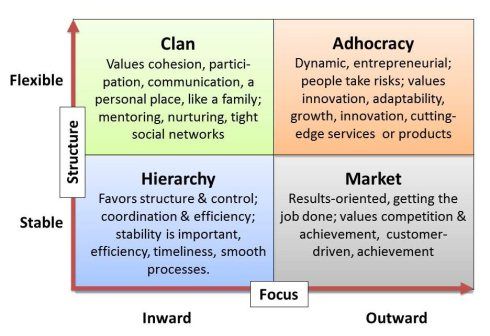

Competing models of management refer to those models that attempt to explain the competing value framework of organizational management. The organizational management sometimes faces the management challenge of balancing between two or more important processes that affect the operation of an organization. The competing values framework is a model that was developed by Robert Quinn and Kim Cameron to assess the organizational culture. The theory of competing values framework, in essence, shows the interrelationship between processes that enable the organization to focus on the internal environment or external environment. The area of focus of an organization leads to the development of the organizational culture and often results in a balancing of two or more competing value factors. This implies that the organizational competing values framework models have a role in the success of an organization. The competing values framework can be used in constructing an organizational culture profile. An organizational Continue reading

Strategic Management Concepts

Moving to Blue Ocean Strategy – Shift from Red Ocean to Blue Ocean

In global market today, it can be supposed that there are two typical kinds of oceans: read oceans and blue oceans. Of two sorts of market, red oceans are defined as a known space for all existent industries nowadays. On the contrary, blue oceans are regarded as an unknown area for industries which do not exist. As a result, red oceans present all existing rules related to business competition and industrial regulations. This market defines and determines the boundaries for all games and rules. In this market, companies strive to compete with their competitors and rivals in order to gain better benefit and dominate more market share of current demand. Therefore, red oceans provide for space for enterprises to focus on their competition for decades. However, the space is limited while competitive battles are becoming increasingly fierce. There are more and more participants wanting to invest in the same products. Continue reading

Porter’s Five Forces and Three Generic Strategies

The long development of Porter’s Five Forces Analysis has brought to the fact that those forces become the determinants of the industry’s competition. These five forces are treat of new entry, rivalry among existing firms, treat from substitute products, bargaining power of buyers, and bargaining power of suppliers. Furthermore, five forces analysis is treated by the organization to measure the level of competition, besides that, it is used as a strong first step in understanding how one industry compares to another and also to determine industry profitability because they influence the prices, costs, and required investment of firm in an industry. In order to be competitive enough, a normal company that seeks profitability would have to understand how they work in its industry and how they affect the company in its particular situation. Therefore, Three Generic Strategies were implemented to establish a strategic agenda for dealing with these five forces. Continue reading

Five Approaches to Differentiation Strategy

In order to achieve competitive advantage against the competitors, corporations carry out the strategy to distinguish themselves from the competitors in aspects of product, service, image, and etc. The focus of differentiation strategy is to creative the product and service, which is considered to be unique and special by the industry and customers. The foundations of the implement of differentiation strategy are customer needs, competitors, products and services levels. There are many means to carry out differentiation strategy. Such as product differentiation, service differentiation and image differences and so on. By carrying out differentiation strategy, the brand loyalty of users will be cultivated successfully and the corporation can also avoid the direct confrontation of competitors. Therefore, differentiation strategy is an effective competitive strategy, which enables the enterprise to obtain profits above the industry average level. Approaches to Differentiation Strategy Differential Product Strategy: In order to get an advantage different from Continue reading

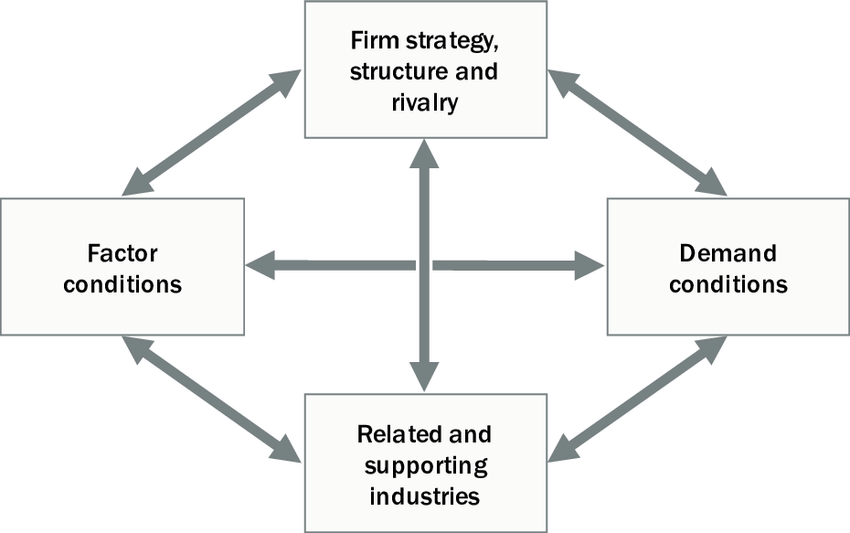

Analysis of Porter’s Diamond Model of National Advantage

Michael Porter introduced the diamond model of national competitive advantage (1990) to explain why a number of countries are more competitive than others and why a number of businesses within the countries are more competitive. Porter’s Diamond Model proposes that the national home base of an industry plays an important role in achieving an advantage on a universal scale. This home base contributes the essential factors that will support the organisations in building advantages in global competition. Porter identified four determinants in attaining a national competitive advantage he concludes that a combination of the four determinants within a nation has an enormous influence on the competitive strength of the firms located there. Porter argues that competitive industries take the form of specialized clusters of home based firms. Clusters are correlated through vertical relations such as buyers integrating with suppliers or through horizontal relations through customers, technology, skills, distribution channels etc. Continue reading

Link Between Core Competency and Competitive Advantage

In order to explore the link between core competency and competitive advantage, it is crucial to understand the implications of both terms. Competitive advantage could imply exploitation of resources resulting in an organisation’s distinctive position compared to competition. While most firms view the attainment of competitive advantage as earning greater investment returns, it can comprise of various aspects, for instance, enhancing environmental impact or capturing a greater market share can be viewed as a source of competitive advantage for a particular firm. Porter (1985) defined competitive advantage as the value delivered by a firm’s products that exceeds costs of creating that value. In this context, competitive advantage was achieved by a firm through adoption of either a differentiation or cost leadership strategy. However, competitive advantage does not solely rely upon implementation of value creating activities as the notion undermines and sometimes ignores to account for the potential of competitors. Therefore Continue reading