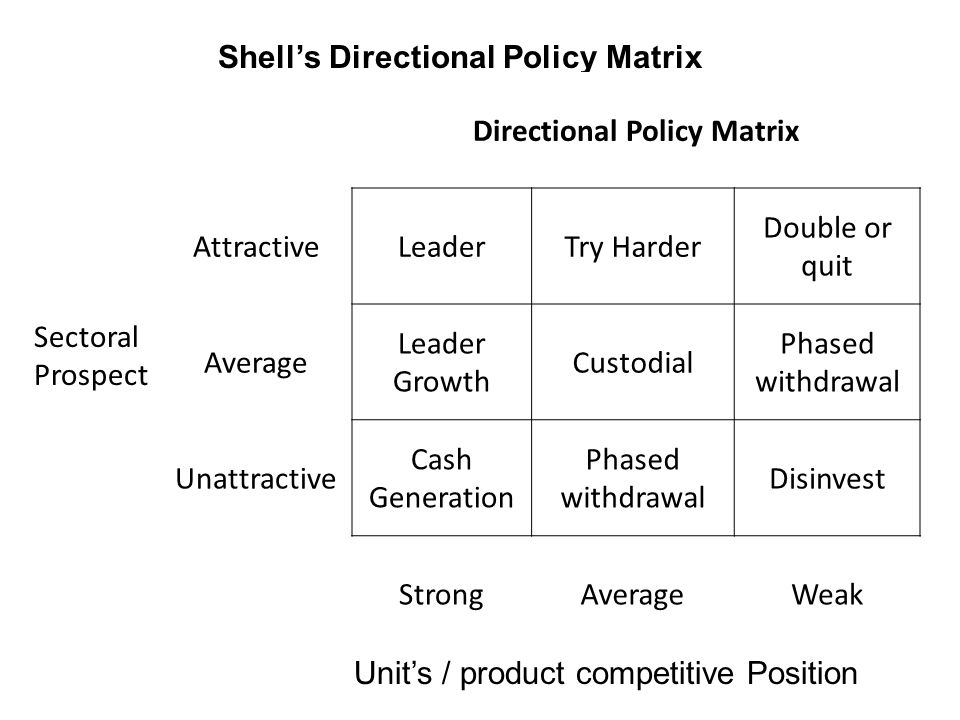

The Shell Directional Policy Matrix (DPM) is another refinement upon the Boston Consulting Group (BCG) Matrix. Along the horizontal axis are prospects for business sector profitability, and along the vertical axis is a company’s competitive capability. Business sector profitability includes the size of the market, expected growth, lack of competition, profit margins within the market and other favorable political and socio-economic conditions. On the other hand company’s competitive capability is determined by the sales volume, the products reputation, reliability of service and competitive pricing. As with the GE Business Screen the location of a Strategic Business Unit (SBU) in any cell of the matrix implies different strategic decisions. However decisions often span options and in practice the zones are an irregular shape and do not tend to be accommodated by box shapes. Instead they blend into each other.

Each of the zones in Shell’s Directional Policy Matrix is described as follows:

- Divest: SBU’s running in losses with uncertain cash flows. They should be divested as the situation is not likely to improve in the near future. These liquidate or move thee assets.

- Phased withdrawal: SBU’s with weak competitive position in a low growth market with very little chance of generating cash flows. They should be phased out gradually. The cash realized should be invested in more profitable ventures.

- Double or quit: Gamble on potential major SBU’s for the future. Either invests more to use the prospects presented by the market or else better to quit the business.

- Custodial: SBU’s are just like a cash cow, milk it and do not commit any more resources. The corporate has to bear with the situation by getting help from other SBU’s or get out of the scene so as to focus more on other attractive business.

- Try harder: SBU’s could be vulnerable over a longer period of time, but fine for now. They need additional resources to strength their capabilities. The corporate try harder to exploit the business prospects thoroughly.

- Cash Generator: Even more like a cash cow, milk here for expansion elsewhere. SBU’s may continue their operations, at least for generating strong cash flows and satisfactory profits. No further investments are made.

- Growth: Grow the market by focusing just enough resources here. These SBU’s need funds to support product innovations, R&D activities etc.

- Market Leadership: Major resources are focused upon the SBU. It must receive top priority.