Definition of Trade Cycle or Business Cycle

According to Keynes, “A trade cycle is composed of periods of good trade characterized by rising prices and low unemployment percentage, alternating with periods of bad trade characterized by falling prices and high unemployment percentage. “

Characteristics of Trade Cycles

From the above definition, it should be clear that trade cycle is the rhythmic fluctuations of the economy, that is, periods of prosperity followed by periods of depression. However, the waves of prosperity and depression need not always be of the same length and amplitude. Further, trade cycles varied tremendously in magnitude. While some have smaller cyclical fluctuations in economic activity, others have great intensity of fluctuations. Expansion in some cycles reaches the full employment level and stays there. However, in some cycles, the peak is reached even before full employment. Sometimes, the cyclical fluctuations may be prolonged for one reason or the other.

Phases/Stages of a Trade Cycle

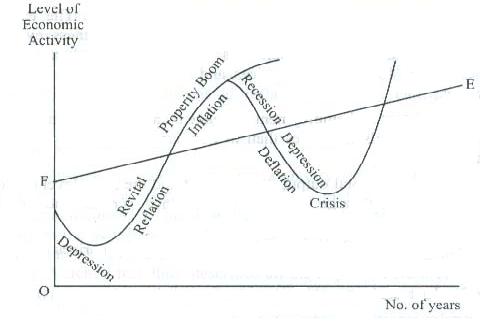

Every trade cycle is characterized by two main phases namely, the upward phase and the downward phase. These two phases further have four or five different sub-phases, such as depression, recovery, full employment, boom and recession. In monetary terminology, the same phases correspond to depression, deflation, full employment, disinflation and deflation.

The following figure shows the different stages of a trade cycle. FE represents the full employment line, it may be taken as the dividing line. Above this line there is business prosperity and boom and below this line there is business depression. As a trade cycle is a continuous phenomenon, it is essential to break it somewhere. It is customary to start at the lowest point of the upward phase, namely, the depression.

- Depression: During depression, the level of economic activity is extremely low. The price level is low, profit margins do not exist, firms incur losses and unemployment is high. Interests, wages and profits are all low. While all sections in the economy suffer, some suffer more than others do. For instance, the producers of agricultural goods suffer badly because the prices of agricultural goods fall the most during depression. This is due to inability of the farmers to adjust their output according to the market demand, which is low. The worst hits are the working classes that suffer heavily because of unemployment. The depression is thus, a period of great suffering, low income and unemployment.

- The Phase of Recovery: Depression gives place to recovery. There is revival of business and economic activity. There is greater demand for goods and services and consequently there is greater production. Prices, wages, interests and profits all start rising. Employment increases and so docs the national income. There is increase in investment, bank loans and advances. Through multiplier and acceleration effects, the economy is proceeding upward steadily and rapidly. The process of revival and recovery becomes cumulative. Increased receipts result in increased expenditure causing further increase in receipts. which in turn, result in further increased expenditure and so on. The wave of recovery once initiated soon begins to feed upon itself.

- The Phase of Full Employment: The cumulative process of recovery continues until the economy reaches full employment. Full employment implies that all the available men are employed. The economy has reached the optimum level of economic activity. During this phase, there is an all round economic stability referring to stability of output, wages, prices and income. Wages, interests and profits are high, output is highest with the given technology and employment is maximum. There may be small percentage of unemployment, but it is not of an involuntary type but of voluntary and frictional type. The period of full employment has become the usual goal of most national economic policies.

- The Phase of Boom or Inflation: The phase of recovery frequently ends not in a stable state of full employment or prosperity but further leads to a boom or inflation. Beyond the stage of full employment, the rise in investment results in increased pressure for the available men and materials and rise in wages and prices. During this period, there is hectic activity going on everywhere in the economy such as new buildings come up, new factories are commissioned and many new trades are started. In a matter of weeks or months, full employment paves the way for overall employment, i.e., a peculiar situation in which there are more jobs than the available workers. Money wage rise, profits increase and interest rates go up. The demand for bank credit increases and there is all round optimism. At the same time, bottlenecks begin to appear in the economy. Factors of production, particularly raw materials and labor become scarce, commanding higher prices and wages and thereby distort the cost calculations of the entrepreneurs. They now realize that they have overstepped the mark and become overcautious. Their over-optimism paves way for their pessimism. Generally, the failure of a firm or bank bursts boom and lead to recession.

- Recession: The entrepreneurs realize their mistakes and find that many of the ventures started in the rosy anticipation of the boom are not profitable. The over optimism of the boom gives way to pessimism characterized by feelings of hesitation, doubt and fear. Fresh enterprises are postponed for some remote future date and those in hand are abandoned. Credit is suddenly curtailed sharply as the banks are afraid of failure. Business orders are cancelled and workers are laid off. Liquidity preference suddenly rises and people prefer to hoard rather than invest. Building activity slows down and unemployment appears in construction industries. Unemployment spreads to other sectors also because the multiplier effect begins to work in the downward direction. Unemployment leads to fall in income, expenditure, prices, profits and industrial and trade activities. Panic prevail in the stock market and the prices of shares fall rapidly. Once business and economic activity start declining, it becomes almost difficult to stop this decline and finally ends in a hopeless depression.

Features of Trade Cycle Stages

We have described the various phases of a trade cycle, but we should note, that all these phases rarely display smoothness and regularity. The movement at times may be irregular in such a manner that one phase may not easily follow the other. Thus it is quite likely that a state of fairly stable business depression may lead to recovery or it may decline to further recession. Similarly, a recovery may turn into a recession without allowing for either full employment or even boom. Sometimes, the depression may be unstable and recover very rapid.

Some of the important features of various phases of a trade cycle should be emphasized here.

- The process of revival is generally very gradual but once it picks up, it becomes rapid.

- The boom period of the trade cycle is marked by high level of business activity.

- The crash of the boom is always sudden and sharp.

- The downward trend of the trade cycle is rather very rapid.

- The depression period is prolonged and is painful because of widespread unemployment.