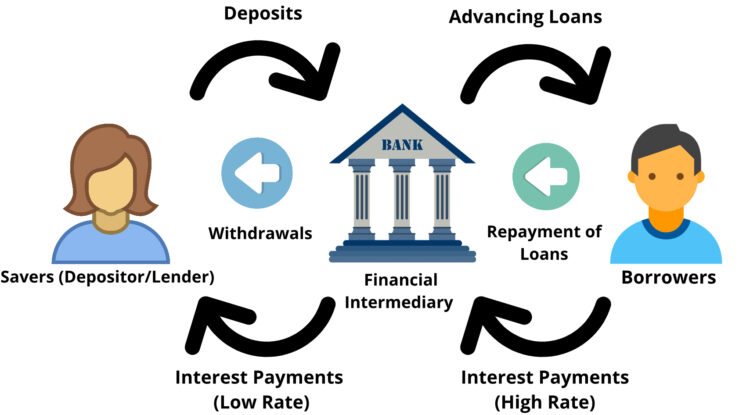

Financial intermediation is defined as the process which had been carried out by the financial intermediaries as the middleman between the borrower (spender) and lender (saver) to smooth the flow of the fund. Financial intermediation called the process of using indirect finance in the financial system, which the primary route to transfer funds from lender to borrower. Those savers who have the surplus money will deposit their funds in the financial institution, which will lend those funds to borrowers such as business firms, households, government, or foreigners who shortage of funds. Financial intermediaries are that financial institutions such as commercial banks, finance companies, or merchant banks.… Read the rest

Financial Management Concepts

Impact of Financial Management Practices on Organizational Performance

Financial Management is the deliberate management of planning and organizing of financial activities. It applies the basic management principle to control the flow of funds and properly utilizes financial resources. It sets the financial goals by properly analyzing the available data. The common methods to carry out financial activities like accounting and budgeting are considered to be the financial management practice. Financial management practices is the discipline dealing with the financial decisions for long and short-term goals to ensure the return on capital exceeds the cost without taking an excessive financial risk. It clarifies the efficient financial management practices and is used in the business to respond to another business environment.… Read the rest

An Introduction to Behavioral Finance

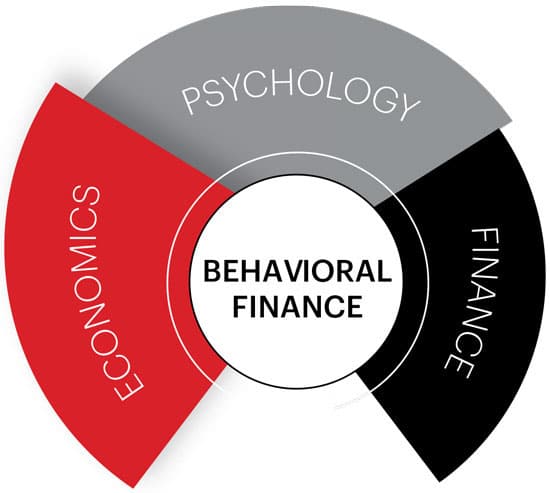

Traditionally, economics and finance have focused on models that assume rationality. The behavioral insights have emerged from the application of insights from experimental psychology in finance and economics.

Behavioral finance is relatively a new field which seeks to provide explanation for people’s economic decisions. It is a combination of behavioral and cognitive psychological theory with conventional economics and finance. Inability to maximize the expected utility (EU) of rational investors leads to growth of behavioral finance within the efficient market framework. Behavioral finance is an attempt to resolve inconsistency of Traditional Expected Utility Maximization of rational investors within efficient markets through explanation based on human behavior.… Read the rest

Altman Z-Score Formula – Corporate Bankruptcy Prediction Model

The financial failure of a company can have a devastating effect on the all seven users of financial statements e.g. present and potential investors, customers, creditors, employees, lenders, general public etc. As a result, users of financial statements as indicated previously are interested in predicting not only whether a company will fail, but also when it will fail e.g. to avoid high profile corporate failures at Enron, Arthur Anderson, and WorldCom etc. Business failure is defined as the unfortunate circumstance of a firm’s inability to stay in the business. Business failure occurs when the total liabilities exceeds the total assets of a company, as total assets is consider a measure of productivity of a company assets. … Read the rest

Creative Accounting – Definition, Techniques and Ethical Considerations

Creative accounting is accounting practice that falls outside the regulation and give benefit to certain people. It can be described as a practice with a clear aim to interrupt the financial reporting process which affects reported income to make it looked normal and provides no true economic advantages to relevant parties like shareholders. Concisely, creative accounting is the transformation of financial accounting figures from what they actually are to what users’ desire by taking advantage of the accounting policies which is permitted by accounting standards.

Creative accounting is a practice that potentially being undertaken as a result from some individual care more on their own interest and indirectly causes issues arise in ethical dimension of creative accounting.… Read the rest

Beyond Budgeting Approach

A traditional budget is usually prepared by reviewing past year’s budget and actual expenses, with addition or deduction towards extra business activities or reduced business activities planned and also by effecting changes towards changing factors, such as growth, inflation etc. It is basically to tie managers to predetermined actions in order to achieve the planned budget. It is usually based on organizational hierarchy and centralized leadership. In a business that operates in a very dynamic, rapidly changing, and innovative environment, traditional budgeting is inappropriate to exercise. Budget is a barrier for the business because the vibrant market demands flexibility, fast response, innovation, process improvement, customer focus, and shareholder value.… Read the rest