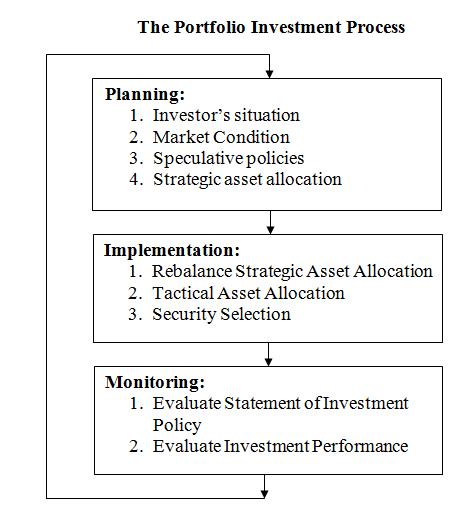

The ultimate aim of the portfolio manager is to reduce the risk and increase the return to the investor in order to reach the investment objectives of an investor. The manager must be aware of the portfolio investment process. The process of portfolio management involves many logical steps like portfolio planning, portfolio implementation and monitoring. The portfolio investment process applies to different situation. Portfolio is owned by different individuals and organizations with different requirements. Investors should buy when prices are very low and sell when prices rise to levels higher that their normal fluctuation.

Portfolio Investment ProcessPortfolio investment process is an important step to meet the needs and convenience of investors.… Read the rest