In the presence of globalization, financial statements have become the standard measurement in judging a company’s performance. Financial statements are an overall impression of the company which shows profitability, efficient utilization of assets, settlement of outstanding debts, management of equity, and liquidity position to make economic and business decisions by both internal and external users. The analysis of financial statements is the application of financial activities and additional facts of the business, the examination of historical, present, and possible results and monetary situation to make investing, financing, and commercial decisions. External decision makers of an organization are defined as potential shareholders, clients, creditors (banks), and tax authorities who need a financial record to give decisions about investment, approval of loan application, acquisition of products, and compliance with applicable tax laws and regulations.… Read the rest

Business Finance

Business Finance is that business activity which is concerned with the acquisition and conservation of capital funds in meeting financial needs and overall objectives of business enterprises.

Relationship Between Agency Theory and the Existing Accountancy Practices

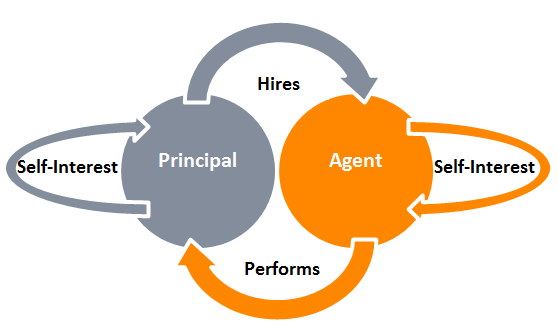

The agency theory is a mixture of the relationships between principals and agents, it occurs when the principal and the agents create a delegation. The agency theory argues that in modern corporations, where share ownership is widely held, managerial actions depart from those required to maximize the shareholder’s return. In Agency theory terms, the owners are principals and the managers are agents and there is an Agency loss which is the extent to which returns to the residual claimants, the owners, fall below what they would be if the principals, and the owners, exercised direct control of the corporation.

The long-term strategies for agency theory include the principle of the company, business, franchise, etc.… Read the rest

Audit Theories – Theories of Demand for Audit

Audit refers to an examination of the financial reports of a firm by an independent entity. The separation of business ownership and management in modern society has created a need for accountability; causing the role of audit to change as the needs of stakeholders’ change. Audit, in itself, caters to the relationship of accountability; independent from other parts of the firm to provide a true and fair view of the financial reports of an organisation. Whereas, the ‘value relevance’ refers to the auditors’ ability and responsibility to provide reasonable assurance that financial statements are free of material misstatement, either due to fraud or error; or both.… Read the rest

Management Accounting Best Practices – Cost Allocation

Cost allocation is the process of identifying and assigning the costs of services necessary for the operation of a business or other type of entity. Unlike a cost rating, the allocation is less concerned with the actual amount of the cost, and more concerned with allocating or assigning the cost to the correct unit within the organization. From this perspective, cost allocation can be seen as a tool that helps track all costs associated with the ongoing operation more efficiently, since each cost is associated with specific departments or groups of departments within the organization.

A simple example of cost allocation would be the wages or salary of an employee assigned to work in a specific department.… Read the rest

Harmonization of Accounting Standards

Many authors have put together different definitions for accounting harmonization in various ways. It would seem not an easy word to define, as neither the European Commission nor other organs of the commission have explicitly defined the concept of accounting harmonization. Some have even complicated the whole concept, by attempting to substitute harmonization with standardization, as if to mean that the process is the same, rather than making it more compatible. In practice, harmonization of accounting standards tends to mean the process of increasing the compatibility of accounting practices by setting bounds for the degree of variations. This can be accepted to be the most suitable definition of the concept.… Read the rest

Importance of Audit Independence for Stakeholders

The importance of audit independence can be categorized into four reasons: Firstly, audit independence can hold the public confidence and avoid interest conflicts; Secondly, audit independence can help auditors to provide high quality financial report and avoid scandals like ‘Enron bomb’; Thirdly, the development of no-audit services make it more difficult but more important to maintain audit independence; Lastly, audit independence can improve the quality of audit and it can assist managers to make strategy formulations.

Stakeholders make economic decisions by taking advantage of financial reports. Whether those reports are related and reliable are questions. Audit can help to solve this problem.… Read the rest