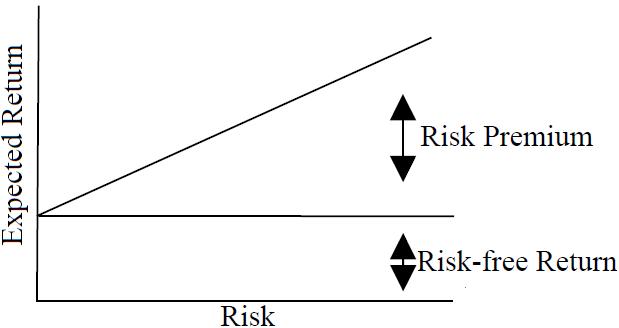

Risk-Return Trade off

Risk may be defined as the likelihood that the actual return from an investment will be less than the forecast return. Stated differently, it is the variability of return form an investment.

Financial decisions incur different degree of risk. Your decision to invest your money in government bonds has less risk as interest rate is known and the risk of default is very less. On the other hand, you would incur more risk if you decide to invest your money in shares, as return is not certain. However, you can expect a lower return from government bond and higher from shares.… Read the rest