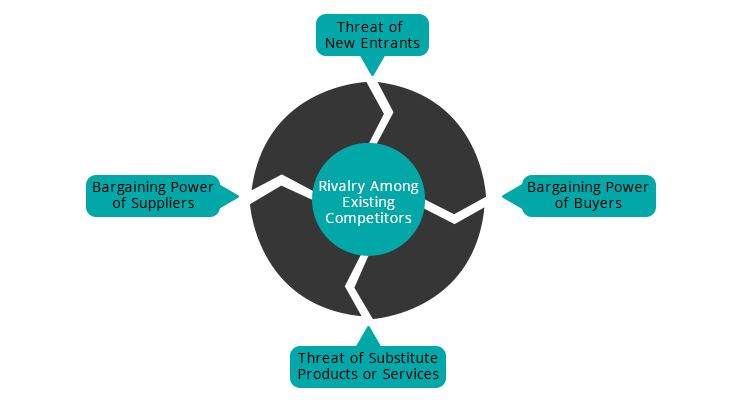

Porter’s Five Forces Framework

Porter’s Five Forces Framework introduced back in 1979 by Michael E. Porter from Harvard University in his first book “Competitive Strategy”. It becomes international best seller, and considered by many to be a definitive work on corporate strategy. The book itself had been published in nineteen languages and re-printed almost sixty times, changes the way business leaders thought and remains a guide of choice for strategic managers the world over. It has become an important tool for analyzing an industry structure and strategy process. The tool provides a simple perspective for assessing the position and competitiveness of a corporation or business organization within the industry. Porter points out five forces which the upturn and downturn, will affect the profitability and existence for a corporation or business organization.

The development of Porter’s Five Forces Framework is based on the idea of attractiveness of an industry. As for the attractiveness itself, is determined by the profitability within the industry. More profit means the industry is more attractive and low profitability means a low attractive industry. The way of thinking in the model is to achieve a better competitive position against other players. The competitive advantages developed from strengthening the own position within this Five Forces. The Five Forces framework is based on microeconomics. It considers supply and demand, substitutes and complementary product, and the relationship between production volume and cost of production; also the market structures such as monopoly, oligopoly, or perfect competition.

Force 1: Threat of New Entrants

The chances in which new competitors can enter the market and drive the current players’ price down. The threat to entry depends on six major forces of barriers which Porters describes as: economies of scale, product differentiation, capital requirements, cost disadvantages independent of size, access to distribution channel, and government policy. The decision of the new-comer also pretty much influenced by their expectation on the existing player. If the incumbents known for previously fought vigorously to new entrants, or possess such substantial resources to fight back (such as excess cash, unused borrowing power, available productive capacity, or clout with distribution channel and customers), the new entrants will likely to have second thought on entering the market. This also happened if they know that the incumbents seem likely to cut the prices. New entrants fear more also when the industry growth is so slow so that newcomers can gain volume only if they take it from the incumbents.

Force 2: Bargaining Power of Suppliers

Another force Porter mention in the model is how powerful the supplier to drive up the prices of is corporate input. The term supplier includes all sources of input that are needed to provide the product. A supplier of group is powerful when it is dominated by few companies and more concentrated than the industry it sells to. The products are also differentiated or unique – means relatively no substitutes for the particular input – so that it built up the switching cost. The power of supplier also increase when there is a possibility for the supplier for integrating forwards in order to obtain high prices or so. Also when the industry is not an important customer of the supplier group or when it is not obliged to contend with other products for sale to the industry.

Force 3: Bargaining Power of Customers

Similarly, bargaining power of customer settle on how powerful is the customer can impose pressure on margins and demands. Buyer are powerful if it is purchase in large volumes and/or the product it purchases is standard or undifferentiated, means they can always find alternative suppliers. Customer will also become more powerful if the products it purchases from the industry form a component of its product and represent an significant fraction of its cost, in other words, the customer become more price sensitive. Furthermore when they know that the company earns low profits, which create great incentives to lower its purchasing cost; and when the industry’s product is unimportant to the quality of the buyers’ product or services, then the bargaining of customer increase. More threat comes from the possibility of the customer to integrating backward and has the ability to produce the product themselves. Another factor mentioned by Porter is that customer will be more prices sensitive when they recognize that the industry’s product does not save the buyer money. He gave an example of logging of oil wells, where an accurate survey can save thousands of dollars in drilling costs, therefore affect the market price.

Force 4: Threat of Substitute Products

The extent of which substitute product can be used in place of one product. Porter highlighted the characteristics of substitute products that deserve the most attention as those products that are subjects to trends improving their price-performance trade-off with the industry product or are produced by industries earning high profit. Porter also said that substitutes come into play when the competition within industry increases which lead to price reduction or performance improvement.

Force 5: Rivalry Among Existing Competitors

This factor describes the strength or the intensity of competitiveness among the existing players within the industry. High rivalry limits the profitability of an industry. Factors that shape the intense rivalry in a industry are: (a) payers are roughly equal in size and power (b) the growth of the industry is slow, precipitating fights for market share (c) lacks of differentiation and switching cost of the products (d) strong willingness to cut the price either because the fixed cost are high or the product is perishable (e) high barriers to exit the industry (f) capacity is normally augmented in large increments, and (g) diversity of strategies, origins, and “personalities” of the rivals. Other than the intensity, the dimension basis in which the rivalry takes place also reflects the strength of the rivalry such as price, products features, support service, delivery time, and brand image. Whether the competition takes place in the same dimension, or the rivals converge to compete on same dimensions.

Contemporary Relevance Between Porter’s Five Forces and Corporate Strategy

Any organization, especially ones dealing with corporation or business environment realize that their success depend on both internal and external factors. With his Five Forces, Porter tries to emphasis on the most important or most influencing forces to the business profitability and existence. The competitors, the new entrants, new substitute, also the bargaining power of both supplier and buyer covered most aspects of a business activity. Indeed, Porter’s Five Model focuses heavily in competitive strategy, which is essential. To be specific, the Five Forces, mentioning competition, are related more to analysis of external forces from the market environment of the strategy.

Of course, all business organization will always seek the best way to maximize corporate profit and determining the attractiveness of an industry. This is a need that will always be in manager’s mind in every industry, from every era. Therefore, through his model, Porters tries to give a framework that can help the decision maker to create a strategy where enable the company to stay in the market, defend their current position, and even grow the market size. It supports the decisions about to enter or to exit from an industry or market.

As a business leader, it is important to understand the competition in the industry. The model can be used to compare the impact of one competitive force on our own company and to the impact on the competitors. With the knowledge of power and intensity of competitive forces, the strategy can be developed in way that gives the company options to influence the forces to improve their own position, such as new positioning or differentiation of product. It also gives the details on how to prevent the new entrants. Not only new entrants, the strategy should be able to cope with the substitute product that is getting more and more accessible now for the customer. Bargaining power of supplier and buyer is more relevant to supply and demand. It is essential to know which side of supply and demand equation our business is referring to. The framework tells us how profitability can be affected, in good way and in bad way from the context of industry rivalry and competition. It creates to position the firm to leverage its strengths and defend against the unfavorable effects from the five forces.

Generally speaking, the model talked about the profitability and survival of a company. Referring to the definition of corporate strategy, Porter’s Five Forces seems irrelevant. Corporate strategy designs the grand strategy for the company grand purpose. And almost no company has a mission statement for to be ‘the most profitable’ or so. Most company longing for sustainability; to be able to hold on success for a long term period. They achieve this by creating more value through their business, managing portfolio business, and developing business units; things that we don’t learned through Porter’s Five Forces. Profitability is just one way to get to the grand purpose. That is the reason why, for the grandiose strategy of a company, to be based on only Porters that is focus on profitability, is unadvisable. The strategy such as focus and differentiation for competitiveness can be implemented at business unit level strategy to create competitive advantage. It may be relevant in corporate level as for the interest of stakeholder, indirectly. When the business unit strategy is achieved the desired goal, which most likely to be more profit, this is also will considered as favorable by the investors. Corporate strategy also concerned about the development and coordination of portfolio of business. The complexity that portfolio has cannot be found in the Porter’s model. Multi-variance product, multi-company in different industries, all this density of current market environment made Porter’s Five Forces become less practical.

Other relevance is the dimension of competition. It is something that decided at the corporate level. Porter’s mentioning that based on the competitive advantages, we must choose the dimension of competition and it is best to create a battle field in that dimension, not in other dimension. This is about knowing our company competitive advantages and where to compete and win over the rivalry.