An interesting evolution of the Ansoff matrix, the Innovation Ambition Matrix, coined in an article from Harvard Business Review by two recognized consultants, Bansi Magji and Geoff Tuff, entitled ‘Managing Your Innovation Portfolio’.

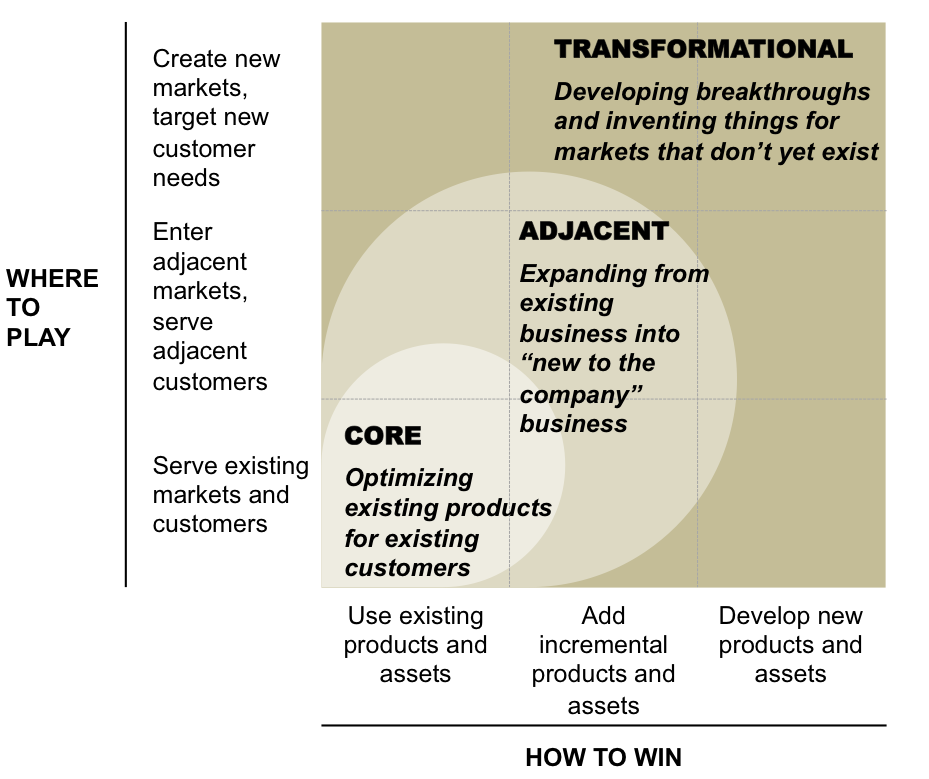

Innovation Ambition Matrix is a simple six-cell model with the vertical axis concerned with where an organisation is competing (ranging from serving existing markets/customers at the bottom, entering adjacent markets in the middle, and creating new markets at the top end of the axis) and the horizontal axis referring to type of products/assets used (using existing products, adding incremental products, and developing new products/assets). The axes of the matrix are labeled as follows:

- “How to Win.” This is designated for the novelty of the product that you are offering to customers. Are you using existing, adding incremental, or developing new products?

- “Where to Play.” This measures the novelty of your customers. Will the innovation serve an existing, enter an adjacent, or create a new market?

The principle behind the Innovation Ambition Matrix is that the relationship between markets and product portfolio invention is an important framework for determining an organization’s innovation ambition.

The matrix might be more appropriate to define the Innovation Strategy of the company, rather than to define its Growth Strategy. According to Nagji and Tuff, the best approach to innovation is to think in terms of managing an integrated, balanced ’portfolio’ of innovation initiatives which are divided into three types:

- Core innovations – These innovations are incremental by definition. The vast majority of innovation projects falls into this category such as line extension, refreshing or improving the performance of existing products. These are fairly safe bets.

- Adjacent innovations – Those innovations take the company into new business (without venturing too far from the core), by incrementally adding new products and assets.

- Transformational innovations – Those innovations are often described as breakthrough innovations, or discontinuities. They are not directly related to existing markets or technologies, but represent totally new products or services which are not extensions of existing ones. These are the “out of the box” types of ideas that many business leaders seek.

According to Nagji and Tuff, accomplished innovators manage initiatives across all three opportunity categories. The balance between program initiatives will vary by company but what is pertinent is that a mix of the three is well-advised. ie. The authors urge organisations to manage for “total innovation” by managing the three types of initiatives in a holistic, integrating fashion.

An innovation portfolio has to covers all the three of these activities. A good rule of thumb is that 70% of the investments are in level one, 20% in level two, and only 10% in level three. In terms of value creation potential, however, the ratios are inverted: core innovation efforts typically contribute 10% of the long-term cumulative return on innovation investment, adjacent initiatives contribute 20%, and transformational projects yield a huge 70%. The right balance of innovation investment will vary from company to company according to particular factors like age of the company, its competitive position in the market and characteristics of the industry served (e.g. number of suppliers, market growth, regulatory patterns, etc).

“Typically they are aware of a tremendous amount of innovation going on inside their enterprises but don’t feel they have a grasp on all the dispersed initiatives…………The pursuit of the new feels haphazard and episodic, and they suspect that the returns on the company’s total innovation investment are too low.” – Nagji and Tuff

Most companies tend to be heavily oriented toward just core innovation and whilst this is understandable in terms of avoiding the greater risks and uncertainties associated with adjacent and transformational initiatives, the result will be steady, long-term decline in business and attractiveness to customers if a company never tries some adjacent or transformational projects.

External Links:

- Managing Your Innovation Portfolio (Harvard Business Review)

- A Simple Tool You Need to Manage Innovation (HBR Blogs)