Thomas Alva Edison established Edison Electric Light Company in 1878. General Electric Company, known as and commonly abbreviated simply to GE, was formed in 1892, as a result of a merger of the competing companies Edison General Electric Company and the Thomson-Houston Electric Company. Having its headquarters in United States, GE is a major technology conglomerate and is the only company listed in the Dow Jones Industrial Index today that was also included in the original index of 1896. GE is a big multinational corporation and has a diversified infrastructure. Its business activities span a wide range of areas from aircraft engines, industrial products, water processing products, power generation to financial services, medical diagnostic imaging, security technology, consumer financing, and television programming. GE operates in more than 100 countries and employs about 300,000 people worldwide. In smaller and less developed countries, it operates through distributorship or dealership channel by giving the rights to its distributors’ companies to sell and service its products. Administratively, the General Electric Company is organized into 5 divisions known as Technology Infrastructure, Consumer & Industrial Electronics, Energy Infrastructure, NBC Universal and Capital Finance. A sizable portion of its products’ manufacturing is done in countries outside United States. Even some products’ research work for GE is done in Japan.

In 2009, GE delivered excellent financial results despite the hard economic conditions with earnings of $11.2 billion. Industrial cash flow from operating activities for the year remained strong at over $16.6 billion. Today the company is one of the largest in the world, and owns numerous research and manufacturing firms around the world as well as two television networks and other businesses.

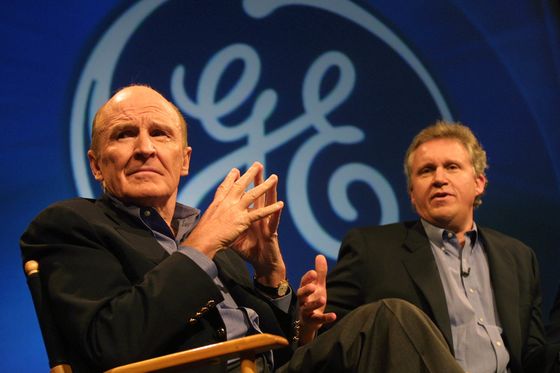

John F. (Jack) Welch, Jr. Era: 1981 to 2001

When John F. (Jack) Welch, Jr., became chairman and CEO in 1981, GE was in economical and financial crisis. Under his leadership, GE entered a period of radical change. Jack Welch restructured GE existing operations in an effort to make GE more competitive and profitable in all of its businesses. He sold lot of GE unprofitable businesses and fired brutally thousands of GE employees not performing well or doing redundant jobs. Welch’s first order of business was to return much of the control of the company to the periphery. He decentralized GE management and reduced hierarchical management layers. However, he retained his predecessor Reginald Jones’s system of classifying divisions according to their performance. His goal was to make GE number one or two in every field of its operation and to make every GE business division profitable. He acquired lot of successful and profitable companies. Over the next several years, GE bought 338 businesses and product lines for $11.1 billion and sold 232 for $5.9 billion. Mr. Welch said that his aim was to make GE the nation’s largest company.

In early 1990s, GE’s operations were divided into three business groups of technology, service, and manufacturing. Its manufacturing division accounted for roughly one-third of the company’s earnings then. However, the service sector was growing faster and represented more than three-quarters of the U.S. economy of mid-1990s. The company launched an aggressive campaign to become dominant in the growing services sector. Research and investment continued towards energy conservation such as more efficient light bulbs, jet engines and electrical power transmission methods. Despite a global economic downturn in the early 1990s, GE managed to keep aggregate sales from its technology, service, and manufacturing operations stable at about $60 billion annually. Acquisitions in the late 1990s centered on two of the company’s growth initiatives: services and globalization. Under Welch’s leadership, GE in the late 1990s also adopted “Six Sigma,” a quality control and improvement initiative pioneered by Motorola, Inc. and Allied Signal Inc. The program aimed at to cut costs by reducing defects in manufacturing. GE claimed that by 1998 Six Sigma was yielding $1 billion in annual savings. The company also continued to restructure where ever necessary, including taking a $2.3 billion charge in late 1997 to close redundant facilities and shift production to cheaper labor markets. During 1999 General Electric adopted a fourth growth initiative i.e. e-business (globalization, services, and Six Sigma being the other three). In October 2000, Jack Welch planned a $40 billion merger of United Technologies Corporation and Honeywell International Inc. This was the largest acquisition in the company’s history. However, the Honeywell deal ended up in a sour ending for the Welch era. Jeff Immelt, who joined GE in 1982, was named as president and CEO of General Electric in September 2001.

Key Actions by Jack Welch Leadership

When John F. (Jack) Welch, Jr., took over as a chairman and CEO of GE in 1981, GE was in bad economical and financial situation. He found GE was overgrown, laden with too many layers of management and too many people duplicating work.

Jack Welch restructured GE existing operation extensively. He ruthlessly fired thousands of GE executives and employees and took out GE of hundreds of business lines. Soon he won the nickname of “Neutron Jack” means getting rid of people while retaining buildings. He decentralized GE management and dismantled the 29 layers of hierarchy and made GE an informal company. Jack opened the GE culture to ideas from everyone, every where by introducing the motto of “Imagination at Work”, and made boundary less behavior a reflexive, natural part of their culture. He made acquisition of several profitable companies and businesses to make GE more profitable. Jack believed in Globalization and hence implemented strongly. He mentioned that “Globalization is good. Globalization makes countries more interdependent on each other. And, the more interdependent we are, the better chances we have for peace”. One of the theories of leadership that Welch perfected as CEO of GEl was his theory of the 4 E’s. Officially known as “E to the fourth power,” Welch created a leadership dynamics that he employed both at GE and hopes others will employ at their own organizations as well. His program is, “for people who have enormous personal energy, the ability to motivate and energize others, ”edge”–the GE code word for being instinctively competitive–and the skill to execute on those attributes.” He very strongly enforced the process of Six Sigma. “Six Sigma” is a vision of quality which equates with only 3.4 defects per million opportunities for each product or service transaction, hence strives for perfection. With its services spanning from the services to the manufacturing sectors, GE realized that the only way they could achieve business excellence in what they were doing was by standardizing processes to minimize variations and hence defects. Today’s competitive environment leaves no room for errors. GE is spoken of in the same breath as Motorola for the initiatives that it took on reengineering business processes by Six Sigma approach. It is this Six Sigma approach that has led to retention of old customers and acquisition of new ones to the GE’s ever-growing list of customers. GE’s success with Six Sigma has exceeded most optimistic predictions. Having taken GE with a market capitalization of about $12 billion, Jack Welch turned it into one of the largest and most admired companies in the world, with a market value of about $500 billion, when he stepped down as its CEO 20 years later, in 2000.

Effectiveness of Jack Welch Leadership

Jack Welch led the company to massive revenues. In 1980, the year before Welch became CEO, GE recorded revenues of approximately $26.8 billion; in 2000, the year before he left, revenue blasted to nearly $130 billion; almost five fold. When Jack Welch left GE the company had gone from a market value of $14 billion to one of more than $410 billion at the end of 2004, making it the most valuable and largest company in the world, up from America’s tenth largest by market cap in 1981. Through the 1980s, Welch worked to restructure GE and make it a more competitive and profitable company. He also pushed the managers of the businesses to become ever more productive. Welch worked to eliminate inefficiency by dismantling the bureaucracy and made GE a more informal company. He shut down factories and sold unprofitable businesses and laid off low productive staff. Welch’s strategy was later adopted by other CEOs across corporate America. In 1999, he was named “Manager of the Century” by Fortune magazine.

Some people believe that Welch is given too much credit for GE’s success. They argue that individual managers are responsible for the company’s success. It is also held that Welch did not rescue GE from great losses as the company had 16% annual earnings growth during the tenure of his predecessor, Reginald H. Jones. Each year, Welch would fire the bottom 10% of his managers. Still GE hires and fires its employees very swiftly; the continuation of same strategy. As soon as GE sees any losses of revenue or contracts, it fires employees or send them on suspended employment. Critics also say that “the pressure Welch imposes leads some employees to cut corners, possibly contributing to some of the defense-contracting scandals that have plagued GE or to the humiliating Kidder, Peabody & Co. bond-trading scheme of the early 1990s that generated bogus profits”. Welch has also received criticism over the years for his lack of compassion for the middle class and working class. Welch has publicly stated that he is not concerned with the discrepancy between the salaries of top-paid CEOs and those of average workers. Jack Welch had a record salary of $94 million a year, followed by his record retirement-plan of $8 million a year.

Jeffrey Robert Immelt Era: 2001 and Beyond

Jeffrey Robert Immelt began to place his imprint in earnest on GE in 2002 through major restructurings and several significant acquisitions. He launched a reorganization of GE Capital. The financial services unit was divided into four separate units to streamline management, increase oversight, and improve transparency. GE began feeling the effects of the economic downturn that year as revenues fell nearly 3 percent, to $125.68 billion; profits nevertheless increased 7.5 percent, reaching $13.68 billion, though that was a far cry from the yearly 13 to 15 percent increases that Wall Street came to expect from GE during the Welch era. The stock ended the year trading at $24.35 per share, less than half of the high price for 2001. Next year, profits rose modestly, to $14.12 billion, or about 3 percent. Taking advantage of the economic downturn to acquire desirable assets from distressed sellers, GE’s deal-making appetite grew only larger in 2003. As part of its effort to shift emphasis to higher growth fields, General Electric completed two significant acquisitions in healthcare. Continuing his transformative leadership, Immelt reorganized GE’s 13 businesses units into 11 focused on specific markets and customers. Also during 2001, GE Lighting had the largest product launch in its history when it introduced the GE Reveal line of light bulbs to generate a cleaner and crisper light. The reorganization, effective at the beginning of 2004, brought similar businesses together in an effort to increase sales and cut costs. Overall, through the myriad moves engineered during just a few years in charge, Immelt was seeking to cut General Electric’s reliance on financial services and mature industrial businesses in favor of such higher growth areas as healthcare and entertainment. He built operations in fast-growing economies such as China’s. GE was aiming to outsource $5 billion by 2005 of parts and services from China and simultaneously grow sales in China to a like figure.

Key Actions by Jeff Immelt Leadership

In 2001, shortly after Jeff Immelt took over as CEO, a series of events such terrorist attacks on American soil and corporate scandals (Enron Scandal, Worldcom Scandal) occurred. These events created significant uncertainty and led to a crisis of confidence among investors community which in turn caused a slow down of the global economy. GE’s stock price went down by 16% slightly more than S&P 500. Immelt recognized that managing GE’s exposure to business cycles would be critical to organization’s long term stability. With most of the productivity gains already achieved by his predecessor through extensive internal reforms, Immelt realized that organic growth is essential for future profit growth. In 2002, Immelt set a goal for GE to achieve a sustained organic growth rate of two to three times the growth of global GDP. Hardly any company has achieved this kind of growth what GE was looking for, and none on a revenue base of $150 billion. Immelt identified the emerging global trends, uneven economic growth, increasingly interdependent global economy, global competitiveness of emerging markets and a more volatile and uncertain world. He aimed at creating value for customers by leveraging GE’s core competencies, particularly the ability to develop, test and deploy new products, highly customized products and services for high growth markets. In his letter to shareholders in 2003, Immelt articulated GE’s three strategic imperatives as: 1) sustaining GE’s strong business model 2) strengthening the portfolio and 3) driving growth initiatives.

To implement this strategy, GE’s business portfolio was restructured through a series of acquisitions and divestments around five key growth initiatives: Technical Leadership, Services, Customer Focus, Globalization and Growth Platforms. Technical Leadership i.e. Technology and Innovation was at the heart of Immelt’s GE growth initiatives. Identifying new growth platforms was established as a central strategic challenge for all GE’s businesses and involved analyzing the market to identify high-growth segments that offered potential for attractive returns.

An important step towards developing growth potential has been the launch of the Ecomagination business initiative to help meet customers’ demand for more energy efficient products. In formulating his approach, Immelt viewed technology as a key driver to GE’s future growth and took measures to expand GE’s research and development capabilities and supported them with adequate financial backing. Another essential part of Immelt’s growth strategy has been implementation of the Customer Focus Initiative. This manifested in the renewal of GE’s marketing function – most notably through the creation of GE’s Commercial Council and the deployment of a whole suite of customer-oriented programs. An important outcome of customer focus was the organizations ability to create new value for the customer in vertical selling by bundling products with support services and combining products and services across businesses to deliver highly customized solutions. This enhanced GE’s capacity to meet customer specific needs.

Historically GE is known for developing professional managers who are broad problem solvers with experience in multiple businesses or functions. Immelt realized that he needs to transform GE into a growth oriented culture to achieve success in his growth initiatives, and initiated a management development program – Leadership, Innovation, and Growth (LIG) for senior managers of the company to enable managers to effectively lead the change in culture from operational excellence to a growth culture at GE. He aimed at raising a generation of growth leaders – people with market depth, customer touch and technical understanding emphasizing the depth.

GE has sold modified Western products to emerging markets for decades. But now, it has embraced the reverse innovation (develop in-expensive products for emerging economies and bring them to the developed nations) to pre-empt the emerging giants. For past 30 years of globalization of products, GE’s major functional units like R&D, manufacturing are centralized and are headquartered in the developed world which acts as a barrier for the success of reverse innovation strategy. However, changing a long established structure, practices and attitudes is an enormous task and to bring any major change requires company’s top leaders to play a major role. Jeff Immelt and its leadership team created a new organizational form – Local Growth Teams (LGTs) by giving them special status, funding and personally monitoring them on a monthly basis to facilitate faster implementation of the reverse innovation strategy.

GE realized that Marketing is an essential function to achieve long-term growth and has strengthened Marketing by doubling its size from 2,500 in 2003 to 5,000 today. CMO (Chief Marketing Officer) positions were created for all GE businesses and at the corporate level. Marketing has established a Center of Excellence (COE) that would gather and disseminate key competitor information. The COE’s biggest contribution is its delineation of potential scenarios.

GE gradually reduced its representation in certain parts of financial services industry as it continues to reposition itself in the market place around the key themes that Immelt has identified as emerging global trends. By 2010, its operating frame work was centered on four main businesses: energy, technology & infrastructure, finance, home & business solutions and media.

Effectiveness of Jeff Immelt Leadership

In 2001, Immelt demonstrated his ability to recognize the changing business environment in the face of a sliding share price in the aftermath of 9/11 and Enron and World com scandals, and assured shareholders by communicating his commitment to good corporate governance and transparency by the introduction of more detailed financial disclosure. He developed and implemented organic growth strategy for organizations long-term sustainable growth considering the emerging global trends in the business environment. Jeff Immelt also addressed the alignment of the structure, systems, skills and staff to effectively achieve the organizational change – to transform GE into a company with growth initiative as a core competency. In the context of global financial crisis of 2008, GE’s repositioning towards technology and industry has played an important role in protecting GE’s revenue and earnings base. Despite the global financial crisis of 2008 which impacted severely on GE’s share price, its financial performance continued to show remarkable resilience through 2009. However, the GE’s stock price is still down at $16 and has under-performed despite earnings growth. One reason could be its financial units’ perceived exposure in financial markets. In these challenging economic times, the jury is still out on the long term success of Jeff Immelt’s growth strategy for GE. However, the time will be the ultimate judge.

Good business leaders create a vision, articulate the vision, passionately own the vision and relentlessly drive it to completion. By imbibing all these qualities, Jeff Immelt has been successful as an effective leader in positioning GE for sustainable growth in the long term.