Accounting fraud is the manipulation of financial statements in order to benefit the business financially or to create a false appearance of financial health. In the situation of Caterpillar Inc. (CAT) – a manufacturer of heavy construction and mining equipment, diesel-electric locomotives, diesel, and natural gas engines, and industrial gas turbines – the payment of federal income taxes on their earnings was avoided to boost the company’s financial status, saving the company billions of dollars and keeping its stock price high. CAT, having more than 500 locations worldwide – including the Americas, Asia Pacific, Europe, Africa, and the Middle East – is vast in size and an economic standpoint, with sales and revenues of $53.9 billion in the year 2019.… Read the rest

Business Ethics Case Studies

Business Ethics Case Study: The Volkswagen Emissions Scandal

Over the last few decades, there has been great concern regarding the sustainability and conservation of the environment. Environmental pollution and globalization have become the concern of most environmental protection agencies. The harmful and mortal effects of nitrogen oxide, which is a pollutant found in car exhaust have led the Environmental Protection Agency (EPA) to tighten emission control considering the attention paid to conservation and saving the green. These concerns have made the EPA constantly announce restrictions for standard emissions for all types of vehicles the sports car, heavy-duty trucks, automobiles, and other types of cars. These stringent measures are necessary considering that nitrogen gas emitted is harmful to human health and results in diseases such as asthma, premature death, bronchitis, and respiratory and cardiovascular.… Read the rest

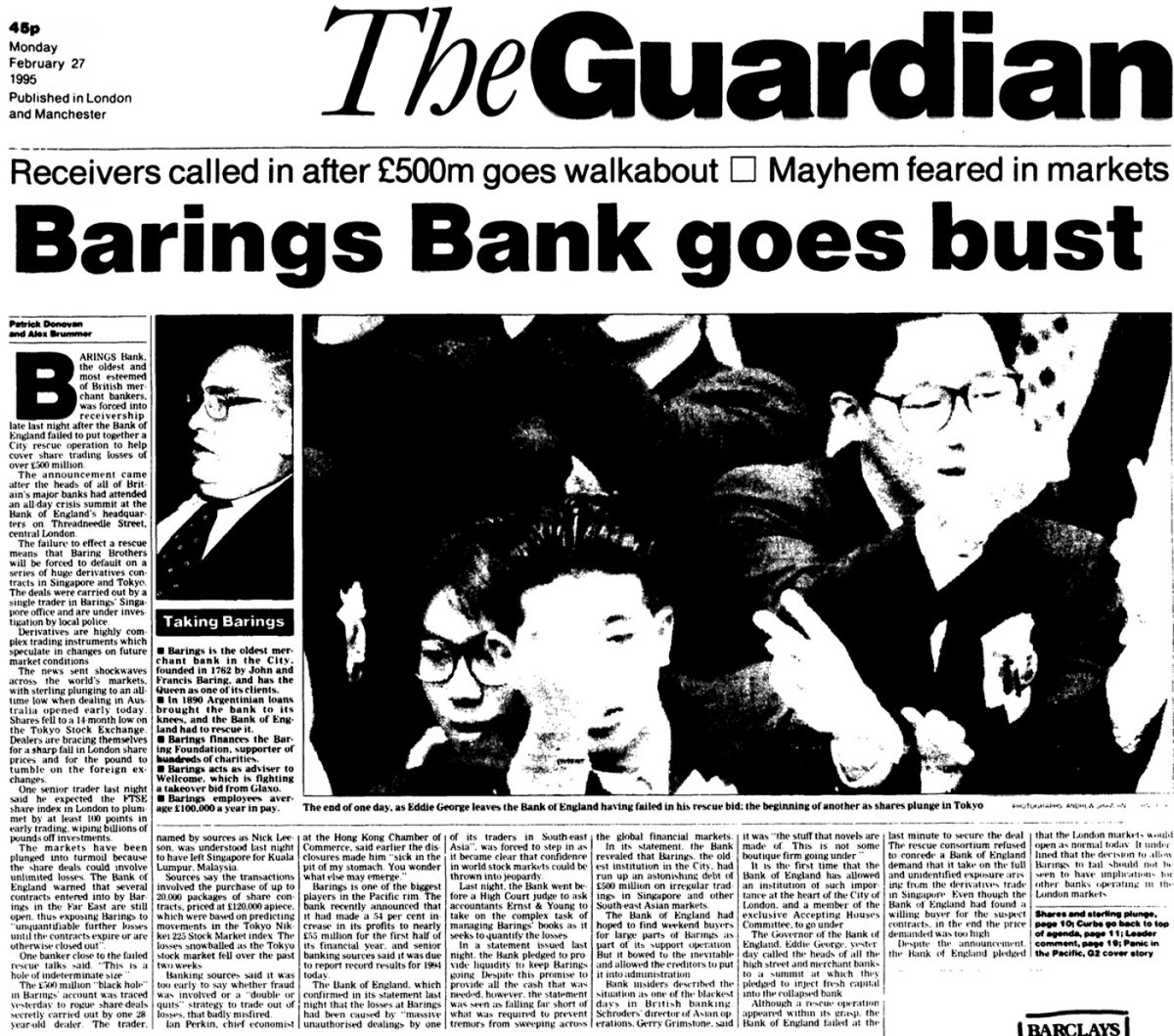

Case Study: Nick Leeson and the Collapse of Barings Bank

In 1985, Nick Leeson had a job as a clerical work at Coutts & Co. The Coutts & Co is a private banking house in United Kingdom which own by aristocrat. This bank was a subsidiary of the National Westminster Bank. During that period, the stock markets were rising for several years and the bank were expanding into a new financial instruments coming in and demand for labor was high. During that time, Nick Leeson was the person who had many working class young men.

After two years, Nick Leeson moved to Morgan Stanley, one of the US investment bank. Nick Leeson be a settlements clerk at that bank.… Read the rest

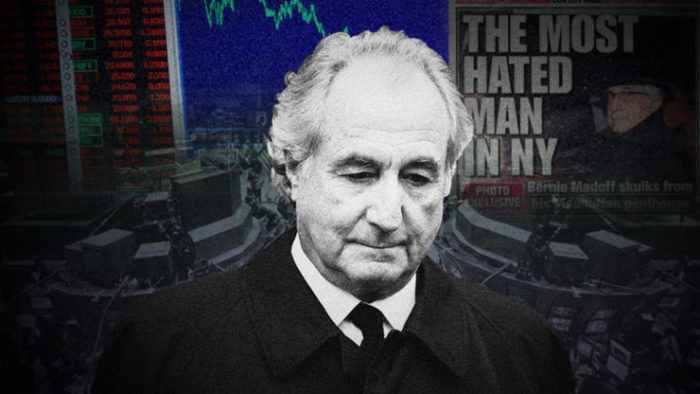

Case Study on Business Ethics: Madoff Investment Scandal

Bernard “Bernie” Lawrence Madoff is an American investment adviser and stock broker who operated Madoff Investments in an unethically acceptable manner. He used the company as a front to commit a Ponzi scheme which fleeced investors of over $65 billion. This has been regarded as the largest Ponzi scheme ever. Madoff grew up in a humble background and he established the Madoff Investments Company with support from the father in law. A few friends and family members also supported Madoff with the operations and growth of the business. Madoff used the returns from investment to support several charitable and political causes which his firm believed in.… Read the rest

Case Study on Business Ethics: The Inside Story of the Collapse of AIG

AIG or American International Group and its subsequent failure are one of, if not the most well-known company failures in financial history. Of the more recent bankruptcies filed for companies like Enron and Worldcom, the effects and unforeseeable consequences of the failure of a company like AIG would be much more widespread and felt by many more Americans at the lay person level. AIG is primarily an insurance company that sells Property casualty, life, and travel insurance to customers the world over. However, there was another arm to the company known as AIG FP or American International Group Financial Products division.… Read the rest

Madoff Scandal – How Bernie Madoff’s Ponzi Scheme Worked?

Bernard L. Madoff, simply known as Bernie is an American allegedly the operator of what is known as the largest Ponzi scheme in history. Bernie before his capture, acted as the stock broker, investment adviser and non-executive chairman of the NASDAQ stock market. It was not later than 2009 when Madoff pleaded guilty; he was guilty for turning his wealth management business into a massive Ponzi scheme. This scheme according to various sources defrauded thousands of investors billions of dollars.

In 1960, Bernard Madoff founded one of the biggest firms in Wall Street. He was the chairman of his company “Madoff Investment Securities LLC”, until his arrest was warranted on the December of 2008.… Read the rest