Load is the factor that is applied to the Net Asset Value (NAV) of a mutual fund scheme to arrive at the price. If a commission is paid to agents to bring in new business this represents the cost incurred by the mutual fund for additional sale. The fund may therefore decide that, investors who are already in the scheme need not bear this cost. Therefore, it may decide to impose this cost on the new investors by increasing the price at which they can buy units. This is called the sales load. Similarly, if an investor stays in a fund for a short while and decides to repurchase his units, the fund may incur some costs in liquidating the portfolio and paying off this investor.… Read the rest

Investment Terms

Stock – Meaning and Definition

Stock is the share in the ownership of the company. Stock represents the claim on the company’s assets and earnings. In other words, it means, the more the stock, the ownership stake in the company becomes greater. The stock is represented by a stock certificate which is a document that proves the ownership in the company. Few years ago when the person wanted to buy or sell shares, he/she physically took the certificates to the brokerage firm. But now information technology has increased, because of which this stock document is stored electronically. Now trading with a click of mouse or a phone call has made transacting easier.… Read the rest

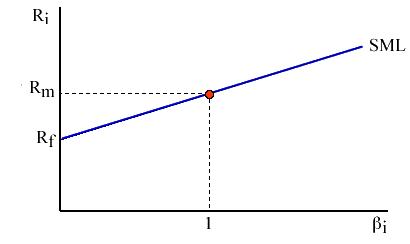

What is Stock’s Beta?

An investor is concerned with the risk of his entire investment portfolio, and that the relevant risk of a particular security is the effect that the security has on the entire portfolio. By “diversified portfolio” we mean that each investor’s portfolio is representative if the market as a whole and that the portfolio Beta is 1.0. Stock’s Beta indicate how closely the security’s returns move with from a diversified portfolio. A beta of 1.0 for a given security means that, if the total value of securities in the market moves up by 10 percent, the stock’s price will also move up, on the average by 10 percent.

Capital Asset Pricing Model (CAPM)

The risk or variation in return of a security is caused by two types of factors. The first type of factors will affect the return of almost all securities in the market. Examples of such sources of risks are changes in the interest rates and inflation of the economy, movement of stock market index and exchange rate movement. The risk caused by such factors is known as systematic risk. Apart from systematic risk, the variation in return of a security is also caused by some other factors which are specific to a security, like a strike in a company or the caliber of the management of a company.… Read the rest

Defensive and Aggressive Securities

Defensive securities are kind of securities that exhibits less volatility than the market as a whole (i.e., its BETA is less than 1.0), providing lower, but more stable, returns. Investors often acquire defensive securities during periods of financial turmoil or uncertainty. Defensive securities tend to remain more stable in value than the overall market, especially when prices in general are falling. In times of market downturn, investors tend to seek defensive securities to provide a steady rate of return, or at least to lose less money than the market as a whole. Examples include stocks in utility companies and the health care industry.… Read the rest

Convertible Issues

A convertible issue is a bond or a share of preferred stock that can be converted at the option of the holder into common stock of the same company. Once converted into common stock, the stock cannot be exchanged again for bonds or preferred stock. Issue of convertible preference shares and convertible debentures are called convertible issues. The convertible preference shares and convertible debentures are converted into equity shares. The ratio of exchange between the convertible issues and the equity shares can be stated in terms of either a conversion price or a conversion ratio.

- Convertible Preference Shares: The preference shares which carry the right of conversion into equity shares within a specified period, are called convertible preference shares.