The benefits from diversification increase, as more and more securities with less than perfectly positively correlated returns are included in the portfolio. As the number of securities added to a portfolio increases, the standard deviation of the portfolio becomes smaller and smaller. Hence an investor can make the portfolio risk arbitrarily small by including a large number of securities with negative or zero correlation in the portfolio.

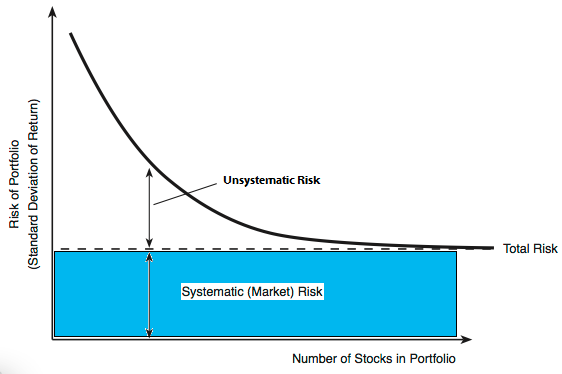

But in reality, no securities show negative or even zero correlation. Typically, securities show some positive correlation, which is above zero but less than the perfectly positive value (+1). As a result, diversification (that is, adding securities to a portfolio) results in some reduction in total portfolio risk but not in complete elimination of risk. Moreover, the effects of diversification are exhausted fairly rapidly. That is, most of the reduction in portfolio standard deviation occurs by the time the portfolio size increases to 25 or 30 securities. Adding securities beyond this size brings about only marginal reduction in portfolio standard deviation.

Adding securities to a portfolio reduces risk because securities are not perfectly positively correlated. But the effects of diversification are exhausted rapidly because the securities are still positively correlated to each other though not perfectly correlated. Had they been negatively correlated, the portfolio risk would have continued to decline as portfolio size increased. Thus, in practice, the benefits of diversification are limited.

The total risk of an individual security comprises two components; the market related risk called systematic risk and the unique risk of that particular security called unsystematic risk. By combining securities into a portfolio the unsystematic risk specific to different securities is cancelled out. Consequently the risk of the portfolio as a whole is reduced as the size of the portfolio increases. Ultimately when the size of the portfolio reaches a certain limit, it will contain only the systematic risk of securities included in the portfolio. The systematic risk, however, cannot be eliminated. Thus a fairly large portfolio has only systematic risk and has relatively little unsystematic risk. That is why there is no gain in adding securities to a portfolio beyond a certain portfolio size.