could expand and change over time.

Home demand conditions can influence the creating of specific factor conditions which can affect the direction of the innovation and advancement of product development. Porter argues (1990) that home demand is rests upon three major characteristics. First the mixture of customer’s needs and wants. Second the demanding buyers in the home base will pressure companies into meeting high standards. For example Japanese consumer’s value space-saving gave the nation a lead in compact products and America’s long distances have led to competitive strength in very large truck engines. Third, an industry will have an advantage in market segments which are more important at home than elsewhere. In each of these instances, it is not the size of the home market that is important, but the extent to which it encourages firms to innovate. A large home market which meets all three conditions will be highly supportive of international competitiveness.

A related and supporting industry is when one globally successful manufacturing company can create advantages in other similar manufacturing companies. A nation’s industries will be better able to compete internationally if there are ‘clusters’ of industries in the home base economy which are linked to each other through vertical or horizontal relationships amongst supplying, customers and distribution channels. For example Denmark has a cluster in health and home products, Germany in chemicals and USA in the semi-conductor industry.

The firm structure, strategy, and rivalry are the conditions governing how businesses are shaped, managed and deal with domestic rivalry in a nation. The cultural factors are important for each nation. For example each country will have different cultural traits in which the business is structured, the working morale within the workforce, or interactions between companies are shaped. This will create benefits for each nation and industry. In Japan the automobile industry rivalry is strong it has seven major companies: Toyota, Honda, Nissan, Mitsubishi, Suzuki, Mazda, and Subaru which all fight for the market share. These seven businesses compete intensely in the home nation, and other nations and markets. Strong domestic competition demands all these businesses to have superior technologies, products, and management practices to compete and survive, for example there is high number of engineers in management that emphasis on improving manufacturing processes. Whereas the US has only two businesses in automobile industry which are Ford and General Motors this is due to Daimler Chrysler merger. Therefore the US hasn’t got a strong domestic competition in Japan. This strong domestic competition has resulted in the Japanese businesses grabbing market share in the US to survive.

In addition to the four conditions, Porter points out two important components which are the role of chance which are important as it allows nations to shift their competitive position and alter the conditions of the diamond model. Chance events have different impacts on nations for example the oil shock helped upgrade Japanese industry. The role of the government is an important influence on modern international competition. The governments can put forward the policies a nation should follow to create advantages, enabling the industries in a nation to develop a strong competitive position globally. For example the government policy for Japan and Korea has created success for these nations. According to Porter governments can progress the advantages by ensuring there is high potential of product performance, ethical standards, or encouraging reasonability and negotiation between the suppliers and buyers on a domestic level.

Nations can use Porter’s diamond model to identify the opportunities and build on home based advantages to generate a competitive advantage and compete with others nations globally. Japanese owes its success to the automobile industry. In the 1970s the Japanese had labor cost advantages, strong networks of suppliers, very demanding consumers which enabled the industry to gain competitive advantage over other nations. Porter captures the essence of what is really important on training, education, domestic competition, automation. These are the core of competitive advantage. However he underplays the role of history, politics and culture in determining competitive advantage, so as a result of defining the problem incompletely, he offers an incomplete solution which shows other ideas are required to explain various business systems and comparative economic performance in nations.

There are limitations to Porter’s diamond model. The diamond conditions emerged from examining the history of 100 industries, but to do this thoroughly histories would have to be written in the form that would allow such analysis. The detail would require the company histories. Neither the references nor the acknowledgements suggest any such documented histories of 100 industries. The four histories quoted from Porter’s research were German printing press industry, American patient monitoring industry, Italian ceramic tile industry and the Japanese robotics industry which are just sketches that illustrate rather than test the theory. The theme of competitive advantage needs to go well beyond aspects of business management and many of the important questions are not even put or even claimed to be solved in Porter’s diamond model.

Porter’s diamond model describes the national environment in which firms are competing in, showing the variations of business systems and comparative economic performance. Porter agrees in that national culture is an important detriment in the competitive advantage of nations, but does not include national culture in his descriptive framework of the diamond. National culture has an important impact on relations between related and supporting industries in different parts of the world. Other critics consider that culture is under-represented in the analysis and that a ‘double-diamond’ approach that places the economy in its proper international context is preferable.

To stress the importance of national culture to competitive advantage, Porter’s diamond model has to be combined with the dimensions of national culture found by Hofstede (1980). Hofstede developed four dimensions of national culture which are: individualism versus collectivism, large or small power distance, strong or weak uncertainty avoidance and masculinity versus femininity. These four dimensions help to understand the underlying concept of uncertainty which plays a major role in theories of the business environment and can contribute to the nation’s competitive advantage. The way people and organisations cope with the uncertainty, in their environment is found as an important dimension of national culture by Hofstede. As it is the extent in which individuals in a society feel the need to avoid ambiguous situations and the extent to which they try to cope and manage these situations.

Porter stresses the importance of the relations between related and supporting industries in his diamond model. Relations between people are known to be influenced by national culture.

In terms of uncertainty avoidance, countries which are to be characterized as strong uncertainty avoiders, people tend to stabilize the relationship they form. In countries with less need for uncertainty avoidance, relations are much looser and hesitation to change is smaller.

For example, Hofstede (1980) found that the difference in uncertainty avoidance between Japan and Western and Northern Europe is large. Japan is, compared to Western and Northern Europe, a very strong uncertainty avoider. Hofstede argues that the variations in values between cultures will require the difference organisational responses. The economic environment of a nation can be determined by the cultural values. The Japanese stress on the importance of ‘uncertainty avoidance’ and social stability can guarantee job security, while Anglo-American economies are based on a large percentage on labor market mobility in which individuals are prepared to accept greater uncertainty about future employment. Japanese is a collectivism society that support group achievement whereas Anglo-American is an individualism society that support personal incentives. Japan’s biggest automobile company is Toyota, when it faced financial crisis during 1940s, the culture traditions of collectivism within the organisation supported the company to adapt to new changes following the “Toyota Way”. It developed unique plants based on specific context as defined by its history, culture and leadership.

Porter neglects the role of historical cause in his diamond model. In the case of Germany and Japan for example, there is probably a direct connection between past militarism and the present industrial domination. Militarism has contributed to industrial excellence by creating a tradition of discipline in the labor force for both of these nations. Germany’s and Japan’s competitiveness owes a great deal to its amoral military past. Particular historical events can be unique to a country which can determine its character. The occurrence of invasion and revolution is a shared experience amongst many successful nations in history. The countries that have had democratic freedom of organisation without invasion in the past will suffer the most from growth repressing organisations. Nevertheless Porter’s diamond model didn’t consider how the history of a nation has an effect on competitive advantage of nations.

Krugman (1994) criticized Porter’s diamond model and described the claim that competition within nations as ‘a dangerous obsession’ and argues against Porter’s diamond model. The main points to his argument are that: nations are not like firms and the concept of national competitiveness is elusive. International trade is not a zero-sum game for example Krugman points that major industrial countries sell products that compete with each other but are in fact each other’s main export and each other’s main suppliers of imports. If the European economy does well this is not the expense of US. On the whole Krugman states that competitiveness is a meaningless word when applied to national economies and the obsession with competitiveness is both wrong and dangerous. It could result in wasteful spending of government money, could lead to trade wars, and could result in bad public policy on a spectrum of important issues. Dicken (1994) also agrees with Krugman arguments and criticizes Porter national competitive advantage model. He states that the theory is highly reductionism in compressing complexity into a simple ‘diamond’ model. It minimizes the role of the state in pursuit of national competitiveness and doesn’t explain how to achieve the four determinates.

Reich (1991) argues that the concept of national competitiveness explained by Porter must be revisited; he argues that economic success is due to national purpose rather than national competitiveness. Nation competitiveness depends on globalization and the ‘skills, training and knowledge’ commanded by its workforce, the key to success is the people of the nation. Reich argues that national industries don’t exist in any meaningful sense, as it is global corporate networks rather than national industries that now dominate economic activity. Resources are placed in those nations offering the best production and marketing advantages. However Porter makes a strong case of the importance of the home country in today’s global economy. Porter argues that by providing a favorable environment for the successful organisations, home countries can play a vital role in wealth creation in the context of international competition, showing the variations of business systems and comparative economic performance.

Its also found that Porter’s diamond model doesn’t explain the international competitiveness of small, open, trading nations such as Canada, New Zealand and Korea. Modifications of the Porter framework are required to analyse the nature of Canada’s foreign owned businesses such as the Canada-US free trade agreement. The arrangements states that the Canadian diamond can be jointly combined with the US diamond, Canadian managers will need to function in this ‘double diamond’ framework. A major problem with Porters model is due to the narrow definition that he applies to foreign direct investment (FDI). Porter defines only outward FDI as being valuable in creating competitive advantage and the inward FDI is ‘not healthy’. He also states that overseas subordinates are importers and that this is a source of competitive advantage. This is not the case for Canada as 70% of Canadian inward FDI trade is done by 50 multinationals with half of these being foreign owned. Also a huge part of Canada’s auto industry is US owned. For example Ford and Chrysler have substantial inward FDI in Canada. They are making valuable contributions to Canada’s manufacturing sector and international competitiveness. Porter’s view on the role of national resources is old fashioned and misguided. Its found hat over time Canada’s resource based industries have developed sustainable competitive advantages for the nation.

Overall Porter’s model (1990) of national competitive advantage to an extent does account for the variations in national business systems and comparative economic performance across different nations and industries. However Porter’s Diamond Model doesn’t consider and explain how culture, history and globalization can have an impact on the economic success of a nation and the variations of business systems.

Another point to consider is it unlikely for a nation to control or dominate an industry entirely. For example Japan makes outstanding automobiles, but this does not stop other nations such as UK or Germany from competing in the industry.