Perfect competition is a market situation where large number of buyers and sellers operate freely and commodity sells at a uniform price. In such a situation no seller or buyer has any influence on the market price. In a perfectly competitive market, a firm is the price taker and industry is the price maker.

Main Features of Perfect Competition

The main features of perfect competition are as follows:

- There are a large number of buyers and sellers. Each seller must be small and the quantity supplied by any seller must be so insignificant that no increase or decrease in his output can appreciably affect the total supply and the market price. So also, each buyer must be small and the quantity bought by any of the buyers should be so insignificant that no increase or decrease in his purchases can · appreciably affect the total demand and the price. As a result, each seller will accept the market price as it is. So also each buyer will regard the price as determined by forces beyond his control.

- Each competitor offers a homogeneous product, i.e. the products are similar to each other in terms of quality, size, design and color. Thus one product could be substituted for the other if the price is lower. Again, the commodity dealt in must be supplied in quantity.

- There is no obstacle with regard to entry or exit of the firms. When these aforesaid three conditions a fulfilled there is a market condition that can be defined as a pure competitive market.

- The market in which the commodity is bought and sold is well organised and trading is continuous. Therefore, buyers and sellers are well informed about the price of the commodities.

- There are many competitors (whether buyers or sellers), each acting independently. There must be no restraint upon the independence of any seller or buyer, either by custom, contract, collusion, and fear of reprisals by the competitors, or by the imposition of government control.

- The market price is flexible over a period of time. In other words, it rises or falls constantly in response to the changing conditions of supply and demand.

- All the firms have equal access to production technologies and techniques.

- There are no patents, proprietary designs or special skills that allow an individual firm to do the job better than its competitors.

- Firms also have equal access to all their inputs, which are available on similar terms.

Thus, perfect competition in an extreme case and is rarely to be found. Actual competition always departs from the ideal of perfect competition. Perfect competition is a mere concept, a standard by which to measure the varying degrees of imperfect competition.

Sometimes, a distinction is made between perfect competition and pure competition. But the line of distinction drawn between the two is very fine. That is why many economists have preferred to use the two terms synonymously. Hence, from managerial viewpoint, there does not seem to be any difference between the two. The underlying presumption in a free competition (close to perfect competition) is that it social interest interest unless the contrary can be proved. Competition safeguards the consumer against exploitation by providing the buyer with alternatives, and makes it unnecessary for the state to intervene by regulating process and production in order to protect him.

Price Determination under Perfect Competition

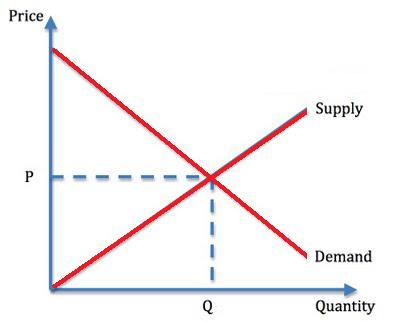

The forces of demand and supply determine prices under perfect competition. The equilibrium price is obtained at the intersection of demand and supply curves as shown in following Figure . The equilibrium price will change only with changes in forces of demand and supply.

Responses to a change in demand or to a change in supply may be primarily in price or quantity. If the demand is highly elastic, consumers will respond readily to price changes by dropping out of the market when prices are lowered’a little. As a result, most of the adjustments to changes in supply (an increase leading to a reduction in price and a decrease leading to an increase in price) would be those in quantity purchased, if the demand is highly elastic. If the demand is inelastic, the adjustments will take place primarily in price. Similarly, if sellers respond readily by greatly increasing their offerings on slight increases in price or by heavy withdrawals in slight price drops, the adjustments to changes in demand will be largely in quantity exchanged. If sellers are quite responsive to, price in their offerings (if supply is very inelastic), the adjustments to changes in demand, will take place largely through shifts in price.

If both demand and supply increase, sales are bound to increase but the price mayor may not increase. In this case there case can be two possibilities

- Price will rise if the amount, which will be demanded at the old price exceeds the supply, which will be made at that old price.

- But the price will fall if the amount, which will be supplied at the old price, is more than the amount demanded currently at that price. In other words, if at the old price, new demand exceeds the new supply, the price will rise but if the new demand is less than the new supply, the price will fall.

An increase in demand with a simultaneous decrease in supply will raise price and increase sales if the new demand price for the old equilibrium amount is higher than its new supply price. Similarly, the price will rise and sales will diminish if the new supply price for the old amount is higher than its new demand.