The Alcar model, developed by the Alcar Group Inc., a company into management education and software development, uses the discounted cash flow analysis to identify value adding strategies.

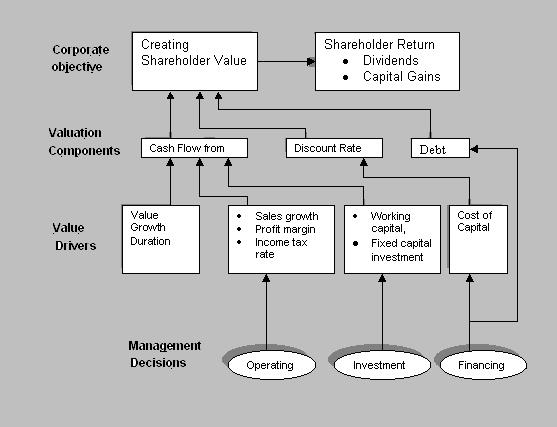

According to Alcar Model of Value Based Management, there are seven ‘value drivers’ that affect a firm’s value. These are

- The growth rate of sales

- Operating profit margin

- Income tax rate

- Incremental investment in working capital

- Incremental investment in fixed assets

- Value growth duration

- Cost of capital.

Value growth duration refers to the time period for which a strategy is expected to result in a higher than normal growth rate for the firm. The first six factors affect the value of the strategy for the firm by determining the cash flows generated by a strategy. The last term, i.e. the cost of capital, affects the value of the strategy by determining the present value of these cash flows. The following figure represents the Alcar approach.

According to the Alcar approach of value based management, a strategy should be implemented if it generates additional value for a firm. For ascertaining the value generating capability of a strategy, the value of the firm’s equity without the strategy is compared to the value of the firm’s equity if the strategy is implemented. The strategy is implemented if the latter is higher than the former. The following steps are undertaken for making the comparison.

- Calculate the value of the firm’s equity without the strategy: The present value of the expected cash flows of the firm is calculated using the cost of capital. The cash flows should take the firm’s normal growth rate and its effect on operating flows and additional investment in fixed assets and working capital into consideration. The cost of capital would be the weighted average cost of the various sources of finance, with their market values as the weights. The value of the equity is arrived at by deducting the market value of the firm’s debt from its present value.

- Calculate the value of the firm if the strategy is implemented: The firm’s cash flows are calculated over the value growth duration, taking into consideration the growth rate generated by the strategy and the required additional investments in fixed assets and current assets. These cash flows are discounted using the post-strategy cost of capital. The post-strategy cost of capital may be different from the pre-strategy cost of capital due to the financing pattern of the additional funds requirement, or due to a higher cost of raising finance. The PV of the residual value of the strategy is added to the present value of these cash flows to arrive at the value of the firm. The residual value is the value of the steady perpetual cash flows generated by the strategy, as at the end of the value growth duration. The post-strategy market value of debt is then deducted from the value of the firm to arrive at the post-strategy value of equity.

The value of the strategy is given by the difference between the post-strategy value and the pre-strategy value of the firm’s equity. A strategy should be accepted if it generates a positive value.