Scheme of Merger The scheme of any arrangement or proposal for a merger is the heart of the process and has to be drafted with care. There is no specific form prescribed for the scheme. It is designed to suit the terms and conditions relevant to the proposal but it should generally contain the following information as per the requirements of sec. 394 of the companies Act, 1956: Particulars about transferor and transferee companies Appointed date of merger Terms of transfer of assets and liabilities from transferor company to transferee company Effective date when scheme will came into effect Treatment of specified properties or rights of transferor company Terms and conditions of carrying business by transferor company between appointed date and effective date Share capital of Transferor Company and Transferee Company specifying authorized, issued, subscribed and paid up capital. Proposed share exchange ratio, any condition attached thereto and the fractionalContinue reading

Strategic Management Basics

Different Types of Mergers

In perspective of merger and acquisition there are different types of mergers that host a difference between each one it. Each merger derived with specific reasons depending on the fitting characteristics in cross boarder operation. Each type of merger will be discussed in detail to know the differences and their characteristics. 1. Horizontal Merger It is a merger of two or more companies that compete in the same industry. It is a merger with a direct competitor and hence expands as the firm’s operations in the same industry. Horizontal mergers are designed to produce substantial economies of scale and result in decrease in the number of competitors in the industry. The merger of Tata Oil Mills Ltd. with the Hindustan lever Ltd. was a horizontal merger. In case of horizontal merger, the top management of the company being meted is generally, replaced, by the management of the transferee company. OneContinue reading

Takeover Bid – Meaning and Types

This is a technique for affecting either a takeover or an amalgamation. It may be defined as an offer to acquire shares of a company, whose shares are not closely held, addressed to the general body of shareholders with a view to obtaining at least sufficient shares to give the offer or, voting control of the company. Takeover Bid is thus adopted by company for taking over the control and management affairs of listed company by acquiring its controlling interest. While a takeover bid is used for affecting a takeover, it is frequently against the wishes of the management of Offeree Company. It may take the form of an offer to purchase shares for cash or for share for share exchange or a combination of these two firms. Where a takeover bid is used for effecting merger or amalgamation it is generally by consent of management of both companies. ItContinue reading

Mergers and Acquisitions – Synergies through Consolidation

Synergy implies a situation where the combined firm is more valuable than the sum of the individual combining firms. It is defined as ‘two plus two equal to five’ (2+2>4) phenomenon. Synergy refers to benefits other than those related to economies of scale. Operating economies are one form of synergy benefits. But apart from operating economies, synergy may also arise from enhanced managerial capabilities, creativity, innovativeness, R&D and market coverage capacity due to the complementarily of resources and skills and a widened horizon of opportunities. An under valued firm will be a target for acquisition by other firms. However, the fundamental motive for the acquiring firm to takeover a target firm may be the desire to increase the wealth of the shareholders of the acquiring firm. This is possible only if the value of the new firm is expected to be more than the sum of individual value of theContinue reading

Strategic Issues in Managing Technology

Due to increased competition and accelerated product development cycles, innovation and the management of technology is becoming crucial to corporate success. The importance of technology and innovation must be emphasized by people at the very top and reinforced by people throughout the corporation. Management has an obligation to not only encourage new product development, but also to develop a system to ensure that technology is being used most effectively with the consumer in mind. External Scanning: Corporations need to continually scan their external societal and task environments for new developments in technology that may have some application to their current or potential products, Stakeholders, especially customers, can be important participant in the new product development process. Technological Developments: Focusing one’s scanning efforts too closely on one’s own industry is dangerous. Most new developments that threaten existing business practices and technologies do not come from existing competitors or even fromContinue reading

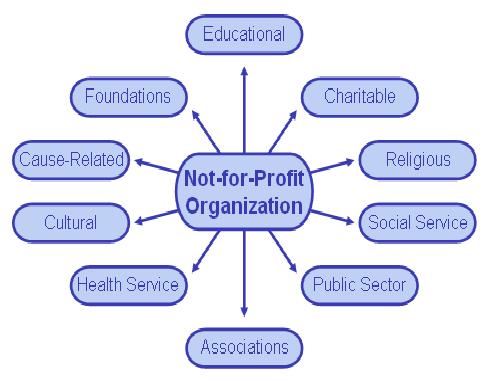

Strategic issues in Not-for-Profit (NFP) organizations

Not-for-Profit (NFP): An organization that provides some service or good with no intention of earning a profit. NFP includes Private nonprofit corporations (such as hospitals, institutes, private colleges, and organized charities) as well as Public governmental units/agencies (such as welfare departments, prisons, and state universities) Types of Not-for-Profit Organizations Importance of Revenue Source: NFPs are dependant on dues, assessments, or donations for their revenue sources. In NFP organizations there is likely to be a very different sort of relationship between the organizations providing and the person receiving the service. Because the recipient of the service typically does not pay the entire cost of the service, outside sponsors are required. The pattern of Influence on Strategic Decision Making: Pattern of influence is derived from its source of revenues. Those who fund the NFP are likely to have a significant influence on its operations The usefulness of Strategic Management and Techniques: someContinue reading