The ADL Matrix or Arthur D Little Strategic Condition Matrix is a Portfolio Management technique that is based on the Product Life Cycle (PLC). It is developed in the 1980’s by Arthur D. Little, Inc. (ADL), one of the best-known consulting firms, intended to help a company manage its collection of product businesses as a portfolio.

Like other portfolio planning matrices, the ADL matrix represents a company’s various businesses in a 2-dimensional matrix. It is a structured methodology for consideration of strategies which are dependent on the life cycle of the industry. The ADL approach uses the dimensions of environment assessment and business – strength assessment ie. Competitive Position and Industry Maturity.

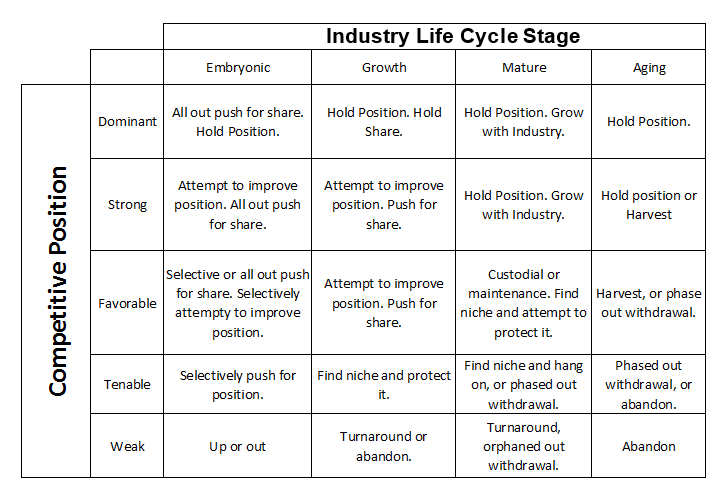

The environment assessment is an identification of the industry’s life cycle and the business strength assessment is a categorization of the company’s SBU’s into one of five competitive positions, these five competitive positions by four life cycle stages. The combination between the dimensions yields 5 (competitive positions) by 4 (life cycle stages) matrix. The positioning in the matrix identifies a general strategy.

The ADL Matrix is often associated with strategic planning at business unit level. However it works equally well when applied to product lines, or at the level of an individual product.

The Competitive Position

Company’s competitive position is determined by strategic actions and competitor’s strategies. Quality and strength of competitive position are indicators of company’s strength. The ADL matrix categorizes every segment of company according to its position which can be dominant,strong, favorable, tenable or weak.

- Dominant: This is a comparatively rare and typically short-lived. In many cases is either to a monopoly or a strong and protected technology leadership.

- Strong: Market share is strong and stable, regardless of competitors. The firm has a considerable degree of freedom over its choice of strategies and is often able to act without its market position being unduly threatened by its competitors.

- Favorable: Business line enjoys competitive advantages in certain segments of market. However there are many rivals, and no clear leader among stronger rivals. Results in the market leaders a reasonable degree of freedom.

- Tenable: Position in overall market is small or niche, either geographical or defined by product. Competitors are getting stronger.

- Weak: Continuous loss of market share. Business line is too small to maintain profitability.

Industry Maturity

Industry maturity could almost be renamed into “Industry life cycle”. Of course not only industries should be considered here but also segments. There are four categories of industry maturity: embryonic, growth, mature and aging.

- Embryonic: The introduction stage, characterized by rapid market growth, very little competition, new technology, high investment and high prices.

- Growth: The market continues to strengthen, sales increase, few (if any) competitors exist, and company reaps rewards for bringing a new product to market.

- Mature: The market is stable, there is a well-established customer base, market share is stable, there are lots of competitors, and energy is put toward differentiating from competitors.

- Aging: Demand decreases, companies start abandoning the market, the fight for market share among remaining competitors gets too expensive, and companies begin leaving or consolidating until the market is demise.

Positioning into one of the four categories is a very sophisticated procedure and depends on many factors.

Four steps in creating ADL Matrix:

- Determining the SBU’s of the company (strategic segmentation done by clearly defined procedures)

- Identifying phases of industrial maturity for each SBU (this should be done for each business in all SBU’s)

- Determine SBU’s competitive position (company’s competitiveness in specific, narrow defined industry)

- Plotting sizes and positions of SBU’s on ADL Matrix

The distribution and trajectory of the businesses across the ADL matrix helps indicate whether the firm’s product mix is well balanced now and in the future. For example, the company will need to maintain a continuing set of mature businesses in order to generate cash to support new embryonic and growth operations.

If your business unit has a strong market presence and a newly emerging product line, you’ll likely want to aggressively push its position and capture as much market share as you can. But this strategy does not apply so well to business lines with dominant competitive positions in declining markets. In this instance, you’re better off putting your energy into new, growing markets and simply maintaining your current market position in the declining industry. The ADL Matrix addresses these unique needs by recommending general strategies for different combinations of competitive position and industry maturity.

ADL matrix has several limitations. The main limitations are;

- The life cycle has no standard length,

- Determining the current position of an industry in its life cycle is awkward,

- The length of life cycle may be influenced by competitors.