The survival and progression of businesses in the 21st century is highly dependent on the ability of firms to expand beyond their national borders, taking into account the cost effectiveness of expansion and the complexity and risks associated with the company’s chosen international business strategy. The resources and objectives of a firm, as well as the demand for their product outside their national borders are important in taking the decision to globalize a company’s products and/or services. Although three strategies are more common, namely multi domestic, global and transnational approaches, the fourth strategy available to firms is the international approach to global expansion.… Read the rest

International Business

International Business Management deals with the maintenance and development of a multinational operation across national borders, whose manager has the knowledge and the skills to manage and handle cross-cultural processes, stakeholders and business environments in a right way.

Multinational Marketing Information System (MMIS)

In general, marketing research is the process wherein vital information pertaining to the market is gathered thru data acquisition and is analysed in order to help the senior management reduce the risk associated with decision-making thru the means of an effective information dissemination system. Because of this, the marketing research tool plays a vital role in the overall process of management information systems.

With the expansion of countries into the global market, multinational marketing research has taken flight. Multinational marketing research is the systematic and objective acquisition of data pertaining to the market in which the company wishes to penetrate. It is a support tool for the decision makers in order to reach a sound decision that involves the proper identification and implementation of their multinational marketing strategies and programs targeting the identified market.… Read the rest

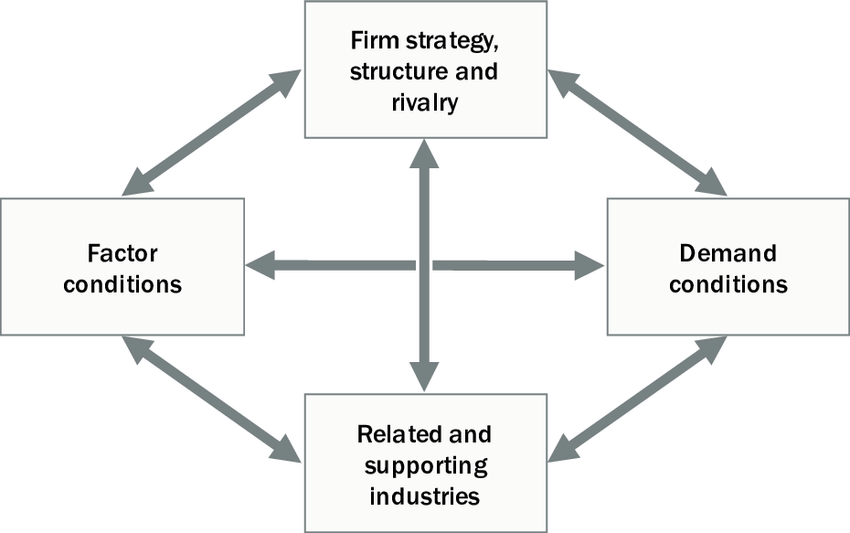

Analysis of Porter’s Diamond Model of National Advantage

Michael Porter introduced the diamond model of national competitive advantage (1990) to explain why a number of countries are more competitive than others and why a number of businesses within the countries are more competitive. Porter’s Diamond Model proposes that the national home base of an industry plays an important role in achieving an advantage on a universal scale. This home base contributes the essential factors that will support the organisations in building advantages in global competition.

Porter identified four determinants in attaining a national competitive advantage he concludes that a combination of the four determinants within a nation has an enormous influence on the competitive strength of the firms located there.… Read the rest

Country of Origin Effect in International Marketing

The Country of Origin Effect is the influence that the manufacturer country has on the positive or negative consumer judgment. Studies have shown that when a customer becomes aware of the country of origin of a product his/her image about the product is influenced either positively or negatively according to his perceptions. Consumers tend to have a stereotype about product and countries that have been formed by experience, hearsay, myth. These stereotypes are generally broad and vague according to which they judge a specific country or a specific product to be the best: French Perfumes, Italian Leather, Chinese Silk and Japanese Technology are all examples of such stereotypes.… Read the rest

Role of Cultural Sensitivity in International Business

Culture plays an important role in life of people as it is closely associated with them. It is very necessary to understand what a culture requires and what emotions are attached to it. Different countries follow different culture and because of this some things will be acceptable in some countries whereas the same things will appear to be rude in other countries because of culture difference. People who are culture sensitive will know that the difference between the culture of different people can create differences in their relationship with respect to the way they behave, communicate etc. Hofstede defined culture as “the manner in which the mind is programmed such that it can differentiate the people of one category with those of other.”… Read the rest

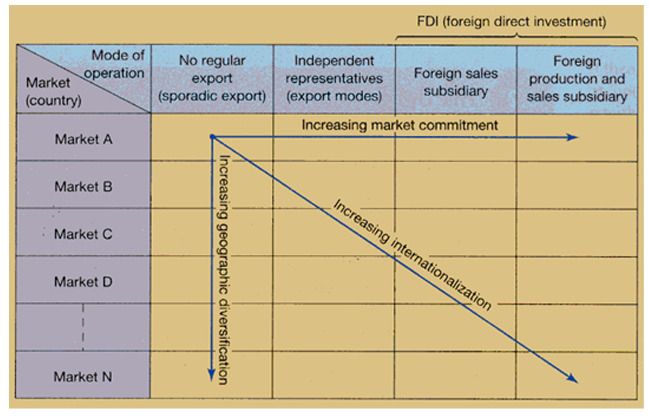

Internationalization Concept -The Uppsala Internationalization Model

Internationalization consists of standardized products or service through globally standardized marketing and production processes that target standardized customer needs. Internationalization can be described as the process of increasing involvement in international operations. Another definition denotes internationalization as the process of adapting firms’ operations (strategy, structure, resources, etc) to international environments. Both definitions emphasize the crucial fact that internationalization needs an overall support from the organisation as it is changing the environment to expand in various manners the process mostly consists of macro factors to evolve.

The Process of InternationalizationInternationalization fundamentally alters the price-setting strategies of domestic economic agents. This is true for agents operating in product markets, factor markets and financial markets.… Read the rest